Finding the Right Path to Modular Home Financing

Looking for modular home financing options? Here’s a quick overview of your main choices:

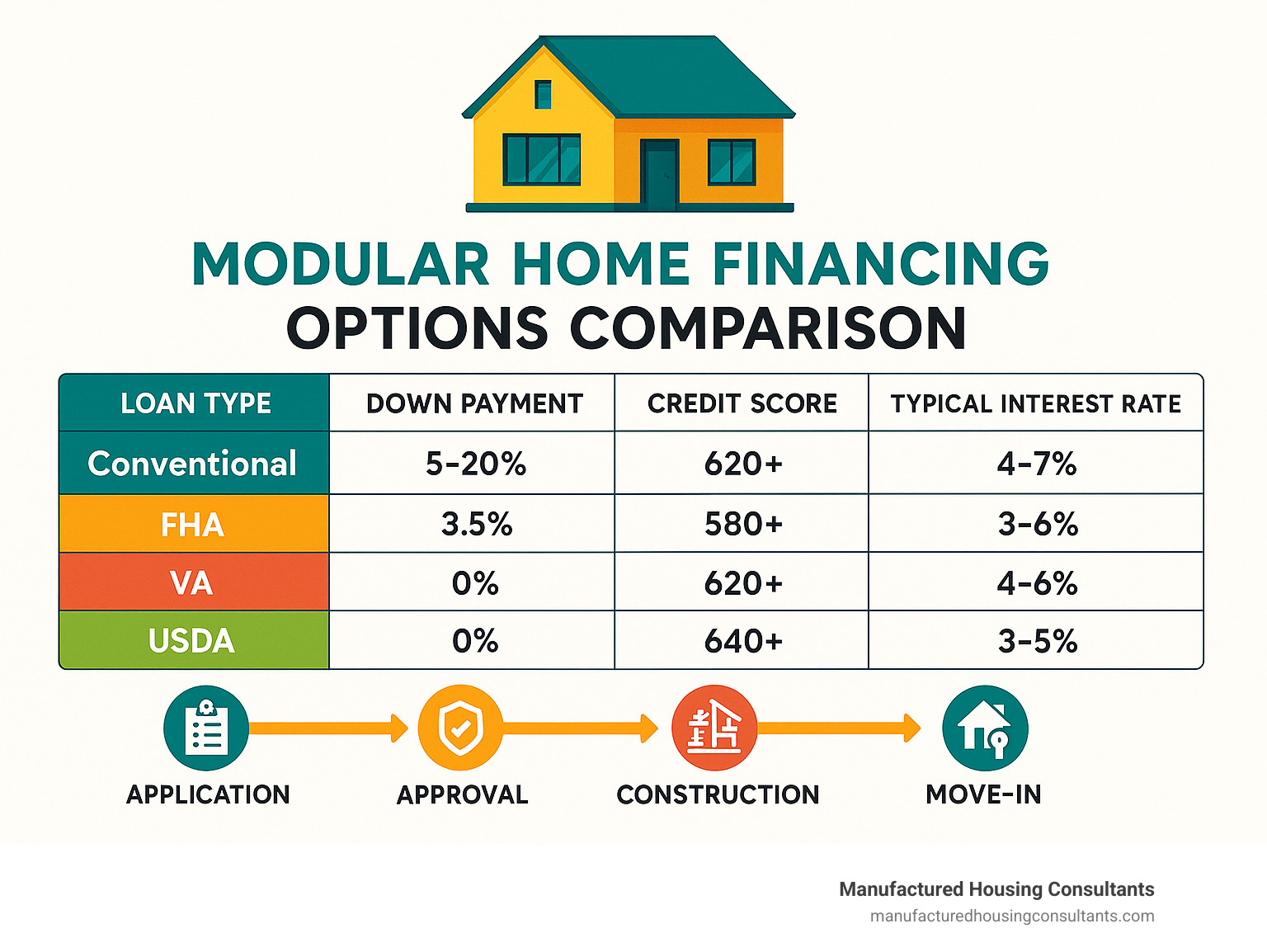

| Financing Option | Down Payment | Credit Score | Best For |

|---|---|---|---|

| Conventional Loans | 5-20% | 620+ | Good credit borrowers |

| FHA Loans | 3.5% | 580+ | First-time buyers |

| VA Loans | 0% | 620+ | Veterans/service members |

| USDA Loans | 0% | 640+ | Rural homebuyers |

| Construction-to-Permanent | 20-25% | 680+ | New builds |

| Personal Loans | Varies | 660+ | Smaller projects |

| Cash Purchase | 100% | N/A | Avoiding interest |

Modular home financing options are more accessible than many people think. Unlike traditional construction, modular homes—built in sections at a factory and assembled on-site—offer a faster, more affordable path to homeownership while maintaining quality and customization.

For Texas families seeking affordable housing, modular homes present a practical solution. With prices averaging $50-$100 per square foot (compared to $155-$416 for similar-sized traditional homes), they’re budget-friendly without sacrificing quality.

What makes financing a modular home different? Since they’re permanently attached to foundations and built to local building codes, modular homes qualify for traditional mortgages—unlike their manufactured home cousins that may require specialized financing.

The challenge comes in understanding the unique lending landscape. Construction happens off-site, requiring specialized loan structures that accommodate factory payments before delivery. This is why working with lenders experienced in modular construction is crucial.

“With the country facing a shortage of housing supply, manufactured housing provides a solution for borrowers ready to purchase affordable homes,” notes Fannie Mae, which has expanded its modular home financing programs in recent years.

Whether you have perfect credit or need financing alternatives, this guide will walk you through all available options to make your modular home dream a reality.

Important modular home financing options terms:

Why Read This Guide?

If you’re considering a modular home in Texas, understanding your modular home financing options can save you thousands of dollars and countless headaches. Many prospective buyers get confused by the specialized terminology, unique loan structures, and differing requirements compared to traditional home loans.

“The most compelling perk of modular homeownership is the bang for your buck,” says industry expert Jamie Johnson. “But navigating the financing can be challenging without proper guidance.”

At Manufactured Housing Consultants, we’ve helped hundreds of Texas families secure financing for their dream homes across San Antonio, New Braunfels, Laredo, and beyond. We’ve seen the common pitfalls that can delay approvals or result in higher interest rates.

This guide will help you:

- Understand which loan programs you qualify for

- Avoid costly financing mistakes

- Steer the construction-to-permanent loan process

- Find the lowest interest rates available

- Use land equity to reduce or eliminate down payments

As one of our recent customers in San Antonio told us: “I was overwhelmed by all the different loan options until I spoke with the team at Manufactured Housing Consultants. They explained everything in plain English and helped me secure a rate I didn’t think was possible with my credit score.”

Modular vs. Manufactured vs. Stick-Built: Financing Foundations

Before we dive into specific modular home financing options, let’s clear up some common confusion. The way lenders classify your factory-built home directly impacts which loans you can get – and potentially saves you thousands in interest.

Modular Homes

Think of modular homes as the best of both worlds. They’re built in sections inside a climate-controlled factory (goodbye, weather delays!), but they follow the same International Residential Code (IRC) and local building standards as traditional homes.

Once these modules arrive at your property, they’re assembled on a permanent foundation – a crucial detail for financing. Because of this permanent foundation and their adherence to local codes, banks classify modular homes as real property, just like the house next door.

“I was amazed how my modular home appraised just like the stick-built homes in my neighborhood,” says Maria from San Antonio. “My lender treated it exactly the same as a traditional home.”

This classification means modular homes typically appreciate in value over time and qualify for all the same financing options as traditional homes – conventional mortgages, FHA, VA, the works!

Manufactured Homes

Here’s where the differences really matter for your wallet. Manufactured homes are also factory-built, but they’re constructed on a permanent steel chassis and built to federal HUD code standards rather than local building codes.

These homes arrive at your site fully built and ready to place. The catch? Unless permanently affixed to a foundation on land you own, they’re often classified as personal property – like a car or boat – not real estate. This classification can limit your financing options and may lead to depreciation rather than appreciation.

“The biggest mistake I see is buyers not understanding that the financing rules are completely different between modular and manufactured homes,” explains Tony, a loan officer at one of our partner banks. “It can mean the difference between a 30-year mortgage at 5% or a 20-year chattel loan at 8%.”

Stick-Built Homes

These are the traditional homes built piece-by-piece on your property. They never move from their original construction site, always count as real property, and qualify for all standard mortgage options.

The comparison between these housing types matters tremendously for your financing journey. Modular homes offer significant advantages over manufactured homes when it comes to financing flexibility, interest rates, and loan terms. Plus, modular construction can offer a 5% reduction in emissions compared to traditional building – good for both your wallet and the planet!

How Modular Homes Are Classified For Lending

What transforms your modular home from “just a structure” to a mortgage-worthy property in the eyes of lenders? It comes down to four key factors:

First, your modular home must be permanently affixed to a foundation that meets local building codes. As Sarah, one of our financing specialists, often tells clients: “If it can’t move, banks treat it like a traditional home.” This means all wheels, axles, and towing hitches must be removed, and the home must be connected to permanent utilities.

Second, the property must be titled as real estate, not personal property. This might seem like paperwork semantics, but it dramatically affects your financing options and future resale value.

Third, zoning matters. Before you fall in love with a piece of land, verify that modular homes are permitted there. Some neighborhoods have restrictions that could derail your plans – and your loan application. We’ve helped many families in Texas steer these zoning requirements, saving them from potential heartbreak.

Finally, the appraisal process looks at comparable properties to determine value. In areas with few modular homes, appraisers often use similar traditional homes as comparables.

“A good appraiser focuses on the finished product, not how it was built,” notes Miguel, a real estate appraiser who specializes in factory-built housing. “They’re looking at square footage, features, location, and quality – not whether it arrived in pieces or was built stick by stick.”

The good news? Studies by the Manufactured Housing Institute confirm that well-built modular homes on permanent foundations typically appreciate at rates similar to traditional homes in the same neighborhoods. This makes them not just affordable housing options, but solid long-term investments too.

With these foundations understood, you’re ready to explore the specific modular home financing options that can turn your dream home into reality.

Modular Home Financing Options Explained

Now that we understand how modular homes are classified, let’s dive into the various modular home financing options that can make your dream home a reality in Texas.

Construction-to-Permanent Loans

If you’re planning to build a custom modular home from scratch, a construction-to-permanent loan is likely your best bet. These clever financial tools are designed specifically for new builds and offer a seamless transition from construction to homeownership.

When you choose this route, you’ll enjoy the simplicity of a single loan closing (saving you a bundle on closing costs) and only make interest-only payments during the building phase. Once your beautiful new home is complete, the loan automatically converts to a regular mortgage.

“Construction-to-permanent loans are perfect for folks who want to customize every aspect of their modular home,” explains our financing specialist at Manufactured Housing Consultants. “The one-time close eliminates the worry about interest rates jumping between construction and permanent financing.”

Be prepared, though – these loans typically require a 20-25% down payment and higher credit scores (usually 680 or above). But for many of our San Antonio clients, the convenience is well worth it.

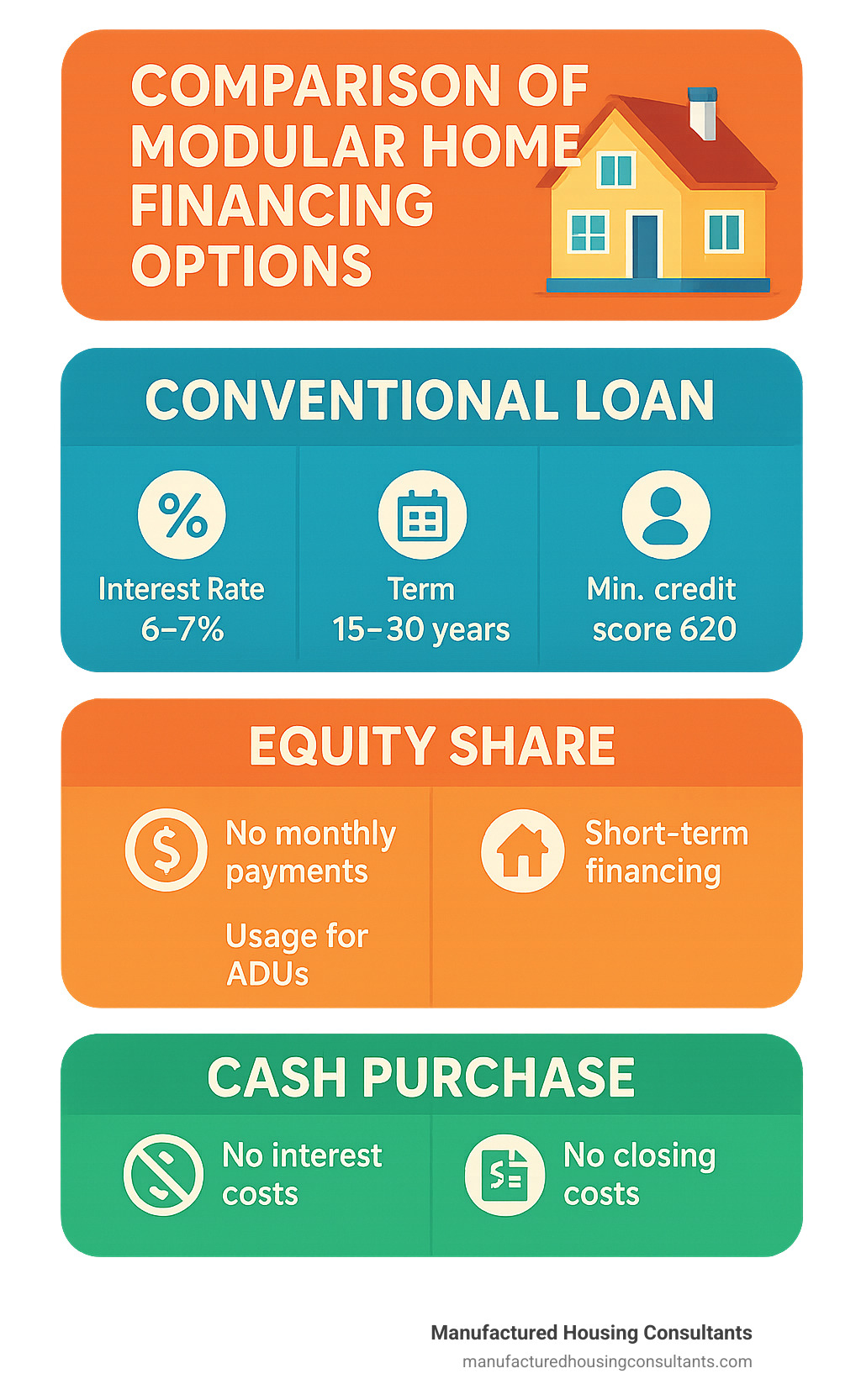

Conventional Loans

Looking to purchase an existing modular home or need end-loan financing after construction? Conventional loans might be your answer.

With down payments typically ranging from 5-20% and minimum credit scores around 620, these traditional mortgages work just like they would for stick-built homes. You’ll have options for fixed or adjustable rates and terms from 15-30 years. The sweet spot? If you can put down 20% or more, you’ll avoid the extra cost of mortgage insurance altogether.

I’m particularly excited about Fannie Mae’s MH Advantage program, which offers conventional financing with down payments as low as 3% for qualifying modular homes that meet specific aesthetic and construction requirements. It’s a fantastic option for first-time buyers who want to maximize their budget.

FHA Loans

For many Texas families, especially first-time homebuyers, FHA loans are a blessing. These government-insured options offer remarkable flexibility with down payments as low as 3.5% (with a 580+ credit score).

What makes FHA loans stand out is their forgiving nature when it comes to credit. You can qualify with a score as low as 500 (though you’ll need 10% down), and they allow debt-to-income ratios up to 57% in some cases – substantially higher than most conventional loans.

While mortgage insurance is required, the competitive interest rates (averaging 6.45% as of August 2024) often make these loans the most affordable option for many of our clients in New Braunfels and surrounding areas.

VA Loans

For our veterans, active military members, and eligible spouses, VA loans are truly unbeatable. No down payment required. No private mortgage insurance. Competitive interest rates. It’s the government’s way of saying “thank you for your service” – and it’s a powerful benefit.

“VA loans are a game-changer for eligible service members,” says a VA loan specialist we work with regularly. “The zero-down option makes modular homeownership accessible without compromising on quality or customization.”

There is a funding fee of 0.5-3.3% (which can be rolled into the loan), but even with this fee, VA loans typically offer the most affordable path to homeownership for those who qualify. Plus, the more flexible credit requirements make approval easier than with many conventional options.

USDA Loans

One of the most overlooked gems in the modular home financing options treasure chest is the USDA loan. Designed for rural and some suburban homebuyers, these loans offer zero down payment and lower mortgage insurance costs than FHA loans.

“USDA loans are often perfect for modular homes in rural Texas communities,” notes our lending team. “We’ve helped countless families in places like Von Ormy and Victoria secure zero-down USDA financing when they thought homeownership was out of reach.”

There are income limitations (you must be below 115% of area median income), and the property must be in an eligible rural area, but you might be surprised how many Texas locations qualify. With a typical minimum credit score of 640 and maximum debt-to-income ratio of 41%, these loans are accessible to many moderate-income families.

Personal Loans

Sometimes traditional mortgage options aren’t the right fit, especially for smaller modular projects. Personal loans can bridge this gap.

With loan amounts typically up to $45,000 (occasionally up to $100,000), these unsecured loans don’t require collateral but do come with higher interest rates than mortgages. The trade-off? A much faster approval process with no appraisal or title work required, and shorter terms (typically 2-7 years) that can work well for certain situations.

Renovation Loans

Have your eye on an existing modular home that needs some TLC? Renovation loans allow you to purchase and upgrade under one convenient loan.

These clever financing tools are based on the “as-completed” value of the home and can finance up to 97% loan-to-value in some cases. With a minimum credit score typically around 620 and down payments starting around 5%, they’re accessible to many buyers who want to put their personal stamp on an existing modular home.

Equity Share/Co-Investment

A newer arrival to the modular home financing options scene is equity sharing or co-investment. Rather than charging interest, these innovative programs involve selling a share of your home’s future appreciation.

With no monthly payments and no interest charges, these can be particularly attractive for short-term financing (1-2 years). They’re especially popular for ADUs or guest houses, where traditional financing might be challenging to secure.

Cash Purchase

For buyers with substantial savings or equity from a previous home sale, cash is still king. No mortgage approval process, no interest costs, no closing costs, no appraisal requirements – just a straightforward transaction with a faster closing timeline and stronger negotiating position.

While not feasible for everyone, cash purchases offer significant long-term savings by eliminating interest payments entirely.

For more information about various financing programs, visit our page on how to Finance Manufactured Homes.

Typical Requirements for Modular Home Financing Options

No matter which financing path catches your eye, lenders typically evaluate several key factors before approving your loan.

Your credit score plays a starring role in the approval process. With excellent credit (720+), you’ll qualify for the best rates on all loan types. Good scores (680-719) still get you eligible for most loans with competitive rates. Even with fair credit (620-679), you can qualify for conventional, FHA, VA, and USDA loans. Those with poor scores (580-619) may still qualify for FHA with 3.5% down or specialized programs, while very poor scores (500-579) limit you to FHA with 10% down or alternative financing.

“Your credit score impacts not just whether you get approved, but also how much you’ll pay,” explains our financing specialist. “A difference of just 40 points could save or cost you thousands over the life of your loan.”

Down payment expectations vary widely by loan type. Conventional loans typically require 5-20%, while FHA loans go as low as 3.5% with a 580+ credit score. VA and USDA loans are the stars of the show for eligible buyers, requiring 0% down. Construction loans usually demand 20-25%, though land equity can count toward or even eliminate down payment requirements in some cases.

Your debt-to-income (DTI) ratio – the percentage of your monthly income that goes toward debt payments – is another crucial factor. Most lenders cap DTI at 43%, though some loan programs are more flexible. FHA allows up to 57% in some cases, VA evaluates each case individually, USDA maxes out at 41%, and conventional loans typically allow 43-50%.

Be prepared to provide substantial documentation, including a personal financial statement, recent tax returns, pay stubs, bank statements, employment verification, ID, proof of insurance, building plans, and construction contracts. Self-employed folks face additional problems, typically needing to provide two full years of business tax returns and profit/loss statements.

Step-By-Step Process for Modular Home Financing Options

Understanding the timeline for securing modular home financing options helps set realistic expectations for your homebuying journey.

The process begins with pre-approval, which typically takes 1-2 weeks. You’ll check your credit report, gather financial documents, apply with multiple lenders to compare offers, and receive a pre-approval letter outlining your loan amount and terms.

“Pre-approval isn’t just a formality – it’s essential before selecting your modular home,” advises our San Antonio office manager. “It establishes your budget and gives you real negotiating power with builders.”

Next comes property and home selection, where you’ll choose your land (or confirm your existing land meets requirements), select a modular home manufacturer and floor plan, finalize customizations, obtain a detailed construction contract, and secure building permits.

The formal loan application follows, typically taking 2-4 weeks. You’ll submit your complete application with supporting documentation, the lender will order an appraisal and title search, underwriting begins, and eventually, you’ll receive conditional approval.

For new builds, the construction phase lasts about 3-4 months. After loan closing for the construction phase, site preparation and foundation work begin, followed by factory construction of the modules, delivery and assembly, utility connections, and inspections at key milestones.

Funds are typically disbursed in draws – about 15-20% at foundation completion, 50-60% at module delivery, and the remaining 20-35% upon final completion.

The final step is conversion to permanent financing, taking 2-4 weeks. After final inspection and certificate of occupancy, your construction loan converts to a permanent mortgage, you complete the final loan closing, and begin regular mortgage payments.

For existing modular homes, the process is similar to traditional home purchases, skipping the construction phase entirely.

For more information on combined land and home financing, visit our page on Manufactured Home and Land Financing.

Government-Backed Paths: FHA, VA, USDA

Government-backed loans offer some of the most accessible modular home financing options, particularly for first-time buyers, veterans, and rural homeowners.

FHA loans are truly the first-time buyer’s best friend. These Federal Housing Administration-insured loans reduce risk for lenders, allowing for more flexible terms like down payments as low as 3.5% with a 580+ credit score (or 10% down with scores between 500-579). They accommodate higher debt-to-income ratios (up to 57% in some cases) and typically offer lower interest rates compared to conventional loans for similar credit profiles.

“FHA loans are often the path of least resistance for first-time modular home buyers,” explains our financing specialist. “The combination of low down payment and flexible credit requirements opens doors that would otherwise remain closed.”

For modular homes to qualify for FHA financing, they must be built to local building codes, permanently installed on a foundation, titled as real property, and serve as the buyer’s primary residence.

VA loans honor military service with exceptional benefits. For veterans, active-duty service members, and eligible surviving spouses, these loans offer zero down payment, no private mortgage insurance, competitive interest rates, and flexible credit requirements. The funding fee can be rolled into the loan and is even waived for some disabled veterans.

“VA loans are truly the gold standard in mortgage financing for those who qualify,” says a VA loan specialist we work with regularly. “The combination of zero down and no PMI creates substantial monthly savings that can add up to tens of thousands over the life of the loan.”

USDA loans make rural housing remarkably affordable. The U.S. Department of Agriculture’s Rural Development program offers zero down payment loans for properties in eligible rural areas, with lower mortgage insurance costs than FHA and competitive fixed interest rates. These loans can include not just the home but also land, site preparation, and other costs.

“USDA loans are perfect for modular homes in rural Texas communities,” notes our New Braunfels office manager. “Many areas that seem suburban actually qualify as ‘rural’ under USDA guidelines, so it’s always worth checking eligibility.”

To qualify for USDA financing, the property must be in an eligible rural area (population under 35,000), household income must be below 115% of the area median, the home must be your primary residence, and the modular home must be permanently installed on a foundation.

Many areas throughout Texas, including parts of Von Ormy, New Braunfels, Victoria, and the outskirts of San Antonio, qualify for USDA financing. The USDA offers an online eligibility map to verify if your desired location qualifies.

Construction & End Loans: How They Differ

When building a new modular home, understanding the difference between construction financing and end loans helps you steer the process smoothly.

Construction loans are short-term financial tools designed specifically for the building process. They typically feature higher interest rates than permanent mortgages and only require interest-only payments during construction. Funds are disbursed in stages (draws) as construction progresses, ensuring money is available exactly when needed.

“Construction loans are designed to match the unique cash flow needs of building a home,” explains our financing specialist. “The draw schedule ensures funds are available when needed while protecting the lender’s investment.”

A typical draw schedule for modular construction might start with land purchase (if applicable), then cover site preparation and foundation, factory payment for module construction, delivery and set of modules, and finally completion of finish work and utility connections.

Most construction loans require a contingency reserve – additional funds set aside for unexpected costs. “We always recommend including a 10-15% contingency in your budget,” advises our construction specialist. “Even with the controlled environment of modular construction, site issues or customization changes can create unexpected expenses.”

Once construction is complete, end loans (permanent financing) take over. These traditional mortgages feature lower interest rates than construction loans, require principal and interest payments, offer fixed or adjustable rate options, typically run 15-30 years, and involve standard mortgage closing costs.

Many buyers prefer construction-to-permanent loans, which combine both phases with a single closing. This approach saves on fees, locks in your permanent financing rate before construction begins, eliminates the risk of market rate increases during construction, and simplifies the process with one application and approval.

“For most modular home buyers, the construction-to-permanent loan is the most efficient option,” notes our loan coordinator. “The single closing saves money and provides peace of mind about your permanent rate.”

Special Situations: Bad Credit, Park Placement & Land Purchase

Some modular home buyers face unique circumstances that require specialized financing approaches.

If your credit score falls below conventional thresholds (620+), don’t lose hope. With scores between 580-619, you still have options like FHA loans with 3.5% down, VA loans (if eligible) with flexible credit requirements, higher down payments on conventional loans (10-20%), owner financing in some cases, or adding co-signers to strengthen your application.

Even with scores between 500-579, you might qualify for FHA loans with 10% down, substantial down payments (20%+) with some lenders, or seller financing options. Sometimes, the best strategy is credit repair before applying.

“We’ve helped many clients with credit challenges secure modular home financing,” says our specialist from Manufactured Housing Consultants. “Sometimes it’s about finding the right loan program, and other times it’s about improving credit first.”

For more information on financing options with credit challenges, visit our page on Financing for Mobile Homes with Bad Credit.

While most modular homes are placed on owned land, some may be sited in parks or on leased property. This arrangement has special financing considerations. Lenders typically require a minimum 3-year lease with 180 days’ notice before termination. The home may be classified as personal property rather than real estate, potentially requiring chattel loans or personal loans with higher interest rates and shorter terms (typically 15-20 years maximum).

“When placing a modular home in a park, the lease terms are critically important to lenders,” explains our financing coordinator. “They want assurance that the home won’t need to be moved shortly after installation.”

If you’re buying land along with your modular home, several financing approaches are available. You might secure a single loan covering both land and home, get separate land loan followed by construction financing, use land equity as down payment on the home, or choose a construction-to-permanent loan covering land, site work, and home.

Site preparation costs can be substantial and should be included in your financing plan. Land clearing might run $1,500-$5,000, foundation $10,000-$25,000, utility connections $3,000-$15,000, driveway $2,000-$6,000, and permits and surveys $3,000-$5,000.

“Many buyers underestimate site preparation costs,” cautions our construction coordinator. “These expenses can add 15-25% to your total project cost and need to be accounted for in your financing.”

Conclusion

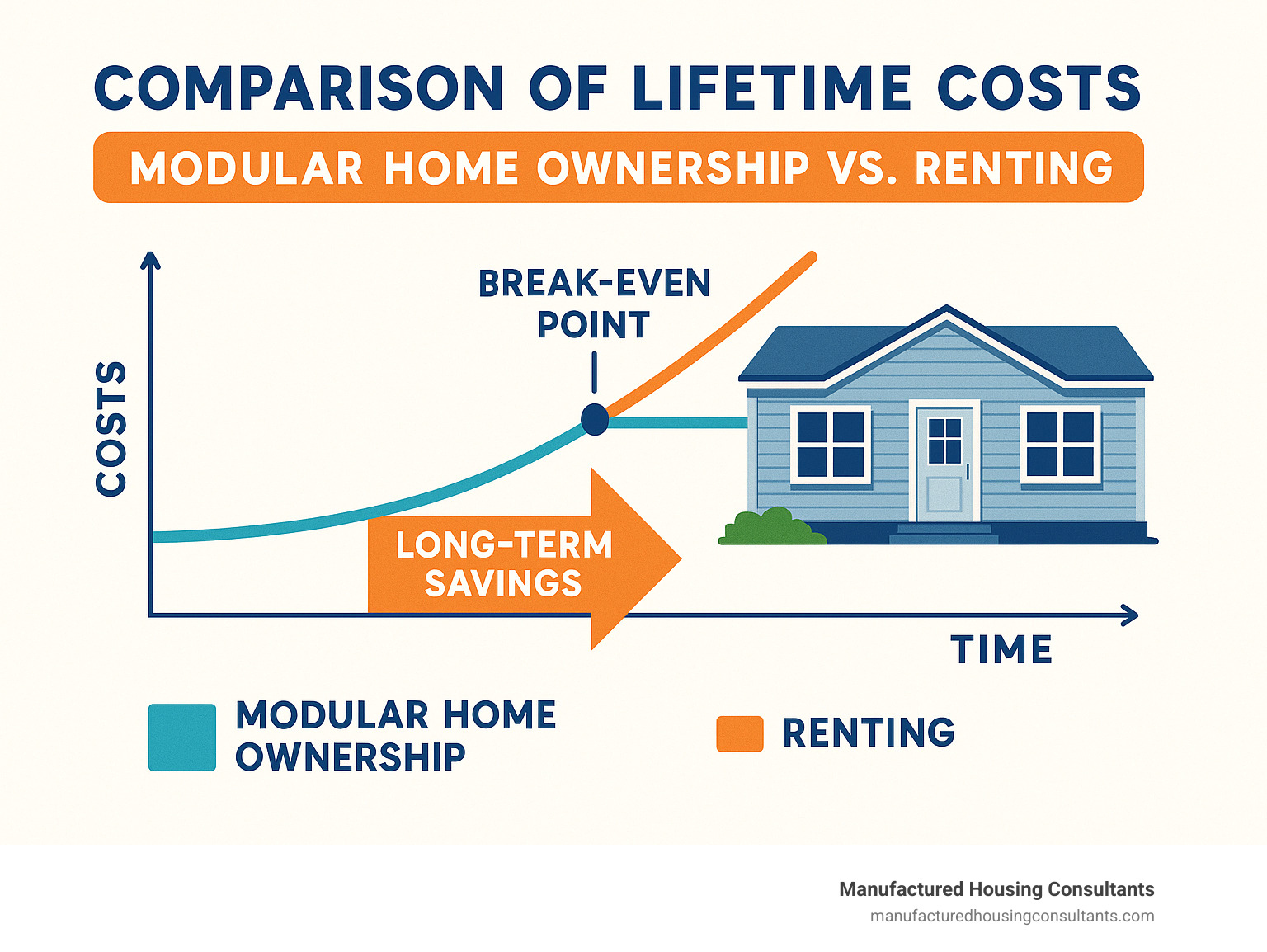

The journey to securing your dream modular home might seem like navigating a maze at first, but I hope this guide has illuminated the path forward. With the right approach, modular home financing options become stepping stones rather than stumbling blocks on your way to affordable homeownership.

Throughout Texas—from the busy streets of San Antonio to the quieter communities of Von Ormy and New Braunfels—families are finding that modular homes offer an unbeatable combination of quality, personalization, and value. The factory-built precision delivers homes that stand the test of time while keeping construction costs predictable.

Modular homes qualify for traditional mortgages when they’re permanently installed on foundations and properly titled as real property. This opens doors to competitive rates and terms that manufactured homes sometimes can’t access. Government-backed FHA, VA, and USDA loans often provide the most accessible terms for many families, with down payments as low as zero to 3.5% depending on your situation.

If you’re building from scratch, construction-to-permanent loans streamline the process with a single closing and seamless transition to long-term financing. This approach saves you both time and money while providing peace of mind about your permanent rate.

Don’t let credit concerns stop you from exploring your options. With programs available for scores as low as 500 (though larger down payments will be required), homeownership may be closer than you think. And if you already own land, that equity can potentially reduce or eliminate your down payment requirements altogether!

One thing many buyers overlook is budgeting properly for site preparation and foundation costs. These typically add 15-25% to your total project cost, so be sure to include them in your financing calculations from the beginning. Working with lenders who understand the unique aspects of modular construction will help ensure a smooth process from application to move-in day.

Here at Manufactured Housing Consultants, we’ve helped countless Texas families find their way through the financing landscape. I’ve seen the relief on people’s faces when we secure them a loan program that saves thousands in interest and fees compared to what they thought was their only option.

“We never thought we could afford a home this nice,” shared one family from Laredo after we helped them leverage their land equity to secure a zero-down loan. “The payment is actually less than what we were paying in rent for a much smaller place.”

Whether you’re dreaming of a cozy two-bedroom or a spacious four-bedroom with all the upgrades, the right financing makes all the difference in turning that dream into your daily reality.

Ready to take the next step? Our team at Manufactured Housing Consultants is here to guide you through every aspect of modular home financing. We work with multiple lenders across San Antonio, New Braunfels, Laredo, Corpus Christi, Victoria, and throughout Texas to find the perfect solution for your unique situation.

For more detailed information about available programs, visit our comprehensive resource page: More info about modular home financing programs.

Your affordable, high-quality modular home is waiting—let’s find the financing to make it happen!