Understanding VA Loan Mobile Home Financing: A Pathway to Affordable Homeownership

VA loan mobile home financing offers eligible veterans and service members a way to purchase manufactured homes with favorable terms. If you’re searching for quick answers about this financing option, here’s what you need to know:

| VA Loan Mobile Home Financing Basics | Details |

|---|---|

| Eligibility | Veterans, active duty service members, reservists with 6+ years of service, and eligible surviving spouses |

| Property Requirements | Must be built after June 15, 1976, have a permanent foundation, and be classified as real property |

| Minimum Size | 400 sq ft for single-wide, 700 sq ft for double-wide |

| Down Payment | Often 0% with full entitlement |

| Maximum Loan Terms | Single-wide: 20 years, Double-wide: 23 years, With land: 25 years |

| Credit Score | No VA minimum, but lenders typically require 620+ |

For many veterans and military families, the dream of homeownership can seem out of reach due to rising housing costs. Manufactured homes offer an affordable alternative to traditional site-built homes, costing roughly half as much per square foot. When paired with the benefits of VA financing, this creates a powerful pathway to affordable homeownership.

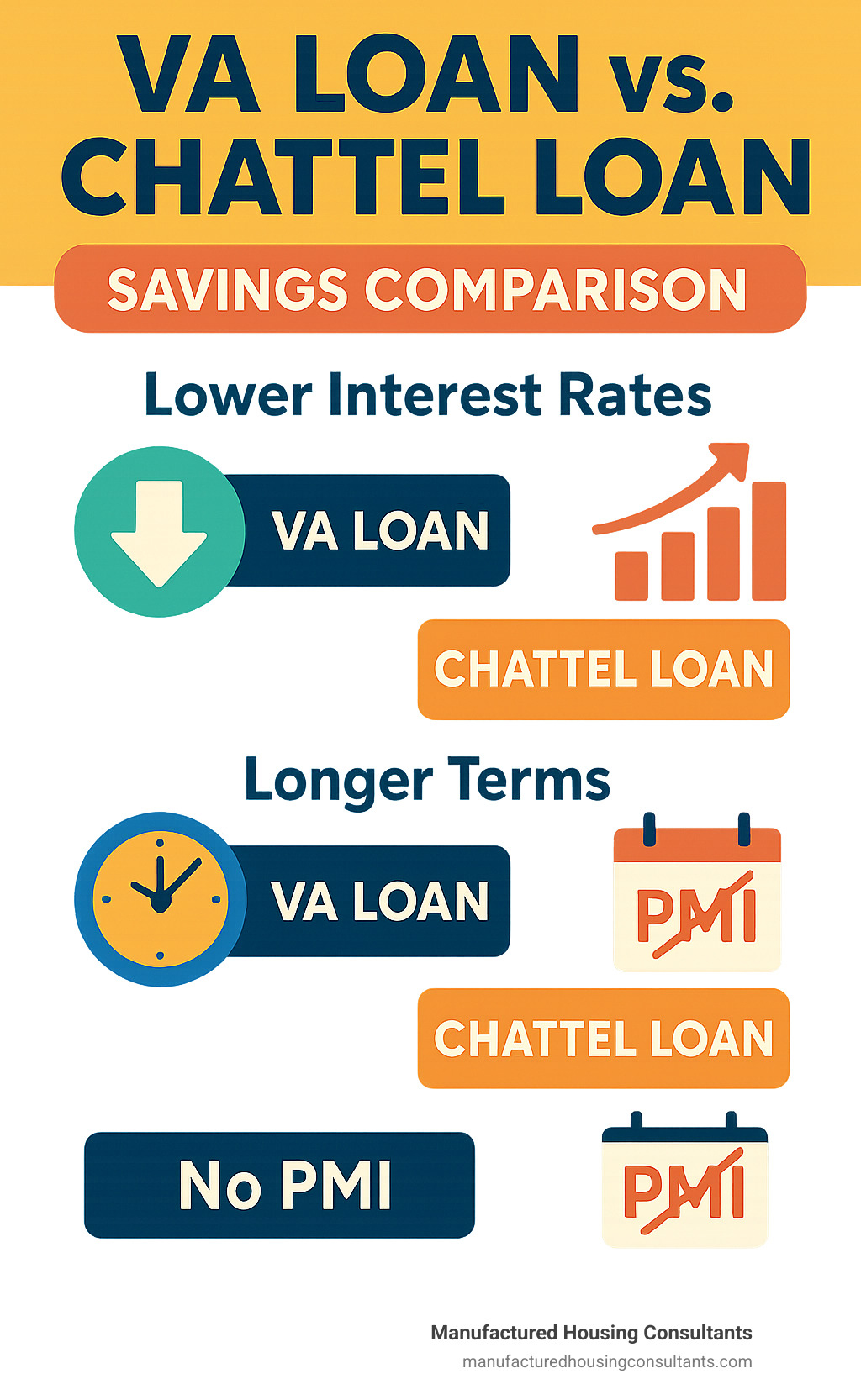

Unlike conventional loans, VA loans don’t require private mortgage insurance and often feature competitive interest rates. However, finding lenders who offer VA loans for manufactured homes can be challenging, as many lenders consider these properties higher risk.

To qualify, you’ll need a Certificate of Eligibility (COE) from the VA, and the manufactured home must meet specific requirements. Most importantly, the home must be built after June 15, 1976 (when HUD standards were implemented), be permanently affixed to a foundation, and be classified as real property rather than personal property.

Remember: Pre-1976 “mobile homes” don’t qualify for VA financing, while post-1976 “manufactured homes” that meet VA property standards do.

Simple guide to va loan mobile home financing terms:

VA Loan Mobile Home Financing: Eligibility, Property & Borrower Rules

The VA loan program was created to help our heroes—service members, veterans, and eligible surviving spouses—achieve the dream of homeownership. When it comes to va loan mobile home financing, there are specific requirements that both you and your future home need to meet.

At the heart of any VA loan for manufactured housing is compliance with the HUD code. This federal building standard, which went into effect on June 15, 1976, ensures manufactured homes are safe, durable, and high-quality. This date matters because it’s the dividing line between what we legally call “mobile homes” (pre-1976) and “manufactured homes” (post-1976).

For your manufactured home to qualify for VA financing, it needs to:

- Display a HUD certification tag on the exterior

- Include the data plate inside (usually in a kitchen cabinet, closet, or utility area)

- Measure at least 400 square feet for a single-wide unit

- Be permanently attached to a foundation meeting VA and local requirements

- Be classified as real property, not personal property

- Be in good condition and meet VA Minimum Property Requirements

“The VA wants veterans to purchase homes that are safe, sound, and will maintain their value,” explains Sarah Edwards, one of our VA loan specialists. “That’s why they’re so particular about the foundation and how the home is classified.”

Who Qualifies for VA Loan Mobile Home Financing?

You may be eligible for a VA loan if you’re:

- A veteran with 90 consecutive days of wartime service

- A veteran with 181 consecutive days of peacetime service

- An active-duty service member with at least 90 days of service

- A National Guard or Reserve member with 6 completed years

- An unmarried surviving spouse of a veteran who died in service or from a service-connected disability

Your first step is getting your Certificate of Eligibility (COE), which tells lenders you qualify for a VA loan. You can request it through the VA website, through your lender, or by mail using VA Form 26-1880.

“Many of our customers don’t realize they can use their VA loan benefit multiple times,” says Michael Rodriguez, one of our loan officers. “It’s a lifetime benefit that can be reused after paying off a previous VA loan, or even while you have an existing VA loan if you have remaining entitlement.”

Ready to get started? Pre-approval is an essential first step that will give you a clear picture of your buying power and help streamline your home search.

Mobile vs. Manufactured vs. Modular: Key Differences

The terms mobile, manufactured, and modular are often used interchangeably, but when pursuing va loan mobile home financing, understanding their differences is crucial.

| Home Type | Construction Standards | Built | Foundation | VA Loan Eligible? |

|---|---|---|---|---|

| Mobile Home | Pre-HUD standards | Before June 15, 1976 | Often temporary | No |

| Manufactured Home | HUD Code | After June 15, 1976 | Can be permanent | Yes, if on permanent foundation |

| Modular Home | Local/State Building Codes | Any time | Permanent | Yes, same as site-built |

Mobile Homes were built before June 15, 1976, when the HUD code went into effect. These homes don’t qualify for VA loans because they were built to less stringent standards and typically lose value over time.

Manufactured Homes are factory-built after June 15, 1976, and comply with the HUD code. Each one has a red HUD certification label on the exterior and a data plate inside. When properly installed on a permanent foundation and classified as real property, these homes can qualify for VA financing.

Modular Homes are built in sections at a factory and assembled on-site. Unlike manufactured homes, they’re built to the same state, local, or regional building codes as site-built homes. For VA loan purposes, modular homes are treated exactly like traditional site-built homes.

“We often meet veterans who think they can’t use their VA benefit for any factory-built housing,” says Jennifer Martinez from our New Braunfels location. “But manufactured homes that meet VA requirements absolutely qualify, and modular homes are treated just like traditional homes.”

Property Standards & Age Limits (Must-Know Checklist)

When pursuing va loan mobile home financing, making sure your potential home meets all VA requirements is essential to avoid heartbreak later in the process.

Your manufactured home must have proper HUD certification, including the red metal tag on the exterior and the data plate inside listing compliance standards. Any structural modifications that violate the HUD code could disqualify the home.

Size matters too—single-wides need at least 400 square feet, while double-wides require a minimum of 700 square feet. The foundation must be permanent and meet HUD guidelines, which usually requires an engineer’s certification. All wheels, axles, and towing hitches should be removed, and the home must be properly liftd above the flood plain.

For the VA to consider the home “real property,” you’ll need to complete title elimination and file an affidavit of affixture with the county (though requirements vary by state).

Most lenders won’t finance manufactured homes older than 15-20 years due to depreciation concerns. The home’s condition is also scrutinized—the roof, electrical, plumbing, and HVAC systems must be in good working order with no evidence of water damage, mold, or structural issues.

The land requirements are straightforward: you must own the land (not lease it), have access to an all-weather public or private street, and have adequate utilities.

While these are the national guidelines, there are also unique local requirements that vary by region. Here in Texas, for example, homes in coastal areas may need specific wind zone ratings due to hurricane risk.

“The age limit catches many veterans by surprise,” notes Carlos Mendez from our San Antonio office. “While the VA doesn’t officially set a maximum age, most lenders won’t finance manufactured homes older than 15-20 years. It’s always better to know this upfront rather than falling in love with a home you can’t finance.”

Borrower Requirements, Credit & Funding Fee Nuances

While the VA itself doesn’t set a minimum credit score, most lenders who offer va loan mobile home financing have their own requirements, typically around 620 or higher. These “lender overlays” are often stricter for manufactured homes due to perceived higher risk.

For manufactured home loans, you might encounter:

- Higher credit score requirements (often 640+)

- Lower debt-to-income (DTI) ratios (ideally 41% or less)

- Stricter residual income requirements

The VA funding fee helps offset the program’s cost to taxpayers. For manufactured home purchases, it typically ranges from 1.4% to 1.65% of the loan amount for first-time use, and 1.65% to 3.3% for subsequent use.

Certain veterans are exempt from this fee, including those receiving VA disability compensation, veterans eligible for disability compensation but receiving retirement or active-duty pay, surviving spouses of veterans who died in service or from a service-connected disability, service members with a proposed rating before loan closing, and veterans with a Purple Heart.

“The residual income requirement is actually one of the most veteran-friendly features of VA loans,” explains Robert Thompson from our Corpus Christi location. “Instead of just looking at your debt-to-income ratio, the VA wants to make sure you have enough money left over after paying major expenses to cover everyday living costs. For a family of four in Texas, you typically need about $1,000 in residual income each month.”

Worried about your credit score? You can get your free score to see where you stand before applying. At Manufactured Housing Consultants, we work with veterans across the credit spectrum and can help you understand your options even if your credit isn’t perfect.

Step-by-Step Process, Costs, Benefits & Pitfalls

Navigating the journey to homeownership with VA loan mobile home financing doesn’t have to be complicated. Let’s walk through each step together, so you’ll know exactly what to expect and how to avoid common roadblocks along the way.

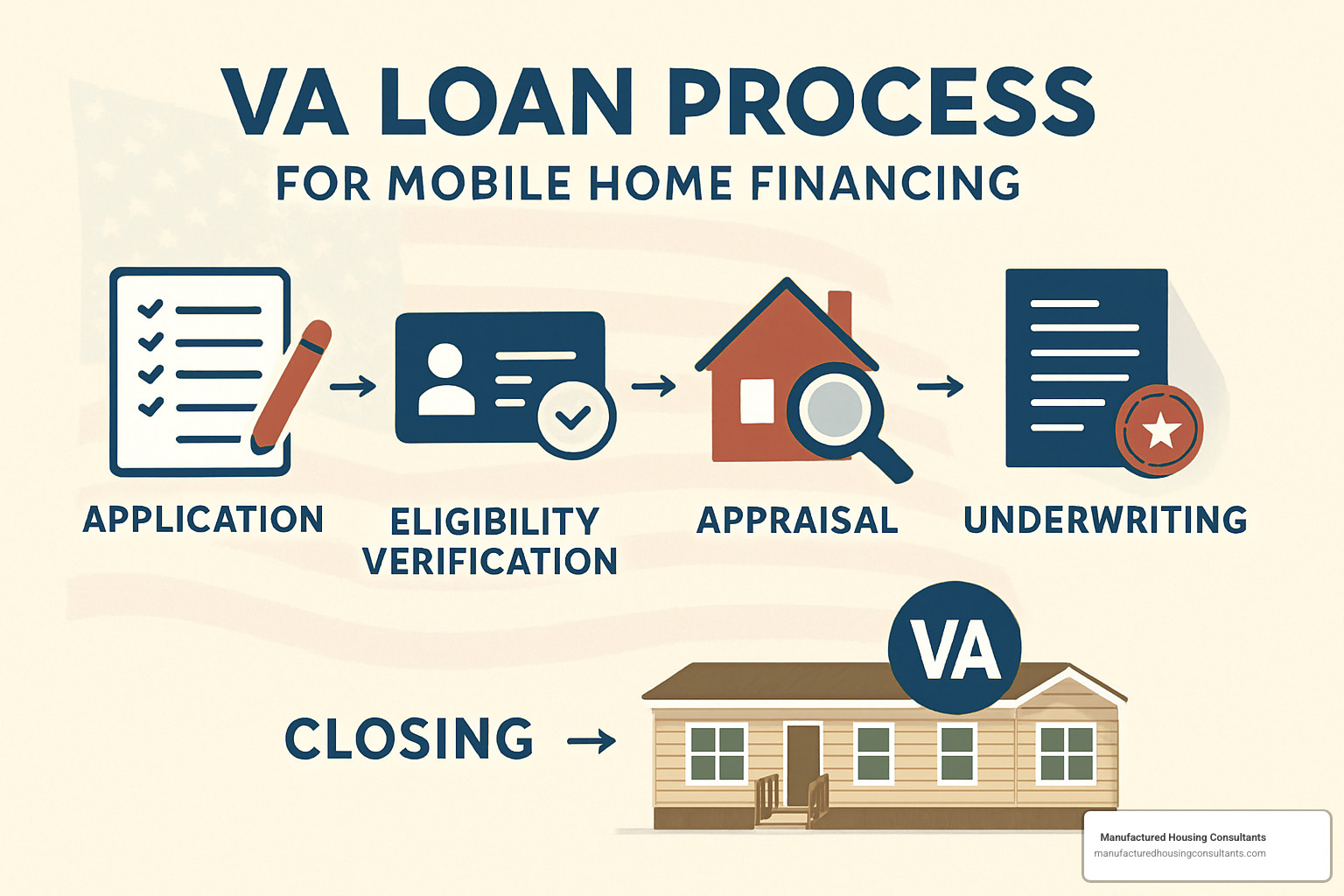

Application Roadmap From COE to Closing

Your journey begins with obtaining your Certificate of Eligibility (COE), which proves your VA loan eligibility. You can easily request a COE online through the VA’s eBenefits portal. Have your DD-214 or service statement handy—you’ll need it to complete this step.

Next comes finding the right lender. This can be trickier for manufactured homes since not all lenders offer these loans. At Manufactured Housing Consultants, we’ve built relationships with multiple VA-approved lenders who understand manufactured housing, giving you access to competitive rates without the runaround.

“Getting pre-approved before house hunting saves our customers so much heartache,” says James Wilson, one of our San Antonio loan specialists. “There’s nothing worse than falling in love with a home only to find it’s outside your budget.”

With pre-approval in hand, you can confidently shop for homes knowing exactly what you can afford. Once you’ve found your perfect manufactured home, you’ll make an offer and sign a purchase agreement that includes contingencies for financing, home inspection, and the all-important VA appraisal.

The full loan application comes next, where you’ll provide documentation of your finances—pay stubs, W-2s, bank statements, and explanations for any credit hiccups. Your lender will then order the VA appraisal, a critical step for manufactured homes since the appraiser verifies HUD certification, foundation requirements, and property classification.

While the appraisal is underway, underwriting begins. The underwriter reviews everything with a fine-tooth comb to make a final loan decision. They might request additional documentation or home repairs before giving the green light.

“I always tell my veteran clients to respond quickly to underwriter requests,” explains Sofia Martinez from our New Braunfels office. “Even a day’s delay in providing a bank statement can push your closing back a week or more.”

Once all conditions are cleared, you’re ready for closing day! You’ll sign the final documents, pay closing costs (including the VA funding fee unless exempt), and receive the keys to your new home. Those closing costs typically include origination fees, title insurance, recording fees, and prepaid items like property taxes and homeowners insurance.

Using a VA Loan Mobile Home Financing to Buy Land + Home

One of the most valuable features of VA loan mobile home financing is the ability to purchase both land and a manufactured home together. This powerful combination offers significant advantages—longer loan terms (up to 25 years and 32 days for double-wides with land), better interest rates compared to chattel loans, and the opportunity to build equity in both the home and land.

“The land-home package is where the real value is,” says David Ramirez, our Victoria finance manager. “While the home itself might depreciate slightly over time, the land typically appreciates, creating overall equity growth that you just don’t get with a home on leased land.”

You have several paths to choose from when financing both land and a home. The simplest option is purchasing an existing manufactured home already installed on land. This streamlines the process since the home is already on a permanent foundation and classified as real property.

Alternatively, you can buy land and a new manufactured home separately. Your VA loan can cover the entire project—land purchase, home purchase, site preparation (including clearing and grading), foundation construction, utility connections, and professional installation. This gives you the freedom to create exactly the home site you want.

The most challenging option—and one we generally recommend approaching with caution—is purchasing land and moving an existing manufactured home to it. Many lenders shy away from financing moved homes, and you’ll need a structural engineer’s certification, professional movers, a new foundation built to VA standards, and re-classification as real property after installation.

For more details about this popular option, check out our comprehensive guide to Manufactured Home and Land Financing.

Refinance, Cash-Out & Streamline Options for Mobile Homes

Already own a manufactured home with a VA loan? You’ve got several refinancing options that could save you money or help you tap into your equity.

The Interest Rate Reduction Refinance Loan (IRRRL), affectionately known as the “VA Streamline Refinance,” is the simplest path to lowering your interest rate. With minimal paperwork—typically no new COE, credit check, or appraisal required—and a reduced funding fee of just 0.5%, it’s a veteran-friendly way to reduce your monthly payment.

“I helped a veteran family in Schertz reduce their rate by 1.75% using an IRRRL last year,” shares Thomas Martinez from our team. “That translated to saving $220 every month on their double-wide. Over the life of their loan, that’s nearly $53,000 kept in their pockets.”

If you need cash for home improvements, debt consolidation, or other expenses, a VA Cash-Out Refinance might be the answer. This option requires full underwriting, including a new appraisal and credit check, but allows you to borrow up to 90% of your home’s value for manufactured homes.

Before refinancing, consider your break-even point—how long it will take for your monthly savings to offset the closing costs. If you’re planning to move in the next few years, refinancing might not make financial sense even with a lower rate.

Manufactured home refinancing still comes with the same maximum loan terms—20 years for single-wides and 25 years for double-wides with land. And homes that have been moved from their original installation site face significant challenges when refinancing.

Benefits vs. Drawbacks—Know Before You Sign

Every financing option has its pros and cons, and VA loan mobile home financing is no exception. Understanding both sides helps you make an informed decision that’s right for your situation.

On the plus side, VA loans offer significant financial advantages. With full entitlement, you can finance 100% of your purchase price—no down payment required. You’ll also avoid the burden of private mortgage insurance (PMI), saving hundreds of dollars annually compared to conventional or FHA loans.

VA loans typically feature interest rates 0.5% to 1% lower than conventional loans, and the VA restricts certain fees while allowing sellers to cover up to 4% of the purchase price in concessions. The program also offers more flexible credit requirements than conventional lenders, making homeownership accessible to veterans who might not qualify otherwise.

“The reusable benefit is something I always emphasize to my clients,” says Jennifer Lopez from our Von Ormy location. “Your VA loan entitlement isn’t a one-and-done benefit—you can use it multiple times throughout your life as your housing needs change.”

On the flip side, manufactured home VA loans come with shorter maximum terms—20 to 25 years versus 30 years for site-built homes. This means higher monthly payments compared to a longer-term loan of the same amount. You’ll also find fewer lenders offering these loans, potentially limiting your options.

The strict property requirements can be challenging to meet, especially for older manufactured homes. Unless you’re exempt due to service-connected disability or other qualifying factors, you’ll pay a funding fee of 1.4% to 3.3% of the loan amount.

Perhaps most importantly, manufactured homes typically don’t appreciate as quickly as site-built homes, though this varies greatly depending on location, condition, and whether you own the land. When it’s time to sell, you might face a smaller pool of potential buyers, potentially extending your selling timeline.

Common Pitfalls & How to Avoid Them

Knowledge is power when navigating VA loan mobile home financing. Being aware of these common pitfalls can save you time, money, and heartache.

One of the most common mistakes is attempting to finance a pre-1976 mobile home. These homes simply don’t qualify for VA financing, no matter their condition. Focus your search on homes built after June 15, 1976, with visible HUD tags.

Another frequent stumbling block involves property classification. To qualify for VA financing, the home must be permanently affixed to a foundation and titled as real estate, not personal property. This effectively rules out homes in parks where you lease the land rather than own it.

“I’ve seen countless deals fall apart because of moved homes,” explains Eduardo Sanchez, one of our loan specialists. “Most lenders won’t finance a home that’s been relocated from its original installation site with a VA loan. If possible, look for homes still on their original foundation.”

Don’t underestimate lender overlays either—these are additional requirements beyond what the VA mandates. Working with a lender experienced in manufactured home VA loans who can explain their specific requirements upfront saves everyone frustration later.

Appraisal issues can also derail your purchase. If the appraisal comes in below the purchase price, you’ll need to negotiate with the seller, cover the difference yourself, or walk away. Including an appraisal contingency in your purchase agreement gives you an exit strategy if needed.

Alternatives if VA Loan Mobile Home Financing Isn’t an Option

Sometimes, despite your best efforts, VA financing just isn’t feasible for a particular manufactured home. When that happens, several alternatives can still help you achieve homeownership.

FHA Title I loans offer financing up to $69,678 for the manufactured home and lot, with a minimum 5% down payment and terms up to 20 years. One significant advantage—they can be used for homes in leased land communities where you don’t own the underlying property.

For homes on permanent foundations, FHA Title II loans provide up to 30-year terms with a minimum 3.5% down payment, though they require monthly mortgage insurance.

Fannie Mae’s MH Advantage program targets higher-quality manufactured homes with site-built features. With as little as 3% down and terms up to 30 years, it offers lower mortgage insurance premiums than FHA loans.

Rural property buyers might qualify for USDA Rural Development loans, which offer 100% financing for homes in eligible areas, though income limits apply and the property must meet specific standards.

Chattel loans—which finance the home as personal property rather than real estate—come with higher interest rates (typically 2-5% above mortgage rates) and shorter terms (15-20 years), but have less stringent property requirements.

For smaller amounts or temporary financing, personal loans might work, though they typically feature higher interest rates and much shorter terms, usually 5-7 years.

“While VA loans offer the best terms for eligible veterans, they’re just one tool in the toolbox,” says Ricardo Torres from our Corpus Christi office. “We pride ourselves on finding the right financing solution for each family’s unique situation, even when the VA path isn’t available.”

Conclusion & Next Steps

The journey through VA loan mobile home financing might feel like navigating a maze at times, but the destination—affordable homeownership—makes every turn worthwhile for our veterans and service members. We’ve covered a lot of ground together, from eligibility requirements to property standards, financing options to potential pitfalls.

What matters most is that this benefit exists specifically for you—those who’ve served our country—to make homeownership more accessible and affordable. The zero-down payment, competitive interest rates, and no PMI advantages can translate into thousands of dollars saved over the life of your loan.

Here at Manufactured Housing Consultants, we see the difference these homes make in veterans’ lives across Texas. As Carlos, one of our recent customers in San Antonio, told us: “I never thought I could afford a home of my own until I learned about using my VA benefit for a manufactured home. Now my family has three bedrooms, two baths, and a yard—all for less than we were paying in rent.”

We’re proud to support veterans throughout Texas with:

- Guaranteed lowest prices on quality manufactured homes (we’ll match or beat any competitor)

- Statewide delivery service to any location in Texas—from the Rio Grande Valley to the Panhandle

- Extensive selection from America’s top manufacturers, with hundreds of floor plans to choose from

- VA-specific expertise from our team members who understand both manufactured housing and veteran benefits

- Relationships with specialized lenders who regularly work with VA loans for manufactured homes

- Start-to-finish guidance through both the home selection and financing processes

Many of our team members are veterans themselves, bringing personal understanding to your journey. We know that navigating this process can feel overwhelming, which is why we’ve created straightforward resources and built relationships with lenders who specialize in helping veterans achieve homeownership.

Ready to take the next step toward affordable homeownership? Browse our website to learn more about our financing programs or stop by one of our locations in San Antonio, New Braunfels, Von Ormy, Laredo, Corpus Christi, or Victoria. Our team is ready to answer your questions, show you our available homes, and help you steer the VA loan mobile home financing process.

Your service to our country deserves recognition, and we consider it an honor to help you use your hard-earned benefits to create a comfortable, affordable home for you and your family. The path to homeownership starts with a single step—we’re here to walk alongside you the rest of the way.