Finding Affordable Housing: The Repo Mobile Home Advantage

Used repo mobile homes for sale near me are a practical solution for affordable housing that can save you 30-50% compared to new manufactured homes. If you’re looking for immediate options:

- Local dealers specializing in repos – Check specialized dealers like Manufactured Housing Consultants

- Bank/lender websites – Visit repossession listings from various lenders

- Financing available – Many repos qualify for loans with no age restrictions

- Price range – Typically $25,000-$60,000 depending on size, age and condition

A repossessed (repo) mobile home is a manufactured home that has been reclaimed by a lender after the previous owner defaulted on their loan payments. In today’s housing market, where traditional home prices continue to climb out of reach for many Americans, repo mobile homes represent a practical path to homeownership.

“Times are tough, we understand that. Because of this, we want to offer you a chance at a home at a great price!” as one repo dealer states. This sentiment captures why repo homes have become increasingly popular – they provide substantial savings while still delivering quality housing.

The benefits extend beyond just the purchase price. Many repo mobile homes are thoroughly inspected and refurbished before resale, and some dealers even offer lifetime warranties on major systems. Additionally, these homes can sometimes be purchased outright for the cost of what would be a down payment on a new model, allowing some buyers to avoid long-term loans entirely.

When properly vetted, a repo mobile home can offer immediate equity and lower monthly housing costs. The key is knowing where to look and what to inspect before making your purchase.

How to Locate and Inspect Used Repo Mobile Homes for Sale Near Me

Finding your perfect used repo mobile home for sale near me doesn’t have to be overwhelming. Here at Manufactured Housing Consultants, we’ve guided countless Texas families in San Antonio, Corpus Christi, Laredo and beyond to affordable homeownership through quality repo homes.

Best Online & Offline Places to Search Nearby

Your search for an affordable repo home can start right from your living room. I’ve found that casting a wide net yields the best results.

Looking beyond your screen pays dividends, too. Various lenders and local credit unions frequently update their websites with repossessed inventory they’re looking to move quickly. I always recommend checking community bulletin boards at local supermarkets and taking weekend drives through manufactured home communities to spot “For Sale” signs before they hit the online listings.

“The early bird gets the worm in this market,” as we often tell our clients. Repo homes rarely sit available for long, which is why developing a relationship with a trusted dealer like us at Manufactured Housing Consultants can give you first dibs on newly available units throughout Texas.

| Search Channel | Avg. Price Range | Pros | Cons |

|---|---|---|---|

| Online Marketplaces | $25,000-$60,000 | Wide selection, photos, filters | Limited inspection opportunity |

| Bank/Lender Listings | $30,000-$55,000 | Often well-maintained, financing is possible | Limited selection |

| Direct from Dealers | $29,900-$59,900 | Inspected, warranty options | May have markup |

| Public Auctions | $15,000-$40,000 | Lowest prices possible | Highest risk, limited inspection |

Must-Have Inspection Checklist Before You Bid

Never, and I mean never, put money down on a used repo mobile home for sale near me without a thorough inspection. Your future happiness depends on it!

Start with the structural integrity – are the floors level and walls straight? Any sagging ceilings should raise immediate red flags. Run your hands along window frames and door jambs, looking for moisture damage. Open and close every window and door to ensure they operate smoothly.

The chassis and frame form the backbone of your potential home. Get underneath (or have someone do this for you) to inspect for rust, bends, or cracks in the steel frame. If the axles and wheels are still attached, they should be in good condition too.

Every legitimate manufactured home should have proper documentation. Look for the HUD certification label (a metal plate on the exterior) and locate the data plate (usually hidden in a kitchen cabinet or electrical panel). These documents verify that the home was built to federal standards.

Don’t forget to test all the systems that make a house a home. Turn on every faucet, flush all toilets, and peek under sinks for leaks. Test every electrical outlet with a simple outlet tester (about $10 at hardware stores), and run both the heating and cooling systems for at least 15 minutes.

“What you don’t see can hurt your wallet later,” is something we remind buyers all the time. While we at Manufactured Housing Consultants thoroughly inspect and refurbish every repo home before listing, this isn’t a universal practice. A few hundred dollars for a professional inspector can save thousands in unexpected repairs.

Verifying Legal Status: Titles, Liens, and Permits

The paperwork might seem boring, but it’s where the real drama can hide when buying a repo home. Clean ownership transfer is absolutely essential to protect your investment.

First, always request to see the current title and examine it carefully. Is it a clear title or a salvage title? The difference dramatically affects value and insurability. Double-check that the VIN on the title perfectly matches the VIN physically stamped on the home – even a single digit difference spells trouble.

A hidden lien can turn your dream home into a nightmare. Visit your county tax office to verify that there are no outstanding tax obligations. Request a UCC (Uniform Commercial Code) filing search to identify any secured creditors who might have claims on the property. Always insist on seeing a lien release form from the previous lender.

Don’t forget about permit requirements in your desired location. Some counties have strict zoning regulations for manufactured homes, while others are more lenient. Verify the home meets current wind zone and energy requirements for your area, and check if there are age restrictions that might affect placement.

If you’re planning to place your home in a mobile home community, do your homework before purchasing. Many parks have specific requirements regarding home age, appearance, and size. Review the lease terms and approval process to avoid disappointment after purchase.

Here at Manufactured Housing Consultants, we take pride in ensuring all our repo homes come with clean titles and complete documentation. We believe your journey to affordable homeownership should be exciting, not stressful. Our team handles the paperwork headaches so you can focus on planning your housewarming party instead.

Financing, Delivery, and Move-In: From Offer to Keys in Hand

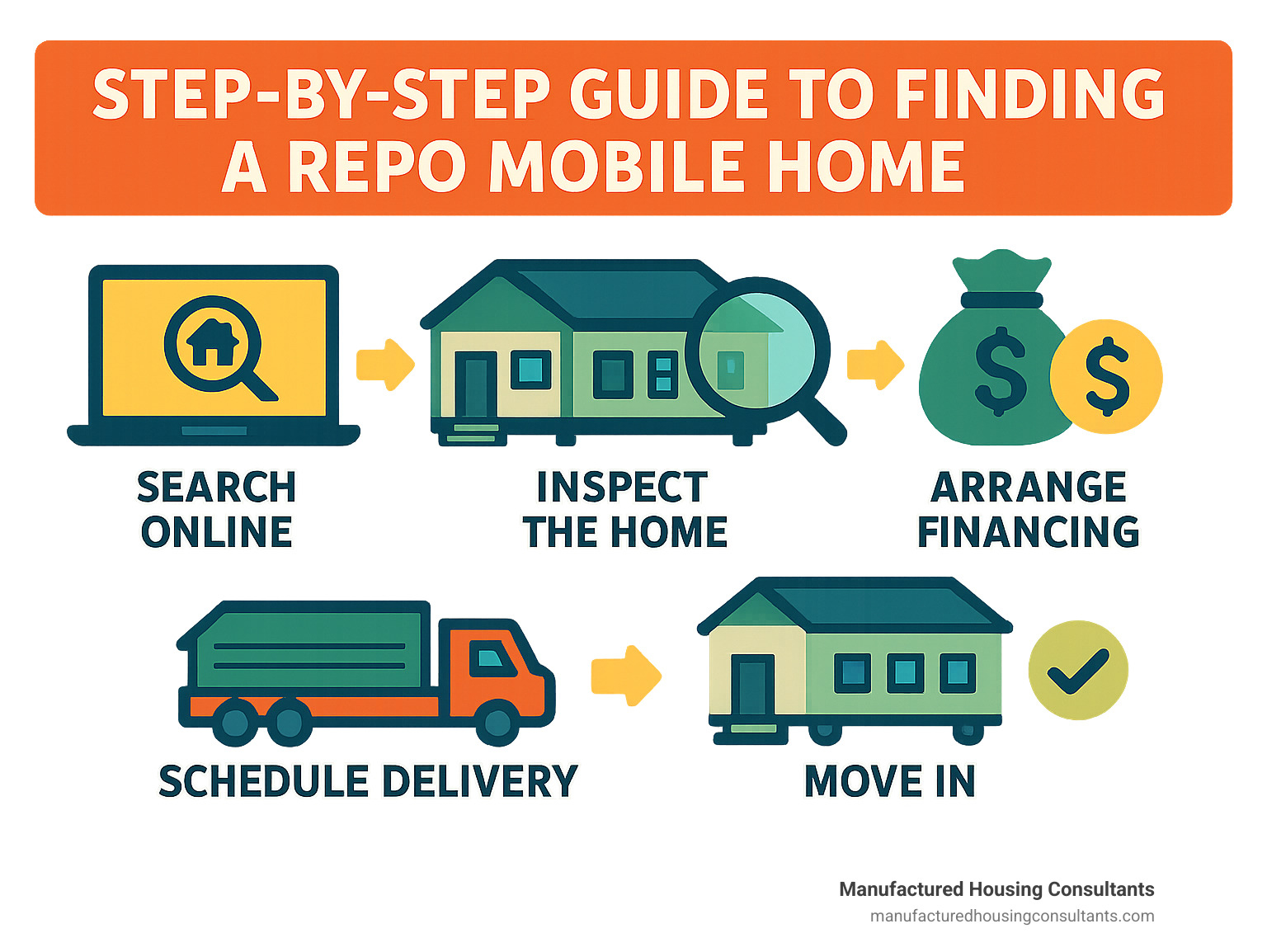

So you’ve found that perfect used repo mobile home for sale near me, and you’re ready to make it yours! Let’s walk through what happens next – from financing your new home to the exciting day you get your keys.

Financing Options & Common Lender Requirements

Good news! Despite what you might have heard, financing a repo mobile home is actually quite doable, and often with terms that might pleasantly surprise you.

Chattel loans are the most common option for mobile homes. These home-only loans typically come with 15-20-year terms and interest rates between 5-15%, depending on your credit score. You’ll usually need a down payment of 5-20%.

If you’re buying both land and a home, land-home packages often offer better interest rates and can stretch out to 30-year terms, similar to traditional mortgages.

“There are no age restrictions for used mobile homes eligible for financing,” as one of our lending partners often reminds buyers. This is fantastic news if you’ve fallen in love with an older repo model that offers great value!

Government-backed options can also be game-changers for many families. FHA Title I loans are specifically designed for manufactured homes, while VA loans serve our veterans, and USDA loans can help those looking in rural areas.

Most lenders look for credit scores of 600+, though we partner with several who work with scores as low as 550. They’ll check your debt-to-income ratio (usually wanting it below 43%) and verify two years of stable income. Some of our lending partners even offer up to 100% loan-to-value on primary residences – meaning you might finance the entire purchase with minimal cash out of pocket!

Negotiation & Closing Steps

Buying your repo home follows a fairly straightforward path:

First, you’ll submit a written offer with your price and terms. This usually includes an earnest money deposit of $500-$2,000 to show you’re serious. Smart buyers include contingencies for inspection, financing, and delivery.

Once your offer is accepted, you’ll sign a purchase agreement and pay any required deposits. This is when you’d schedule a formal inspection if you haven’t already.

The loan process kicks in next – submit your paperwork to the lender, who’ll order an appraisal and begin underwriting. Meanwhile, you’ll prepare for closing by scheduling a final walk-through and arranging insurance.

On closing day, you’ll sign your loan documents, pay closing costs, and receive your title and ownership papers. The whole process typically takes 4-6 weeks for home-only loans and 6-8 weeks if your loan includes real estate.

“All closing costs can be financed except the appraisal fee,” notes one of our lenders – a helpful tip for managing your upfront expenses.

Budgeting for Delivery, Setup, and After-Sale Repairs

Here’s where many first-time buyers get caught off guard – there’s more to budget for beyond just the purchase price!

Transportation costs vary based on distance and home size. Basic delivery runs $3-$7 per mile, with pilot cars (required for wide loads) adding another $1.50-$3 per mile. Don’t forget permits, which run $150-$500 depending on your route and state.

Getting your site ready is another consideration. Land clearing might cost $500-$2,000, depending on what you’re starting with. A proper foundation or pad runs $2,000-$5,000, and connecting utilities (water, sewer, electric) typically costs $1,000-$3,000.

The actual setup includes blocking and leveling ($1,000-$3,000), anchoring ($750-$1,500), skirting ($1,000-$3,000), plus steps and porches ($500-$2,000).

Smart homeowners also budget for post-move expenses. Set aside about 5-10% of your purchase price for initial repairs, $1,000-$5,000 for cosmetic updates, and establish a $1,000 first-year maintenance fund.

At Manufactured Housing Consultants, we believe in total transparency. We’ll provide clear estimates for all these costs upfront – no unpleasant surprises! We can arrange delivery anywhere in Texas, handling all those pesky permits and logistics for you. Our goal is to make your journey to affordable homeownership as smooth as possible.

Conclusion: Your Path to Affordable Homeownership

The journey to finding your perfect used repo mobile home for sale near me might seem daunting at first, but the financial rewards make every step worthwhile. When you consider savings of 30-50% compared to new manufactured homes, it’s no wonder so many Texans are choosing this practical path to homeownership.

I’ve seen countless families walk through our doors at Manufactured Housing Consultants feeling uncertain about the repo home process, only to call us months later to share how their new home has transformed their lives. The pride in their voices tells the whole story – affordable housing doesn’t mean compromising on quality or comfort.

Your success in this journey hinges on a few critical factors. First, never skip the inspection phase. Whether you bring along that handy friend who knows construction or hire a professional inspector (my recommendation), those trained eyes can spot potential issues that might cost you thousands down the road. Think of it as an investment that pays immediate dividends.

Title verification is another non-negotiable step. A clean, lien-free title ensures your investment is protected legally. At our dealership, we handle this paperwork maze for you, but if you’re buying elsewhere, insist on seeing documentation before money changes hands.

When budgeting, the sticker price is just the beginning. Delivery costs, site preparation, and setup fees are all part of the equation. Be especially mindful of the first-year maintenance fund – setting aside about $1,000 for unexpected repairs provides wonderful peace of mind as you settle into your new home.

Financing options for repo homes are more flexible than most people realize. From chattel loans to land-home packages, and even government-backed options like FHA Title I loans, there’s likely a financing solution that fits your unique situation. Many of our customers are pleasantly surprised to learn that repos qualify for loans with no age restrictions – a common misconception that keeps some buyers from exploring older, well-maintained units.

At Manufactured Housing Consultants, we’ve built our reputation on transparency and support throughout Texas. Whether you’re looking in busy San Antonio, coastal Corpus Christi, border-town Laredo, or anywhere in between, our habitability-certified repo homes undergo rigorous inspection before ever hitting our inventory. We don’t just sell homes – we help create futures.

The repo mobile home market moves quickly, with the best units often selling within days of listing. That’s why establishing a relationship with a trusted dealer can give you the inside track on newly available properties. Our team regularly notifies interested buyers about incoming inventory before it’s formally listed.

Ready to explore affordable homeownership? Your perfect repo mobile home might be waiting for you right now. Visit our bank-repo inventory page to see current listings or contact us to discuss your specific needs and budget. With the right guidance and a bit of patience, you’ll soon be holding the keys to not just a house, but a home to call your own.