Manufactured home and land financing can be a daunting task for budget-conscious home seekers, especially those in Texas. This brief guide aims to simplify this process, highlighting key challenges and opportunities to make your dream of homeownership a reality.

Here’s what you need to know to get started:

-

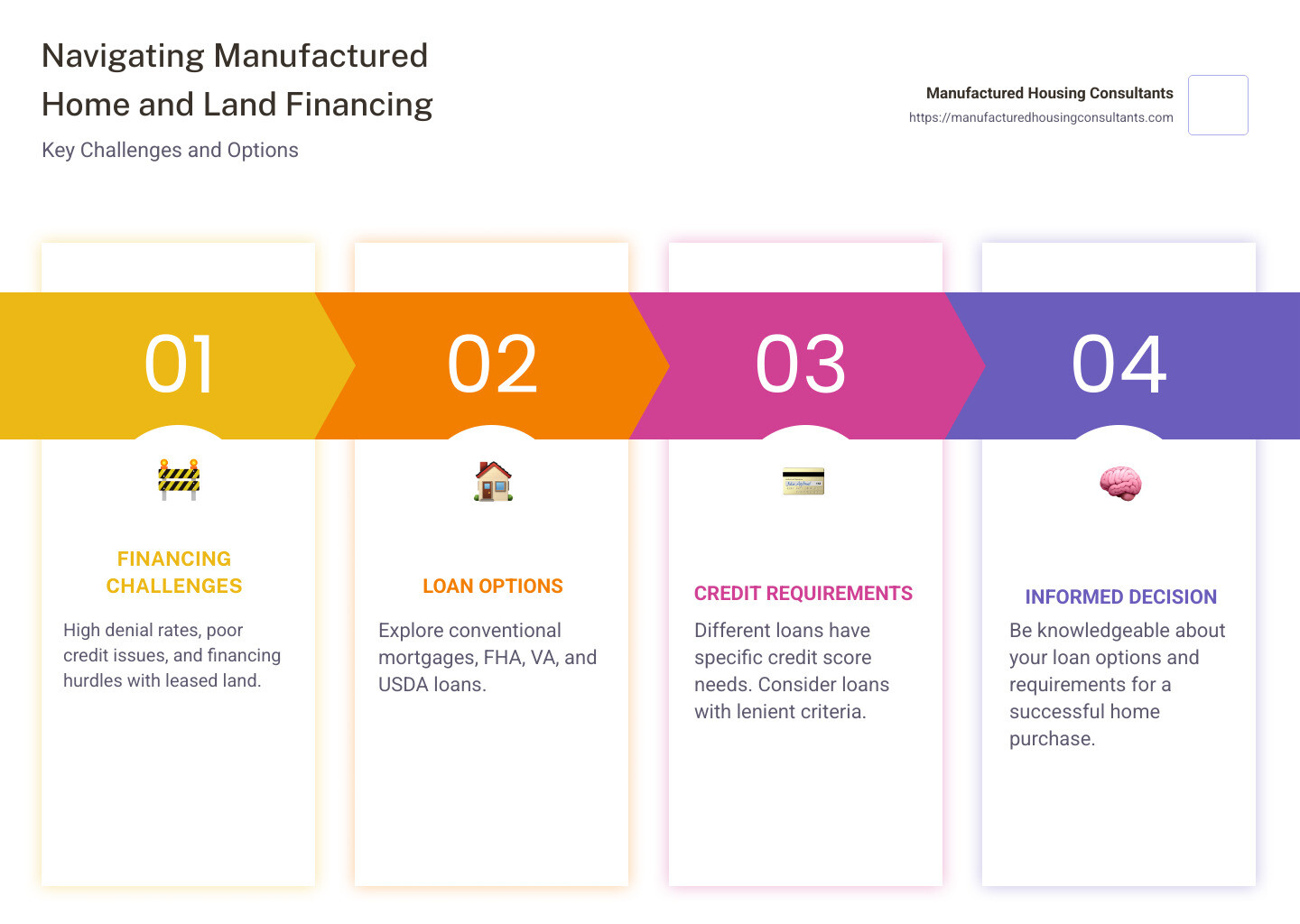

Financing Challenges: Many homebuyers face problems like high denial rates for financing manufactured homes compared to site-built homes. Poor credit and lenders’ reluctance to finance homes on leased land can complicate matters.

-

Loan Options: Various loan types are available such as conventional mortgages, FHA loans, VA loans, and USDA loans. Choosing the right one depends on your eligibility and needs.

-

Credit Requirements: Each loan type comes with specific credit score requirements. Lower scores may limit your loan options, but programs with lenient credit criteria do exist.

By understanding these aspects, you’ll be better equipped to secure a loan that fits your budget and lifestyle. Whether you’re looking at chattel mortgages for personal property loans or traditional loans for homes permanently affixed to land, being informed will help you steer the intricate financing landscape.

Simple guide to manufactured home and land financing:

Understanding Manufactured Home and Land Financing

When it comes to manufactured home and land financing, understanding the various loan types and terms is crucial. Let’s break down the options available and the challenges you might face.

Loan Types and Terms

For financing a manufactured home, you have several options. Here’s a quick overview:

-

FHA Loans: These are backed by the Federal Housing Administration and are a popular choice due to their lower down payment requirements (as low as 3.5%). They are ideal for borrowers with lower credit scores, starting at 500.

-

VA Loans: Available for eligible veterans, these loans offer competitive rates and often require no down payment. They’re a great option if you qualify.

-

USDA Loans: These are for homes in rural areas and also offer no down payment options. They’re backed by the U.S. Department of Agriculture.

-

Conventional Mortgages: These typically require a higher credit score (around 620) and a down payment of at least 3%. They can be more cost-effective in the long run if you have good credit.

-

Chattel Loans: These are for homes not permanently affixed to land, treating the home as personal property. These loans often come with higher interest rates and shorter terms.

-

Real Estate Loans: If your manufactured home is permanently affixed to land, real estate loans can be an option. These are similar to traditional mortgages with longer terms (up to 30 years) and potentially lower interest rates.

Financing Challenges

Securing financing for a manufactured home comes with its own set of challenges:

-

Land Ownership: If the land is leased, it can complicate financing. Lenders prefer homes on owned land, as it provides more security.

-

Depreciation: Manufactured homes can depreciate in value, unlike site-built homes. This can make lenders wary, as they prefer properties that appreciate over time.

-

Lender Security: Lenders want to ensure that their investment is secure. This means they favor homes that are permanently affixed to land, as it reduces the risk of the home being moved.

Understanding these loan types and challenges can help you steer manufactured home and land financing more effectively. By choosing the right loan and addressing potential obstacles, you can make the dream of owning a manufactured home a reality.

Key Considerations for Financing

When diving into manufactured home and land financing, several critical factors come into play. Let’s break them down to make sure you’re well-prepared.

Credit and Down Payment Requirements

Credit Score:

Your credit score is a big deal. Most lenders look for a score of at least 620 for conventional and USDA loans. For FHA loans, you might get by with a score as low as 500. The higher your score, the better your interest rates will be.

Down Payment:

The down payment varies based on the loan type. USDA loans often require no down payment, while FHA loans start at 3.5%. Conventional loans might need at least 3%. A bigger down payment can lower your interest rate and monthly payments.

Loan Process and Costs

Closing Costs:

Be ready for closing costs. These can include loan origination fees, appraisal fees, and title fees. They might add up to 2-5% of the loan amount, so factor this into your budget.

Insurance Requirements:

Lenders will want insurance for the home and land. Mobile home insurance is different from regular homeowner’s insurance, so make sure you have the right coverage.

Appraisal:

An appraisal is necessary to determine the value of your home and land. This ensures the loan amount aligns with the property’s value. It’s a crucial step in the loan process.

Property Type, Zoning Regulations, and Foundation Type

Property Type:

Is your manufactured home on leased land or land you own? This affects your financing options. Homes on leased land might need a chattel loan, which often has higher interest rates.

Zoning Regulations:

Ensure the land is zoned for manufactured homes. This impacts whether you can place a manufactured home on the property and can influence loan approval.

Foundation Type:

Is your home permanently affixed to the land? Homes with a permanent foundation might qualify for real estate loans, which usually offer better terms than chattel loans.

Navigating these considerations will help you secure the best financing for your manufactured home. By understanding credit requirements, loan costs, and property specifics, you can make informed decisions and move closer to homeownership.

Conclusion

At Manufactured Housing Consultants, we understand that manufactured home and land financing can seem daunting. But with the right guidance, it can be a smooth path to homeownership. Our goal is to make this journey as simple and affordable as possible for you.

Homeownership Benefits

Owning a manufactured home offers the dream of homeownership at a fraction of the cost of traditional homes. It’s a practical solution, especially in today’s housing market. Manufactured homes provide flexibility, allowing you to choose the perfect location that suits your lifestyle—whether that’s a serene rural setting or a busy urban environment. Plus, when you own both the home and the land, you build equity over time, contributing to your financial stability.

Financial Planning

Proper financial planning is key when purchasing a manufactured home. Understanding loan types, interest rates, and credit requirements helps you prepare financially. We recommend starting with a realistic budget that considers not only the purchase price but also additional costs like insurance, utilities, and maintenance. A well-thought-out financial plan ensures you can comfortably manage your home expenses without surprises.

At Manufactured Housing Consultants, we specialize in affordable housing solutions for various credit situations. With locations across Texas, including San Antonio, Von Ormy, and Corpus Christi, we offer a wide selection of homes from top manufacturers. Our promise is the lowest prices and delivery anywhere in Texas.

If you’re ready to take the next step toward homeownership, explore our mobile homes financing programs. Let us help you turn your dream of owning a manufactured home into reality.