Financing for mobile homes with bad credit can often seem like a daunting challenge. However, navigating this landscape is more manageable with the right information. If you’re looking for quick tips, here’s how you can secure financing:

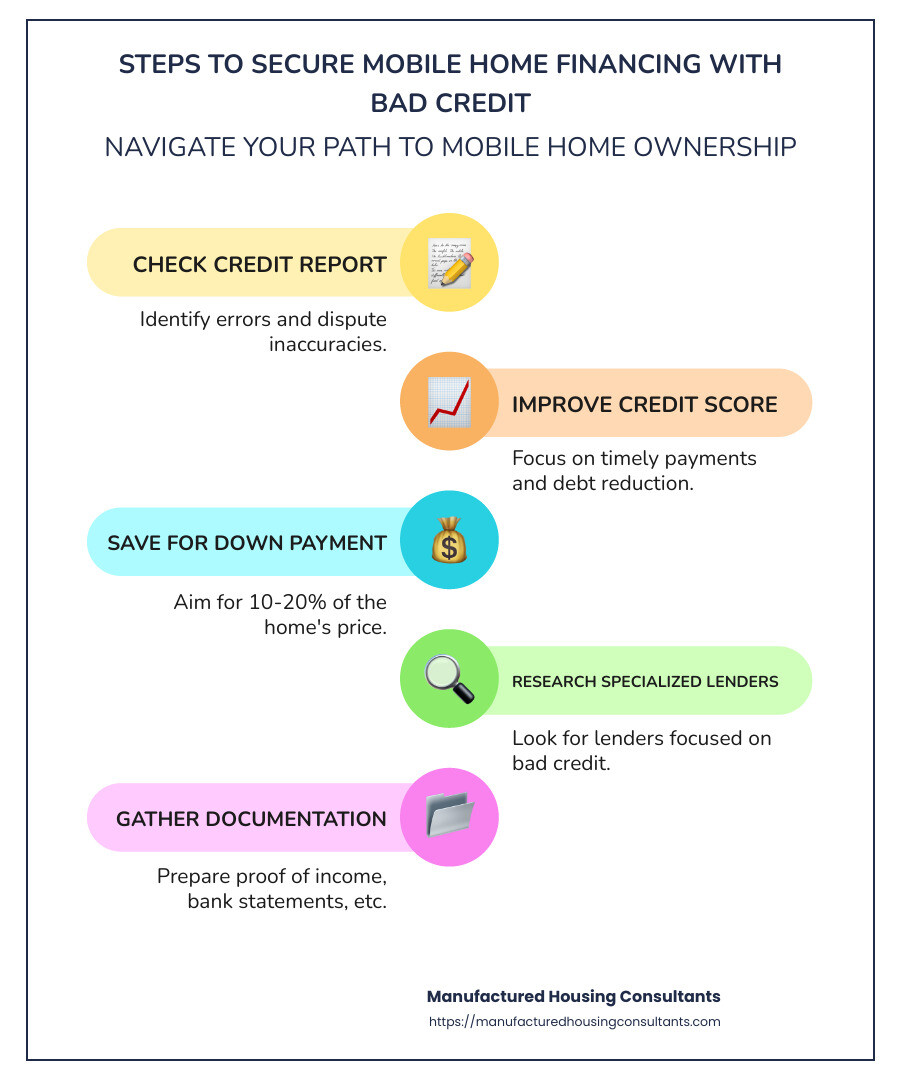

- Check your credit report for errors and dispute inaccuracies.

- Improve your credit score by making on-time payments and reducing debt.

- Save for a down payment, ideally 10-20% of the home’s price.

- Research lenders specializing in mobile home loans for individuals with bad credit.

- Gather necessary documentation such as proof of income and bank statements.

A mobile home can be a dream come true, especially for budget-conscious Texans seeking quality housing on a tight budget. While bad credit can add obstacles to this journey, it doesn’t make it impossible. Many have faced credit challenges, whether due to past financial difficulties or unexpected life events. Fortunately, numerous loan options are specifically designed to accommodate those with less-than-perfect credit.

By understanding your credit situation and exploring various financing options, such as FHA loans, VA loans, and chattel loans, you can make informed decisions. With diligent preparation, securing a mobile home loan with bad credit is achievable.

Understanding Mobile Home Financing

Getting a loan for a mobile home can be tricky, especially if you have bad credit. But don’t worry! There are options out there, like FHA loans, VA loans, and chattel loans, that can help you achieve your dream of owning a home.

FHA and VA Loan Options

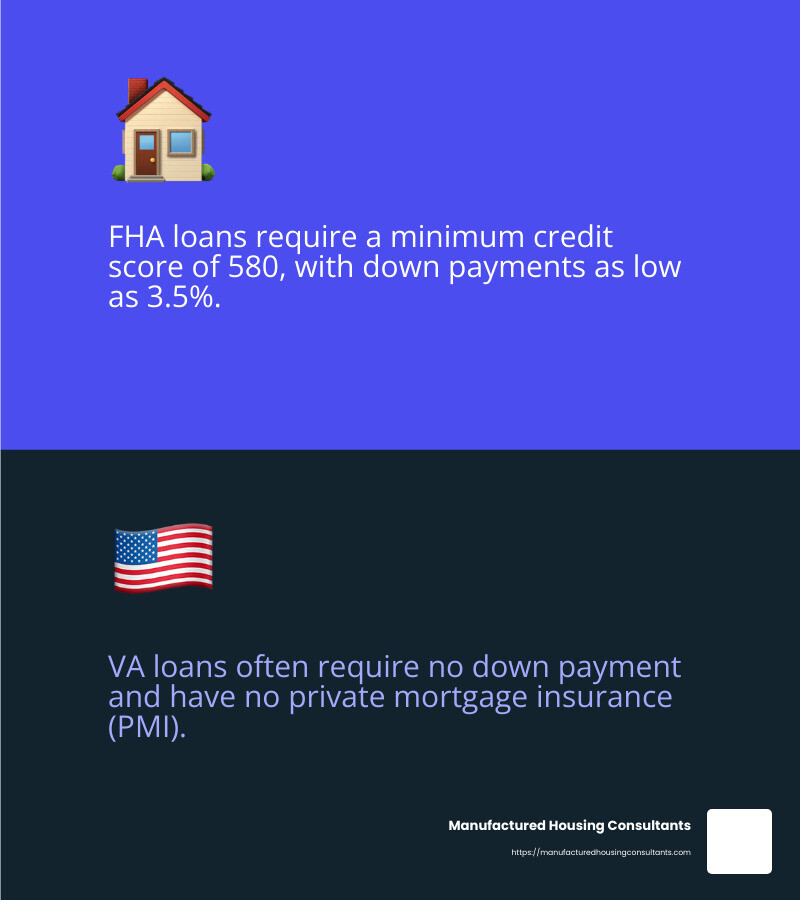

FHA Loans are a popular choice for those with poor credit. These loans are insured by the Federal Housing Administration and are issued by approved lenders. They are designed to help low- to moderate-income families get into homes. One of the biggest perks is the low down payment requirement—sometimes as low as 3.5% of the home’s price. Plus, you can qualify with a credit score as low as 580, though scores between 500 and 579 may still qualify with a higher down payment.

VA Loans are another excellent option, especially for veterans and active military members. Offered by the Department of Veterans Affairs, these loans often require no down payment and have lower interest rates compared to conventional loans. There’s also no need for private mortgage insurance (PMI), which can save you money every month. While the VA doesn’t set a minimum credit score requirement, many lenders look for a score of at least 620.

Both FHA and VA loans are government-backed, meaning they’re insured by the government. This makes lenders more willing to offer loans to those with less-than-perfect credit.

Chattel Loans and Other Alternatives

If you’re buying a mobile home that won’t be placed on land you own, a chattel loan might be the way to go. These loans are specifically for movable property like mobile homes, and they use the home itself as collateral. While they usually have higher interest rates than traditional mortgages, they can be a good option if you’re placing your mobile home in a park or on leased land.

Chattel loans are often shorter-term loans, which means you might pay off your home faster. However, because the home is the loan’s security, if you default, the lender could take the home.

Land ownership can also affect your financing options. If you own the land where your mobile home will sit, you might have more options and potentially better terms. Some lenders offer packages that combine the home and land loan into one, which can simplify the process.

In summary, while financing for mobile homes with bad credit can be challenging, it’s not impossible. By exploring FHA loans, VA loans, and chattel loans, you can find a path that suits your needs and financial situation.

Steps to Secure Financing for Mobile Homes with Bad Credit

Improving Your Credit Score

First things first: check your credit report. Obtain copies from the three major credit bureaus—Equifax, Experian, and TransUnion. Review them for errors. Mistakes happen, and they can drag down your score. Dispute any inaccuracies you find to potentially give your score a boost.

Next, focus on making on-time payments for all your bills. This is one of the most effective ways to improve your credit score over time. If you’re struggling, consider working with a credit counselor. They can offer guidance and help you create a plan to manage your debts.

Also, try to reduce your credit card balances. Aim to keep them below 30% of your credit limit. This can positively impact your credit score.

Saving for a Down Payment

Having a down payment saved up is crucial. It shows lenders you’re serious and can help offset the risk of lending to someone with bad credit. Aim to save at least 10% to 20% of the mobile home’s purchase price. The more you save, the better.

Financial planning is key here. Create a budget and stick to it. Look for areas where you can cut expenses and funnel those savings into your down payment fund.

Finding the Right Lender

Not all lenders are the same. Some specialize in working with folks who have bad credit. Start by researching specialized lenders, credit unions, and online lenders. These places might offer more flexible terms than traditional banks.

When evaluating lenders, compare interest rates, loan terms, and fees. This will help you find the best deal for your situation. It’s okay to shop around and get multiple quotes.

Documentation and Application Process

Once you’ve found a lender, be prepared to provide documentation. You’ll need to show proof of income, such as recent pay stubs or tax returns. Lenders will also want to see bank statements to verify your financial stability.

Your employment history is another important factor. Be ready to provide details about your current job and any recent job changes.

Having all your documents organized and ready can streamline the application process. It shows lenders you’re prepared and serious about securing financing.

By following these steps, you can improve your chances of securing financing for mobile homes with bad credit. It’s a journey, and every small step you take can make a big difference.

Conclusion

At Manufactured Housing Consultants, we believe everyone deserves a chance at homeownership, regardless of their financial history. Our mission is to make financing for mobile homes with bad credit not just possible, but straightforward and accessible. We offer a wide range of options custom to fit various credit situations, ensuring you have the support and guidance needed every step of the way.

Owning a mobile home is more than just a financial decision—it’s about creating a place where you can build memories and establish roots. By focusing on improving your financial habits, such as timely bill payments and saving for a down payment, you can improve your credit profile over time. This not only increases your chances of securing a loan but also sets you on a path to financial stability.

Our team is dedicated to helping you steer the complexities of mobile home financing. From finding the right lender to understanding your loan options, we’re here to provide expert advice and personalized solutions. We encourage you to explore our mobile home financing programs to find the right fit for your needs.

Every step you take towards better financial habits brings you closer to the dream of homeownership. At Manufactured Housing Consultants, we’re committed to being your partner in this journey, helping you turn that dream into a reality.