Bridging the Gap to Affordable Homeownership

Finance manufactured home on land options have become increasingly popular as housing prices continue to rise across the country. If you’re looking for the fastest way to finance a manufactured home on land, here’s what you need to know:

- You need to own or purchase land along with the home

- Permanent foundation required for traditional mortgage financing

- Credit score minimum typically 620 for conventional loans, 500-580 for FHA

- Down payment ranges from 0% (VA/USDA) to 3.5% (FHA) to 5% (conventional)

- Multiple loan types available: Conventional, FHA, VA, USDA, and chattel loans

With the median price of traditional homes over $412,000 and manufactured homes averaging about $127,250, it’s no wonder more budget-conscious homebuyers are exploring this affordable path to homeownership.

Manufactured homes are built in factories under strict HUD Code standards established after June 15, 1976. They’re transported to your land and installed on a permanent foundation, offering quality housing at nearly half the cost per square foot of site-built homes.

The good news? When you finance manufactured home on land together, you can often use the same mortgage products available to traditional homebuyers. This means access to competitive interest rates, longer loan terms (up to 30 years), and consumer protections not available with personal property loans.

“Manufactured homes generally change in value at about the same rate as the local neighborhood,” according to research from Michigan Datacomp, challenging the misconception that these homes always depreciate.

The key to successful financing lies in understanding your options and requirements before you begin. Whether you already own land or need to purchase both simultaneously, there’s a financing solution available to match your situation.

Explore more about finance manufactured home on land:

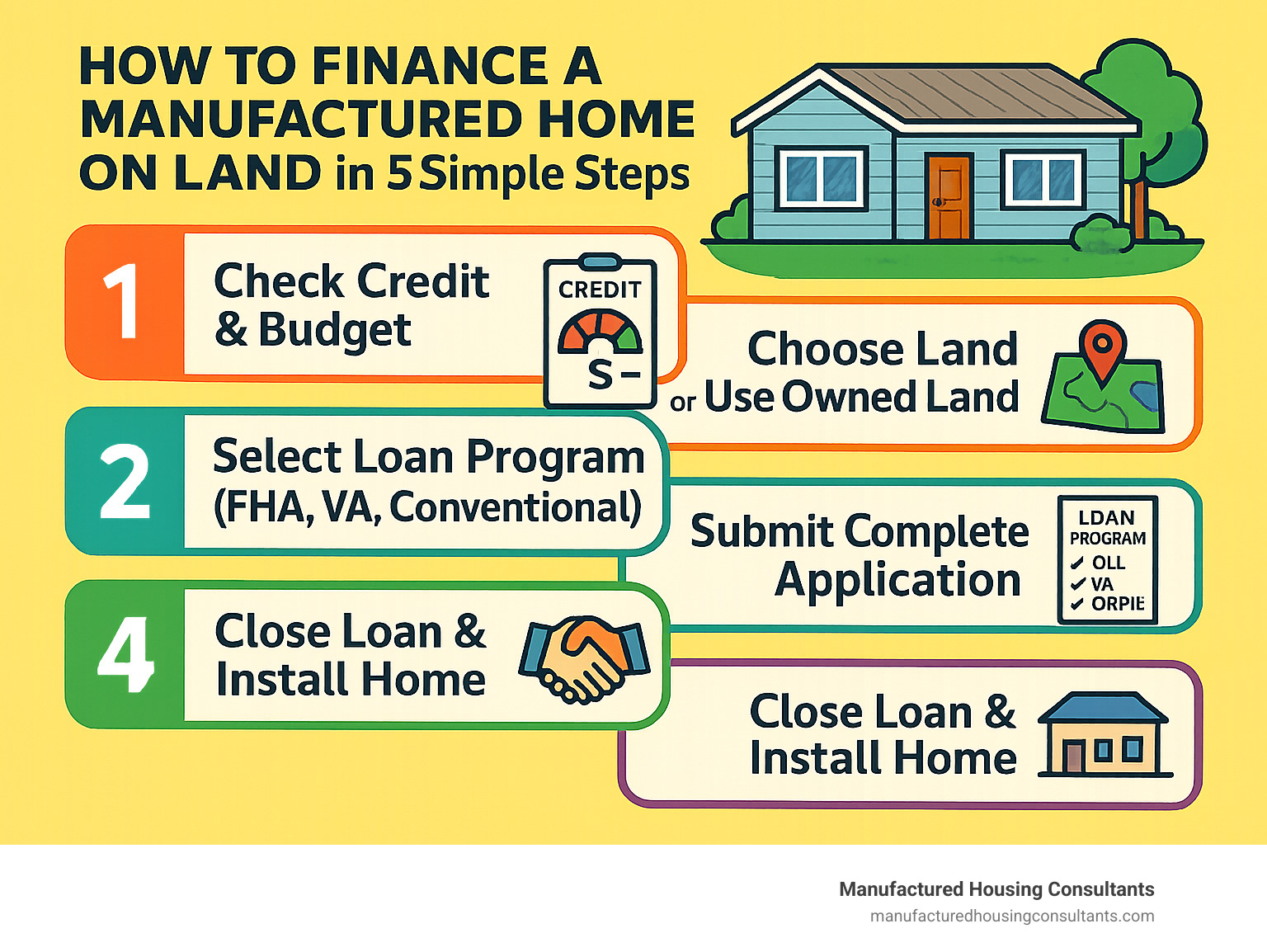

5 Simple Steps to Finance a Manufactured Home on Land

Finding the right financing for your manufactured home doesn’t have to feel like solving a puzzle. At Manufactured Housing Consultants, we’ve guided hundreds of families across San Antonio and throughout Texas toward affordable homeownership with manufactured housing. Let me walk you through our straightforward approach to getting your dream home financed.

Step 1 – Understand What Lenders Require to Finance a Manufactured Home on Land

Before you start filling out applications, it’s helpful to know what lenders are looking for when financing manufactured homes.

Most importantly, your home needs to comply with HUD standards if built after June 15, 1976. Lenders will check for those little metal HUD tags and the data plate inside your home.

Your home also needs to be permanently planted on a foundation that meets FHA, VA, or conventional loan requirements, with all wheels and towing equipment removed, and connected to utilities.

Title conversion is another crucial step. Your manufactured home needs to be classified as real property, not personal property (like a car).

As for your financial qualifications, most lenders look for a credit score of at least 620 for conventional loans, though FHA loans might accept scores as low as 580 with a 3.5% down payment. Your debt-to-income ratio typically needs to stay under 43% of your monthly income.

Want to dig deeper into funding options? Check out our guide on mobile home funding.

Step 2 – Choose the Right Land (or Use Your Land as Down Payment)

The perfect piece of land is just as important as the home itself. Whether you’re shopping for land or already own it, here’s what to consider:

First, check those zoning laws. Not all areas welcome manufactured homes with open arms. Some neighborhoods have restrictions on size, appearance, or even whether single-wide homes are allowed.

Don’t forget to assess utility access. Is there municipal water or will you need a well? How close are the power lines? Setting up utilities from scratch can add around $20,400 to your budget.

If you already own your land, you can often use your land equity as a down payment. This “land-in-lieu” approach can dramatically reduce what you need to bring to closing.

For more guidance on finding the perfect spot for your manufactured home, visit our guide to buying land for mobile and manufactured homes.

Step 3 – Compare Loan Programs and Rates

One of the best things about financing a manufactured home on land is the variety of loan programs available.

FHA loans come in two flavors for manufactured housing. Title I loans can finance just the home, just the land, or both together. Title II loans are for homes permanently attached to land. Both require at least 3.5% down with a credit score of 580 or higher.

If you’ve served in the military, VA loans offer incredible benefits – 0% down payment, no mortgage insurance, and competitive rates.

For rural properties, USDA loans also offer 0% down options with lower mortgage insurance than FHA.

Conventional loans through Fannie Mae’s MH Advantage or Freddie Mac’s CHOICEHome programs offer down payments as low as 3% for homes with features resembling site-built houses.

| Loan Type | Down Payment | Credit Score Min | Term Length | Special Features |

|---|---|---|---|---|

| FHA Title I/II | 3.5-10% | 500-580 | Up to 30 years | Lower credit requirements |

| VA | 0% | 620 (flexible) | Up to 25 years | No PMI, veterans only |

| USDA | 0% | 640 (typical) | Up to 30 years | Rural properties only |

| Conventional | 3-5% | 620-680 | Up to 30 years | Best rates with 680+ credit |

| Chattel | 5-20% | 575-620 | 15-20 years | For home only, higher rates |

For official information on HUD-backed manufactured home financing, visit the HUD website on financing manufactured homes.

Step 4 – Gather Documents & Apply for Pre-Approval

Getting organized before applying can save you weeks of back-and-forth with lenders.

For income verification, most lenders want to see your recent pay stubs, W-2 forms for the past two years, and if you’re self-employed, two years of tax returns.

You’ll also need your tax returns and financial statements – federal returns for the past two years, recent bank statements, and documentation of your current debts.

If you already own your land, you’ll need the deed showing your ownership. If you’re buying land, you’ll need the purchase agreement.

Lenders also require details about both the land and home, including a site plan showing where the home will sit on the property, manufactured home specifications, and HUD certification information.

For current information about financing rates, check out our guide to manufactured home financing rates.

Step 5 – Close, Install & Protect Your Investment When You Finance a Manufactured Home on Land

The final stretch involves closing your loan, preparing your site, installing your home, and protecting your investment.

Closing costs typically run 3-5% of your loan amount. This includes loan origination fees, appraisal fees, title search and insurance, recording fees, survey costs, and foundation certification.

Before your home arrives, you’ll need to prepare the site. This includes clearing and leveling the land, installing utilities, pouring the foundation, obtaining necessary permits, and creating a driveway for delivery access.

After installation, you’ll need a foundation inspection and certification from a licensed engineer. This confirms your home meets all HUD and local requirements.

Protect your investment with comprehensive homeowners insurance that covers both structure and belongings, includes liability protection, and addresses any regional risks.

For more information about financing both manufactured homes and land, visit our guide to manufactured home and land financing.

FAQs, Loan Programs & Long-Term Outlook

Quick Answers About Credit, Down Payments & Closing Costs – Start Financing Your Manufactured Home on Land Today

Navigating manufactured home financing doesn’t have to feel overwhelming. We’ve answered the most common questions our customers ask when they’re ready to take the next step toward affordable homeownership.

Credit Score Requirements: What Number Do You Really Need?

Your credit score opens different doors depending on which loan program you choose. Conventional loans typically require a minimum score of 620, with the best interest rates available for scores above 680.

FHA loans offer more flexibility, accepting scores as low as 580 with just 3.5% down. Even if your score falls between 500-579, you’ll just need a larger 10% down payment.

Veterans benefit from more lenient VA loan requirements, while USDA rural loans generally look for 640+, and chattel loans can work with scores as low as 575 in some cases.

Down Payment Options: How Much Cash Do You Really Need?

Military veterans can access VA loans with zero down payment. Similarly, USDA loans offer 0% down options for properties in qualifying rural areas throughout Texas.

FHA loans remain incredibly popular with their modest 3.5% down requirement (with 580+ credit). Conventional loans typically ask for 3-5% down.

Already own your land? Many of our customers use their land equity as a down payment through “land-in-lieu” programs, sometimes covering the entire down payment requirement.

Closing Costs and Setup: Budgeting for the Complete Picture

When financing a manufactured home on land, plan for all associated costs. Beyond the typical 3-5% in traditional closing costs, manufactured homes have some unique expenses:

The foundation typically averages around $9,247, while utility hookups average about $20,400. Delivery and basic setup generally run $1,500-3,000.

Many lenders allow seller concessions to help offset these costs, and several Texas programs offer closing cost assistance.

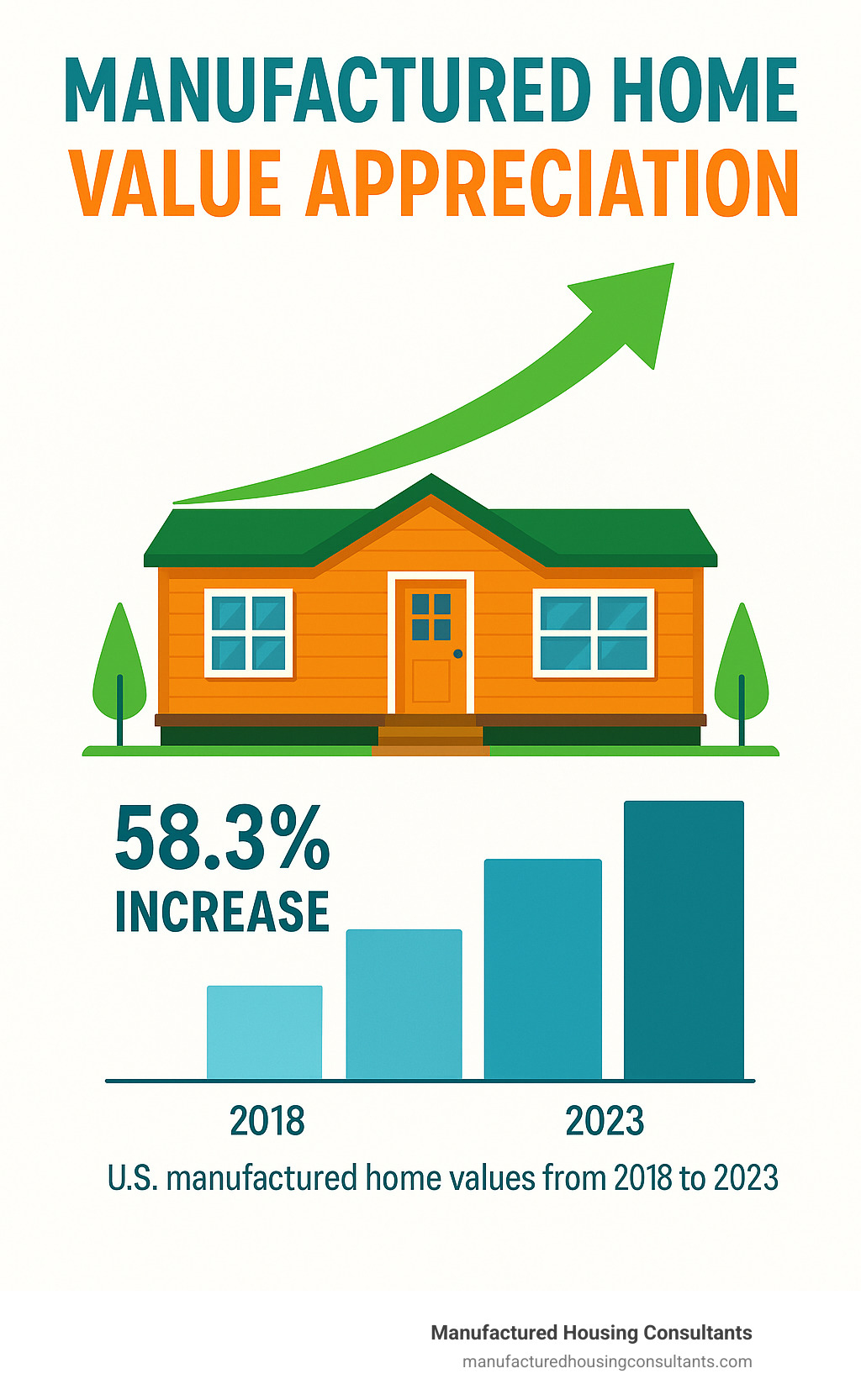

Will Your Home Appreciate? The Truth About Long-Term Value

When permanently installed on land you own, manufactured homes typically appreciate similarly to other homes in the same neighborhood. U.S. Census data reveals manufactured home values increased an impressive 58.34% between 2018 and 2023.

Two factors make the biggest difference in value retention: proper maintenance and land ownership. Plus, you’re getting tremendous value from the start – the average manufactured home costs $71 less per square foot than comparable site-built homes.

Why Texas Families Choose Manufactured Housing Consultants

At Manufactured Housing Consultants, we’ve dedicated ourselves to helping Texas families find and finance manufactured homes on land with confidence and ease. Our team serves San Antonio, Von Ormy, New Braunfels, Laredo, Corpus Christi, Victoria, and communities throughout Texas.

We stand behind our guaranteed lowest prices on quality manufactured homes and offer financing solutions for virtually all credit situations.

The Real Benefits of Financing a Manufactured Home on Land

When you finance a manufactured home on land, you’re making a smart investment in your future. These homes offer remarkable affordability at nearly half the cost per square foot of traditional construction. You’ll move in within months rather than waiting through lengthy traditional construction timelines.

Today’s manufactured homes are built to strict HUD standards in controlled environments, offering quality construction that often surprises first-time buyers.

For more details about financing options, check out our guide on mobile home financing options.

For official statistics and research backing these points, visit the U.S. Census Bureau’s Manufactured Housing Survey.

When you’re ready to explore your options for financing a manufactured home on land in Texas, our team at Manufactured Housing Consultants is here to help. We’ve guided hundreds of families through this process and would be honored to help you achieve affordable homeownership through manufactured housing.

For additional information about financing manufactured homes, visit our comprehensive guide to manufactured home financing.