Making Homeownership Affordable: FHA Mobile Home Financing

FHA mobile home financing is a government-backed loan program that helps buyers with limited budgets purchase manufactured homes with down payments as low as 3.5% and more flexible credit requirements than conventional loans.

Quick Facts About FHA Mobile Home Financing:

- Minimum down payment: 3.5% (credit score ≥580) or 10% (credit score 500-579)

- Loan types: Title I (home only/leased land) or Title II (home + owned land)

- 2024 loan limits: $69,678 (home only), $23,226 (lot only), $92,904 (home + lot)

- Minimum requirements: HUD-certified home built after June 15, 1976; at least 400 sq ft

- Terms: Up to 20 years (single-section), 25 years (multi-section with land)

For many Americans, the traditional path to homeownership seems increasingly out of reach. Rising home prices, tight inventory, and strict lending requirements have created barriers that feel impossible. But there’s a more affordable alternative that’s helping thousands achieve their homeownership dreams: manufactured homes with FHA financing.

The Federal Housing Administration (FHA) has been helping Americans become homeowners since 1934. Their specialized programs for manufactured housing offer a pathway to affordable homeownership with lower down payments and more flexible credit requirements than conventional loans.

In Texas, where housing costs continue to climb, manufactured homes represent a practical solution for budget-conscious buyers. These factory-built homes cost 20-30% less than comparable site-built homes while offering similar quality, customization options, and modern amenities.

Whether you’re a first-time homebuyer, have less-than-perfect credit, or simply want to maximize your housing budget, understanding FHA mobile home financing options could be your key to affordable homeownership.

Fha mobile home financing word roundup:

Why This Guide Matters

The homeownership gap in America continues to widen. While traditional home prices keep climbing, wages haven’t kept pace. This disparity has created a growing need for affordable housing solutions, especially in rapidly growing states like Texas.

In 1976, the Department of Housing and Urban Development (HUD) established the HUD Code, the first and only federally regulated national building code. This milestone transformed the manufactured housing industry, ensuring quality, safety, and durability standards for factory-built homes.

Today, manufactured homes built to the HUD Code represent nearly 10% of new single-family home starts. Their popularity continues to rise as more Americans find the value, quality, and affordability these homes offer.

“You can purchase a mobile home or manufactured home using an FHA mortgage as long as the home can ultimately be taxed as real property,” explains housing finance expert Sarah Sharkey. This flexibility has opened doors for thousands of families who might otherwise be priced out of homeownership.

Who This Guide Helps

This comprehensive guide is designed for:

- First-time homebuyers looking for an affordable entry point into homeownership

- Borrowers with credit challenges who might not qualify for conventional financing

- Rural Texans seeking quality housing options in areas with limited new construction

- Budget-conscious buyers wanting to maximize their housing dollars

- Downsizers looking for smaller, more manageable homes without sacrificing quality

- Anyone interested in the manufactured housing option with government-backed financing

At Manufactured Housing Consultants, we’ve helped countless Texans steer the sometimes confusing world of FHA mobile home financing. From San Antonio to Corpus Christi, Laredo to Victoria, we’ve guided buyers through every step of the process.

FHA Mobile Home Financing 101: Programs, Requirements & Eligibility

The Federal Housing Administration doesn’t actually lend money directly. Instead, they insure loans made by FHA-approved lenders, reducing the lender’s risk and allowing them to offer more favorable terms to borrowers who might not qualify for conventional financing.

This insurance is what makes FHA mobile home financing unique and accessible to a broader range of homebuyers.

What Makes FHA Mobile Home Financing Unique?

When you’re dreaming of homeownership but worried about your budget or credit score, FHA mobile home financing can be a true game-changer. What makes these loans special is their accessibility – they’re specifically designed to help folks who might struggle with traditional mortgage requirements.

The federal government actually stands behind these loans, providing insurance that protects lenders if a borrower can’t make payments. This government backing is why lenders feel comfortable offering such borrower-friendly terms – like down payments as low as 3.5% compared to the typical 5-20% with conventional loans.

For many of our San Antonio families with credit challenges, FHA loans are a breath of fresh air. You can qualify with a credit score as low as 500 (though you’ll need a 10% down payment at that level), whereas conventional loans typically want scores of 620 or higher.

The FHA has also created specific provisions for manufactured housing, recognizing that these affordable homes represent a practical path to homeownership for many Americans. If you’d like to explore more financing options, our detailed guide on how to Finance Manufactured Homes covers everything you need to know.

Mobile, Manufactured & Modular — Know the Difference

I can’t tell you how many times customers walk into our office confused about these terms! Let me clear things up, because the terminology directly impacts your financing options.

Mobile homes technically refers only to factory-built homes made before June 15, 1976. That’s when everything changed with the HUD Code. These older homes generally won’t qualify for FHA financing.

Manufactured homes are what most people are actually looking for – factory-built homes constructed after June 15, 1976, that meet HUD’s federal building standards. They’re built on a permanent chassis and transported to your property in one or more sections. Look for the red HUD certification label on each section – that’s your ticket to FHA financing eligibility.

Modular homes are also factory-built but follow local building codes instead of HUD standards. They don’t have a permanent chassis and are treated just like traditional homes for financing purposes.

As housing expert Sarah Sharkey notes, “Many people use ‘mobile home’ interchangeably with ‘manufactured home’ despite technical distinctions.” We see this confusion all the time, and for simplicity, we’ll use “manufactured home” throughout this guide to refer to modern factory-built homes that qualify for FHA financing.

Borrower Eligibility Checklist

To qualify for FHA mobile home financing, you’ll need to meet several key criteria. Your credit score is important – with a score of 580 or higher, you can put down just 3.5%. Scores between 500-579 aren’t dealbreakers, but you’ll need a 10% down payment.

Your debt-to-income ratio (DTI) generally needs to stay under 43%, though we’ve seen exceptions up to 57% with strong compensating factors. The government will check that you don’t have delinquent federal debts through something called a CAIVRS check.

You’ll need stable income sufficient to make your mortgage payments, and the manufactured home must be your primary residence – not an investment property. And of course, you’ll need a valid Social Security Number and legal residency status.

For more details on qualifying, check our comprehensive Guidelines Manufactured Home Financing.

Property & Foundation Requirements

Not just any manufactured home can qualify for FHA financing – the property itself needs to meet specific standards.

First and foremost, your home must be HUD-certified – built after June 15, 1976, with that all-important red HUD tag on each transportable section. Size matters too – the home needs at least 400 square feet of living space.

The foundation is absolutely critical. Your manufactured home must be permanently installed according to the manufacturer’s requirements and comply with the Permanent Foundations Guide for Manufactured Housing (PFGMH). This isn’t something you can DIY – a licensed engineer must certify that the foundation meets HUD standards.

Your home needs permanent connections to water and sewer/septic systems, and it must be classified (or eligible to be classified) as real property, not personal property. If your perfect spot happens to be in a flood zone, you’ll face additional elevation and insurance requirements.

What makes a foundation “permanent” in the eyes of HUD? It needs durable materials like concrete, mortared masonry, or treated wood. The footings must extend below the frost line for protection, and the entire system should transfer all loads to the underlying soil or rock. A continuous perimeter enclosure that resists wind is essential, and the design should minimize movement from frost, soil settlement, or seismic activity.

FHA Title I vs Title II Explained

The FHA offers two different loan programs for manufactured housing, and understanding the difference can save you thousands of dollars and hours of frustration.

Title I Loans offer remarkable flexibility. You can finance just the home, just the lot, or both together. One of their standout features is that they work for homes on leased land – perfect if you want to place your home in a manufactured home community.

For 2024, Title I loans have nationwide limits of $69,678 for the home only, $23,226 for just the lot, or $92,904 for both combined. The loan terms vary – up to 20 years for a manufactured home or single-section home with lot, 15 years for a lot only, or 25 years for a multi-section home with lot. While they offer fixed interest rates for the entire term, they typically carry slightly higher rates than Title II loans.

Title II Loans work more like standard FHA mortgages for traditional homes. The home must sit on a permanent foundation on land you own outright (fee simple). These loans follow the standard FHA loan limits by county, which are much higher than Title I limits – in most Texas counties, that’s $498,257 for 2024. You can stretch these loans out for up to 30 years, and they generally offer lower interest rates than Title I. The key requirement is that your home must be considered real property, not personal property.

As the Department of Housing and Urban Development explains, “Under the Title I program, FHA approved lenders make loans from their own funds to eligible borrowers to finance the purchase or refinance of a manufactured home and/or lot.”

Can You Get an FHA Loan Without Owning Land?

Yes! This is one of the most valuable features of FHA mobile home financing, particularly with the Title I program. You absolutely can finance a manufactured home that will be placed on leased land, whether in a manufactured home community or on privately leased property.

This flexibility has been a game-changer for many of our San Antonio clients who aren’t ready or able to purchase land. However, the land lease must meet specific requirements: it needs a minimum initial term of 3 years and must provide at least 180 days’ advance notice before termination. The site itself must meet FHA standards for water, sewer, and all-weather access.

One important note – even on leased land, your home must still be installed on a permanent foundation meeting HUD standards. This isn’t negotiable, but it’s worth the investment since it improves your home’s stability, longevity, and often its value.

At Manufactured Housing Consultants, we’ve helped countless families find beautiful, affordable homes in well-maintained communities throughout the San Antonio area, making homeownership possible even without land ownership.

Minimum Credit, Down Payment & Mortgage Insurance

The accessible credit and down payment requirements of FHA mobile home financing have helped many of our customers become homeowners when they thought it was impossible.

Your down payment will depend on your credit score. With a score of 580 or higher, you’ll need just 3.5% down – significantly lower than most conventional loans. If your score falls between 500-579, you can still qualify with a 10% down payment.

All FHA loans require mortgage insurance, which consists of two parts. First, there’s the Upfront Mortgage Insurance Premium (UFMIP) of 1.75% of your loan amount. Don’t worry – most people roll this into the loan rather than paying it out of pocket. Second, you’ll pay an Annual Mortgage Insurance Premium (MIP) ranging from 0.15% to 0.75% of your loan amount, divided into your monthly payments.

Unlike conventional loans where mortgage insurance typically drops off once you reach 20% equity, FHA mortgage insurance usually remains for the life of the loan. However, many homeowners eventually refinance to a conventional loan once they’ve built sufficient equity and improved their credit.

FHA Loan Limits & Buying Home + Land Together

Understanding the loan limits for FHA mobile home financing is essential to planning your purchase.

For Title I loans in 2024, the nationwide limits are straightforward: $69,678 for just the manufactured home, $23,226 for a lot only, or $92,904 for a home and lot combined. These limits don’t change based on where you live in Texas.

Title II loans follow the standard FHA loan limits, which do vary by county. For 2024, most counties in Texas have a limit of $498,257 for a single-family home, while high-cost counties can go up to $1,149,825.

Here’s a tip we often share with our customers: if you already own land, you can leverage the equity in that land toward your down payment when financing a manufactured home to be placed on it. We’ve helped many Texans use this strategy to drastically reduce their out-of-pocket expenses.

At Manufactured Housing Consultants, we pride ourselves on helping families throughout Texas steer these financial details. Whether you’re looking at communities in San Antonio or placing a home on your own land in the surrounding areas, we’ll help you understand exactly how FHA mobile home financing can work for your specific situation.

Comparisons, Process & Pro Tips for FHA Mobile Home Financing

Now that we’ve covered the basics, let’s walk through how to actually get FHA mobile home financing, compare it with other options, and share some insider tips we’ve learned from helping countless Texas families find their dream manufactured homes.

Step-by-Step FHA Mobile Home Financing Application

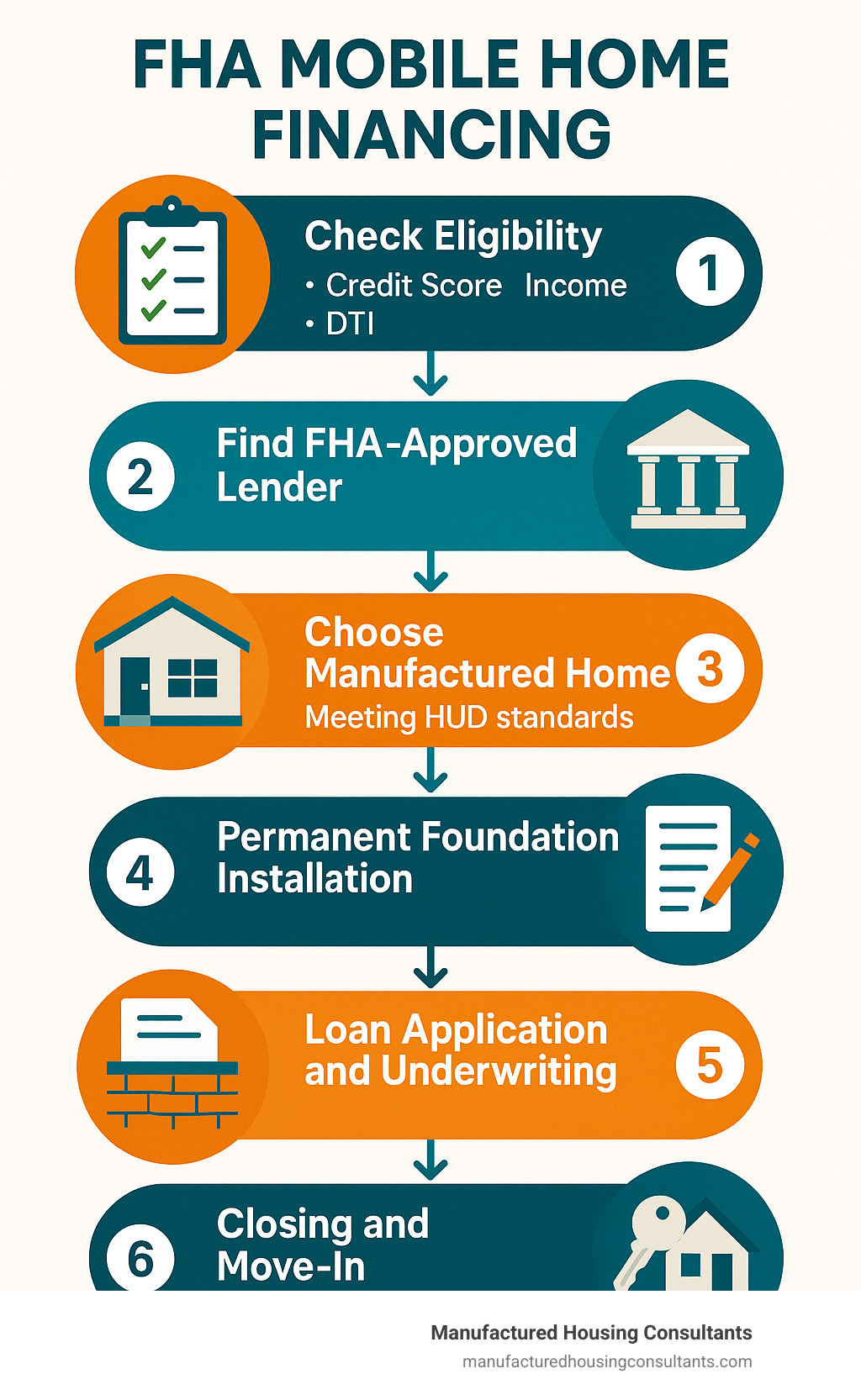

Getting FHA mobile home financing isn’t complicated when you know the steps. Here’s the journey from dreaming about your home to holding the keys:

First, talk with an FHA-approved lender for pre-qualification. This gives you a realistic budget based on your credit, income, and down payment savings. Next, select a manufactured home that meets FHA standards—remember it must be built after June 15, 1976, with those important HUD certification labels.

You’ll need to decide where your home will sit: land you already own, land you’re buying, or a spot in a manufactured home community. Then comes foundation planning—work with your retailer and an engineer to ensure it meets HUD’s permanent foundation requirements.

Once these pieces are in place, submit your formal loan application with all required paperwork. The lender will order an appraisal and you’ll need that engineer’s certification confirming the foundation meets HUD standards. After underwriting reviews everything, you’ll sign closing paperwork, pay closing costs, and finally—move into your new home!

“The process took about 45 days from application to closing for our San Antonio customers last quarter,” shares our lending specialist. “Planning ahead really helps smooth the journey.”

For more details about financing your manufactured home, check out our guide to Mobile Home Loan Financing.

Pros & Cons of Using an FHA Loan

FHA mobile home financing has clear advantages for many buyers. The low down payment (just 3.5% with good credit) opens doors for families with limited savings. The flexible credit guidelines mean you might qualify with a score as low as 500 (with 10% down). You’ll also enjoy fixed interest rates for the entire loan term and the ability to finance both home and land together.

However, there are trade-offs. You’ll pay mortgage insurance for the life of most FHA loans, which adds to your monthly payment. The loan limits can be restrictive, especially with Title I loans. Your property must meet specific HUD standards, which sometimes means additional costs. The process typically involves more paperwork and possibly longer processing times than conventional loans.

Maria from Corpus Christi told us: “I was nervous about buying my first home with a credit score of 612, but my lender helped me get an FHA loan with just 3.5% down. Yes, there was paperwork, but having an affordable fixed-rate mortgage on my beautiful manufactured home made it all worthwhile.”

Refinancing Options — Streamline & Cash-Out

Once you’ve had your FHA mobile home financing for a while, refinancing options open up. The FHA Streamline Refinance is particularly popular—it requires minimal documentation, often needs no new appraisal, and can lower your rate with less hassle. Your loan must be current and at least 210 days old to qualify.

Need to tap into your home’s equity? The FHA Cash-Out Refinance lets you access up to 80% of your home’s value. This requires a new appraisal and full documentation, plus you’ll need to have made at least 6 payments on your current FHA loan.

As your credit improves, you might consider a Conventional Refinance. With sufficient equity (typically 20%), you can potentially eliminate mortgage insurance altogether. This option has stricter qualification requirements but could save significant money long-term.

We’ve helped many families in San Antonio and beyond refinance their manufactured homes to lower monthly payments or fund home improvements. The right timing can make a big difference in your overall savings.

FHA vs Conventional, VA, USDA & Chattel

| Loan Type | Minimum Credit Score | Down Payment | Property Requirements | Mortgage Insurance | Best For |

|---|---|---|---|---|---|

| FHA | 500 (10% down), 580 (3.5% down) | 3.5-10% | HUD standards, permanent foundation | UFMIP + annual MIP | First-time buyers, lower credit scores |

| Conventional | Typically 620+ | 3-20% | Stricter property standards | PMI until 20% equity (if <20% down) | Good credit, higher down payment |

| VA | No minimum (typically 620+) | 0% | Similar to FHA | VA funding fee | Eligible veterans/service members |

| USDA | Typically 640+ | 0% | Rural areas only | USDA guarantee fee + annual fee | Rural homebuyers |

| Chattel | Typically 575+ | 5-20% | No permanent foundation required | None | Homes not classified as real property |

Did you know FHA loans are the #1 loan type for first-time homebuyers nationwide? Their accessibility makes them particularly valuable for manufactured housing, where other financing can sometimes be limited.

Finding FHA-Approved Lenders & Avoiding Deal-Killers

Not all lenders offer FHA mobile home financing, and finding one with experience matters. Use HUD’s lender search tool to find approved lenders, but be sure to specifically ask about their experience with manufactured homes and whether they offer both Title I and Title II programs.

Watch out for these common deal-breakers:

- Foundation issues or non-compliance with HUD standards

- Missing HUD certification labels on the home

- Land lease terms shorter than FHA requires

- Undisclosed debts or credit problems

- Insufficient income documentation

“I always tell our customers to compare loan offers from at least three lenders,” says our finance manager. “The differences in rates and fees can save you thousands over your loan term.”

Documentation You’ll Need

Being prepared with the right paperwork makes your FHA mobile home financing journey much smoother. You’ll need your government ID and Social Security card, along with income verification (pay stubs, W-2s, tax returns). Have your bank statements ready to show assets and any gift letters if someone’s helping with your down payment.

For the property itself, gather your purchase agreement, land deed or lease agreement, home specifications including the HUD data plate, and engineer’s foundation certification. You’ll also need site information like a plot plan and flood zone certification, plus homeowner’s insurance quotes.

We guide our customers through gathering these documents step by step, making the process manageable whether they’re buying in San Antonio, Laredo, or anywhere else in Texas.

Converting Personal Property to Real Property

Many manufactured homes start as personal property (like vehicles) but must become real property for certain financing, especially FHA Title II loans. This conversion process typically includes installing a permanent HUD-compliant foundation, getting an engineer’s certification, surrendering the home title to the state, filing an affidavit of affixture declaring the home permanently attached to the land, and having the home reassessed as real property for taxes.

The specific requirements vary by Texas county, and we’ve helped hundreds of customers steer this process across the state. While it might sound complex, our team makes it straightforward by coordinating with the right professionals at each step.

Conclusion

FHA mobile home financing has opened the door to homeownership for thousands of Texans who might otherwise be priced out of the market. With lower down payment requirements, more flexible credit guidelines, and specific programs designed for manufactured housing, FHA loans provide a valuable pathway to affordable homeownership.

At Manufactured Housing Consultants, we’re committed to helping you steer the sometimes complex world of manufactured home financing. We offer:

- The guaranteed lowest prices on quality manufactured homes

- Delivery anywhere in Texas, from San Antonio to Laredo, Corpus Christi to Victoria

- Expert guidance on all aspects of FHA mobile home financing

- A wide selection of homes from top manufacturers

- Solutions for various credit situations

For more information about the various financing programs available for mobile and manufactured homes, visit our comprehensive guide on mobile homes financing programs.

Ready to Move Forward?

If you’re ready to explore FHA mobile home financing options, here are your next steps:

- Contact us: Reach out to Manufactured Housing Consultants to discuss your housing needs and budget

- Check your credit: Review your credit report and score to understand your financing options

- Gather documentation: Start collecting the financial documents you’ll need

- Explore home options: Visit our locations to see the quality and variety of manufactured homes available

- Get pre-qualified: Work with an FHA-approved lender to determine your budget

- Select your home and location: Choose your perfect home and decide where it will be placed

- Complete the application process: Finalize your financing and prepare for closing

Key Takeaways

- FHA mobile home financing offers accessible paths to homeownership with down payments as low as 3.5%

- Understanding the difference between Title I and Title II programs is crucial to choosing the right option

- Manufactured homes must meet HUD standards and have proper certification to qualify

- Foundation requirements are stringent but ensure the long-term value and safety of your home

- Compare offers from multiple FHA-approved lenders to find the best terms

- Working with experienced professionals like Manufactured Housing Consultants can simplify the process

As housing costs continue to rise across Texas, manufactured homes with FHA financing represent an increasingly attractive option for budget-conscious buyers. With modern designs, quality construction, energy efficiency, and affordability, today’s manufactured homes offer a smart housing solution backed by the security of government-insured financing.

At Manufactured Housing Consultants, we’re proud to help Texans achieve their dream of homeownership through quality manufactured homes and accessible financing options. Contact us today to start your journey home.