Why Manufactured Homes Financing is the Smart Path to Affordable Homeownership

Manufactured homes financing offers an affordable route to homeownership, with options ranging from traditional mortgages to specialized chattel loans. Here are your main financing paths:

Quick Financing Options Overview:

- FHA Title I Loans – 3.5% down, credit scores from 580

- Conventional Mortgages – For homes on owned land with permanent foundations

- Chattel Loans – Personal property loans for homes on leased land

- VA/USDA Loans – 0% down for qualified buyers

- Dealer Financing – In-house options with flexible credit requirements

With the median home price exceeding $412,000, manufactured homes average just $127,250 – making them nearly three times more affordable than traditional site-built homes. This dramatic cost difference explains why manufactured housing accounts for approximately 10% of new home starts in some provinces.

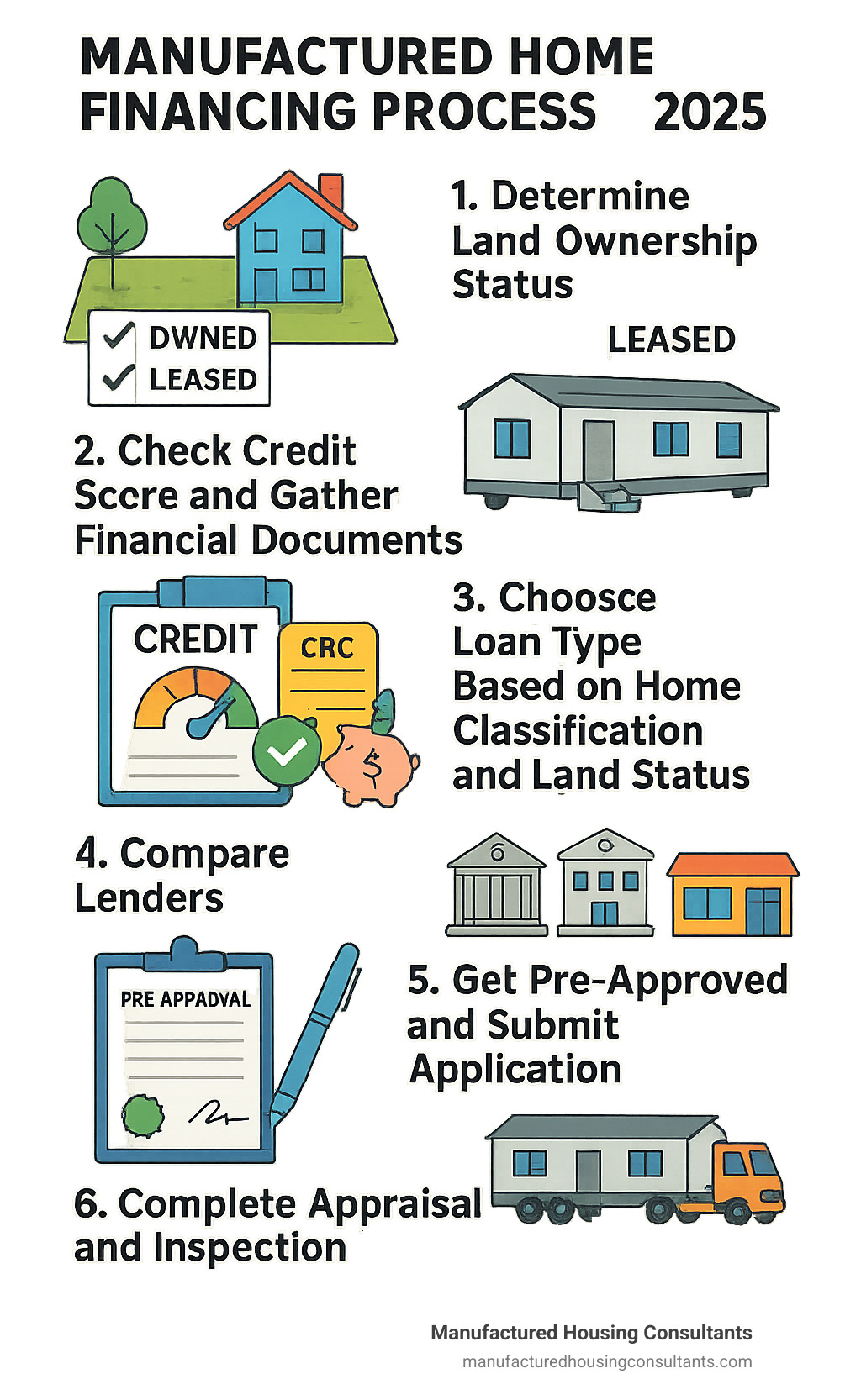

However, financing these homes requires understanding unique rules. Unlike traditional mortgages, your financing options depend heavily on whether you own the land, the home’s age and classification, and local zoning requirements.

Interest rates typically range from 5% to 9% – slightly higher than conventional mortgages due to perceived risk. Down payments vary from 5% to 20%, and about 60% of manufactured homes sit on leased land, which limits your loan choices.

Multiple financing programs exist specifically for manufactured homes, including government-backed options that make homeownership possible even with challenged credit or limited savings.

Simple guide to manufactured homes financing terms:

Manufactured Homes Financing: Loan Options, Costs & Approval Strategy

Manufactured homes financing differs from typical mortgages because modern manufactured homes aren’t the “mobile homes” your grandparents might remember. Since 1976, every manufactured home must meet strict HUD federal building codes – a quality guarantee that ensures your home is built to last.

In Canada, homes follow CSA codes (Z240 for manufactured homes or A277 for modular homes). The Canada Mortgage and Housing Corporation (CMHC) provides mortgage insurance for manufactured home buyers, making lenders more comfortable and lowering interest rates.

The affordability advantage is huge. While regular home prices keep climbing, manufactured homes stay refreshingly reasonable. Over 22 million Americans live in manufactured homes.

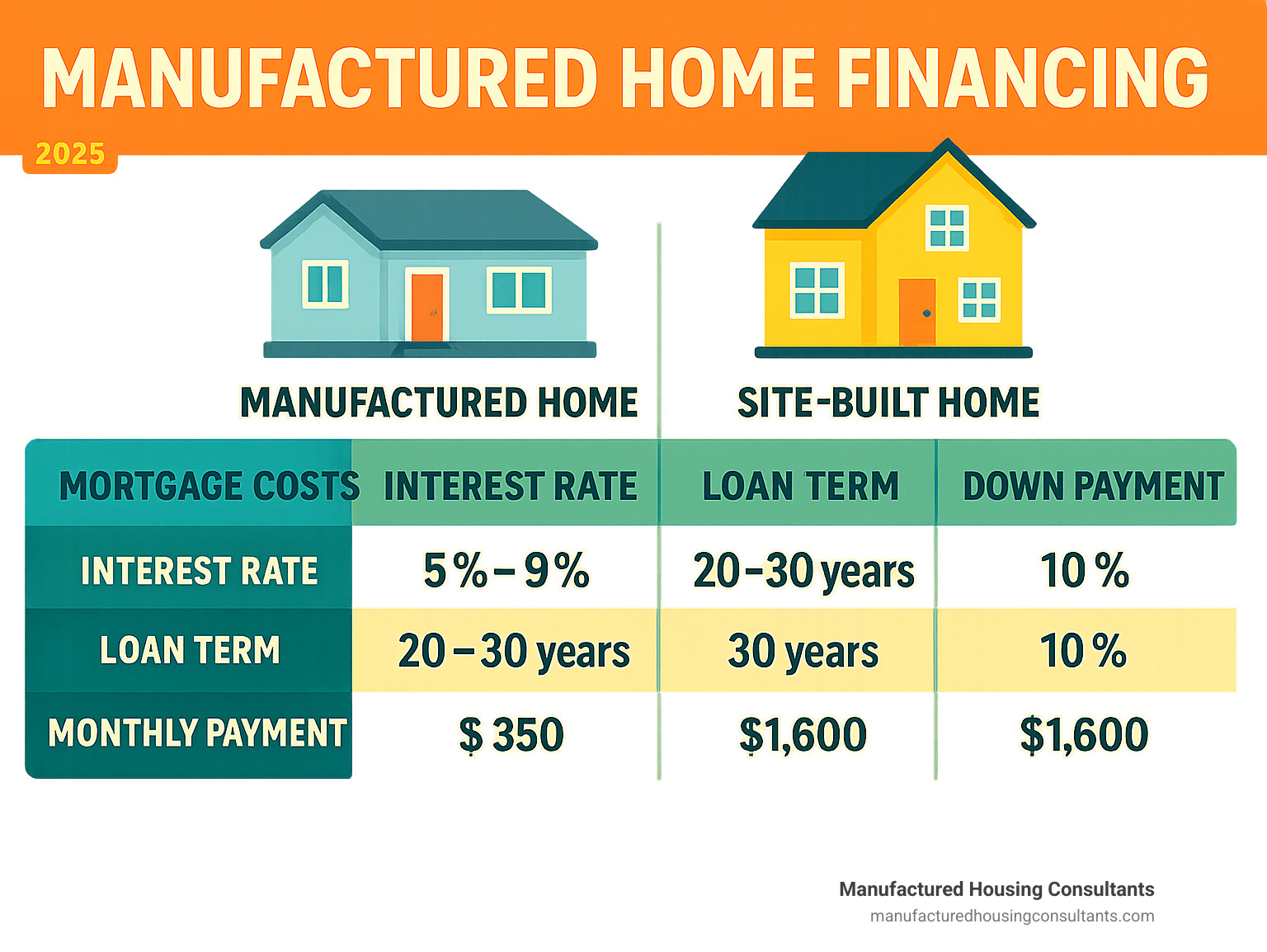

Lenders see manufactured homes as slightly riskier than traditional homes, affecting your financing with higher interest rates (5-9% instead of 3-6%), shorter loan terms (15-25 years instead of 30), and larger down payments (5-20% instead of 3-5%).

Manufactured vs. Modular vs. Site-Built—Why Classification Matters

Your home’s classification opens different financing doors. Manufactured homes built after 1976 follow HUD code standards and can qualify for FHA, VA, and conventional financing when properly installed.

Mobile homes from before 1976 lack HUD compliance, limiting financing options to specialized lenders or cash purchases.

Modular homes (CSA A277 in Canada) are financing favorites, built to local building codes and classified as real estate from day one, qualifying for traditional mortgage financing.

Converting a manufactured home to real property requires installing it on a permanent foundation, removing wheels and axles, filing an Affidavit of Affixture, getting proper permits and inspections, and meeting local zoning requirements. This conversion dramatically improves financing options and helps your home appreciate in value.

Loan Types & Programs You Can Use Today

FHA Title I loans are often the hero of manufactured home financing. You can borrow up to $105,532 for single-section homes or $193,719 for multi-section homes. Terms go up to 20 years for just the home, or 25 years for home and land together. With credit scores of 580+, you need just 3.5% down. You can finance homes on leased land with at least a 3-year lease.

Traditional FHA loans (Title II) work when your home is classified as real estate on owned land. Same 3.5% down payment with good credit, 30-year terms available, but you’ll pay mortgage insurance.

VA loans offer 100% financing – zero down payment – with competitive rates and no mortgage insurance for qualified veterans. Must be your primary residence.

USDA Rural Development loans offer zero-down options for eligible rural areas with populations under 20,000. Income limits apply.

Conventional loans work for homes on owned land with permanent foundations. Need credit scores of 620+, down payments from 5-20%, and mortgage insurance cancels at 20% equity.

Chattel loans are personal property loans for homes on leased land. Rates start around 8%, terms up to 20 years, faster closing than traditional mortgages.

Dealer financing offers in-house financing with flexible credit requirements and quick approval processes.

For homes needing foundation work, scientific research on foundations provides detailed installation standards. Find more information on our mobile home loan financing page.

Rates, Terms & Down Payments Compared to Traditional Mortgages

Manufactured homes financing typically costs more than traditional mortgages, but lower purchase prices often result in significantly lower monthly payments.

Interest rates for manufactured homes typically run 5-9% compared to 3-6% for site-built homes. Chattel loans often hit 8-12%, while personal loans can climb above 12%.

Loan terms vary significantly. FHA Title I loans run 6 months to 25 years maximum. Conventional manufactured home loans offer 15-30 years, while chattel loans typically stick to 15-20 years.

Down payment requirements depend on loan type and credit score. With good credit (580+), FHA loans need just 3.5% down. Credit scores 500-579 require 10%. VA and USDA loans offer 0% down for qualified buyers. Conventional and chattel loans typically require 5-20% down.

Credit scores significantly affect rates. Scores 740+ get the best rates, 680-739 get good rates, 620-679 get standard rates, 580-619 pay higher rates, and below 580 need specialized programs.

Even with higher rates, a $150,000 manufactured home at 7% interest results in much lower monthly payments than a $400,000 site-built home at 5% interest.

Financing on Leased Land & Permanent Foundations

About 60% of manufactured homes sit on leased land in manufactured home communities. FHA Title I loans work for leased land with at least 3-year initial lease terms and 180 days advance termination notice. Loan limits reach $105,532 for single-section homes or $193,719 for multi-section homes.

Chattel loans are common for leased land since the home is personal property. The loan stays with the home if you move it, with faster approval and closing processes.

Credit unions often offer better rates for leased land situations with local decision-making and relationship focus.

Before choosing a community, ensure the park approves your home model and financing, review lease terms carefully, check insurance requirements, and understand selling restrictions.

Permanent foundations open traditional mortgage financing options. The foundation needs proper tie-downs, anchoring systems, appropriate skirting, and frost line compliance. Installation must follow HUD’s Model Manufactured Home Installation Standards.

For detailed land financing options, check our finance manufactured home on land page.

Eligibility, Documentation, Insurance & Common Pitfalls

Credit score requirements vary by loan type. FHA accepts 580+ for 3.5% down, or 500+ with 10% down. Conventional loans want 620+. VA loans prefer 620+. USDA loans like 640+. Chattel loans often work with 575+.

Income and debt requirements follow standard guidelines. Housing costs shouldn’t exceed 32% of gross income, and total debt payments shouldn’t exceed 40-43%.

Documentation includes 2 years tax returns, recent pay stubs, bank statements, employment verification, asset statements, manufacturer’s certificate, HUD certification, installation certification, property survey if applicable, and lease agreement for leased land.

Common pitfalls include age restrictions (many lenders won’t finance homes over 20-30 years old), serial number issues, zoning compliance problems, appraisal challenges, insurance gaps during transport, and missing building permits.

Insurance requirements typically include homeowner’s insurance, flood insurance in applicable areas, wind/hail coverage, liability coverage, and lender named as loss payee.

How to Choose the Right Lender & Boost Approval Odds

Credit unions often offer competitive rates with member-focused service and local decision-making. Traditional banks provide standardized programs and online tools. Dealer financing offers convenient one-stop shopping with flexible credit requirements.

Pre-qualification gives basic assessment without credit checks. Pre-approval involves comprehensive review with binding loan commitment, providing stronger negotiating position.

Ask lenders about loan types offered, current rates and lock periods, fees, approval timelines, loan servicing, moving policies, and refinancing options.

Boost approval odds by improving credit profiles, paying bills on time, reducing credit utilization, providing complete documentation, and considering co-signers if needed.

Choose newer home models (post-2000 preferred) with proper HUD certification and local code compliance from reputable manufacturers.

Rate locks are typically available for 30-60 days. Some dealers offer inventory financing for immediate delivery from dealer stock.

Conclusion & Your Next Steps

You now understand manufactured homes financing completely. When site-built homes average over $400,000, manufactured homes at $127,250 offer a genuine path to homeownership. That’s not settling – that’s being smart about your money while getting a quality home meeting all safety standards.

The financing landscape works in your favor with multiple government programs. FHA loans get you in with just 3.5% down at 580 credit score. VA loans offer zero down for veterans, while USDA loans do the same for rural buyers. Even with challenged credit, chattel loans and dealer financing provide alternatives.

Yes, you’ll pay slightly higher interest rates – usually 5% to 9% versus conventional mortgages. But your monthly payment on a $150,000 manufactured home will still be hundreds less than payments on a $400,000 site-built home.

Your success depends on preparation. Check your credit score early and improve if needed. Decide on land ownership versus leasing. Gather financial documents before shopping, and compare multiple lenders – credit unions often surprise with better rates than big banks.

Government incentives make the journey smoother. In Canada, CMHC insurance opens doors for first-time buyers with 5% down. American buyers benefit from FHA, VA, and USDA programs reducing barriers.

Today’s manufactured homes feature energy-efficient designs, modern layouts, and construction quality rivaling site-built homes. The financing options have evolved too, creating real pathways to homeownership.

At Manufactured Housing Consultants, we’ve helped countless Texas families steer this process. Our guaranteed lowest prices combined with statewide delivery means you get financing help and the best deal possible. Whether you’re in San Antonio, New Braunfels, Von Ormy, Laredo, Corpus Christi, or Victoria, we understand the local market and financing landscape.

Your next step is simple: determine your land situation, check your credit, and start comparing loan programs. Don’t let perfect be the enemy of good – even with imperfect credit or modest down payment, options exist.

For detailed information about all financing choices, visit our More info about Finance Manufactured Homes page. We’ll walk you through every option and help you find financing that fits your specific situation.

Homeownership doesn’t have to stay a dream. With the right financing and a quality manufactured home, you could be holding keys to your own place sooner than you think.