Why Understanding Mobile Home Foreclosure Is Critical for Texas Families

Foreclosure on a mobile home affects millions of Americans who call manufactured housing their home. With approximately 22 million people living in manufactured or mobile homes across the United States, understanding this process could save your family from losing everything.

Quick Answer: Mobile Home Foreclosure Process

- Personal Property: Lender can repossess through replevin or self-help (if allowed)

- Real Property: Must follow state foreclosure laws (judicial or non-judicial)

- Timeline: 3 months to 1+ year depending on state laws and home classification

- Key Factor: Whether your home sits on owned vs. leased land changes everything

The foreclosure process for mobile homes works differently than traditional real estate because of how these homes are legally classified. Your rights, timeline, and options depend entirely on whether your home is considered personal property or real property under state law.

Most manufactured homes start as personal property (like a car) but can be converted to real property (like a house) through specific legal steps. This classification determines whether you face:

- Repossession (personal property) – faster process, fewer protections

- Foreclosure (real property) – longer timeline, more legal safeguards

About 75% of states have laws allowing conversion from personal to real property, but many homeowners don’t know their home’s current status. This knowledge gap can cost families their homes and life savings.

Foreclosure on a mobile home terms to remember:

5 Easy Steps to Steer Foreclosure on a Mobile Home

Step 1 – Identify Your Home & Land Status

The first thing you need to figure out is what type of home you actually own and how the law sees it. This determines whether you lose your home in weeks versus having months to work things out.

What Kind of Home Do You Have?

Mobile homes were built before June 15, 1976. Manufactured homes came after June 16, 1976, and follow federal HUD construction rules. Modular homes are factory-built but follow local building codes instead of HUD standards.

The Big Question: Personal Property or Real Property?

Most manufactured homes start out as personal property – kind of like a really big car. Your home has a title document, and technically it could be moved. When your home is personal property, your lender can take it back through “replevin” or even just show up and haul it away in some states. This process is much faster and gives you fewer rights.

But if your home becomes real property, it’s treated like a regular house. The lender has to go through the full foreclosure process, which takes much longer and gives you way more protections and options.

How to Turn Your Home Into Real Property

If you own your land (not rent a lot), you can convert your home to real property by permanently attaching it. This means removing the tongue, axles, and wheels, installing proper tie-downs, and surrendering your title to the state.

The catch? You generally can’t do this if your home sits on leased land or in a mobile home park.

| Personal Property Path | Real Property Path |

|---|---|

| Process: Repossession via replevin or self-help | Process: Judicial or non-judicial foreclosure |

| Timeline: Weeks to months | Timeline: Months to over a year |

| Notice: Limited notice requirements | Notice: Extensive notice and cure periods |

| Protections: Fewer legal safeguards | Protections: Full foreclosure law protections |

| Right to Cure: Limited or none | Right to Cure: Usually up to 5 days before sale |

| Redemption: Varies by state | Redemption: Often available post-sale |

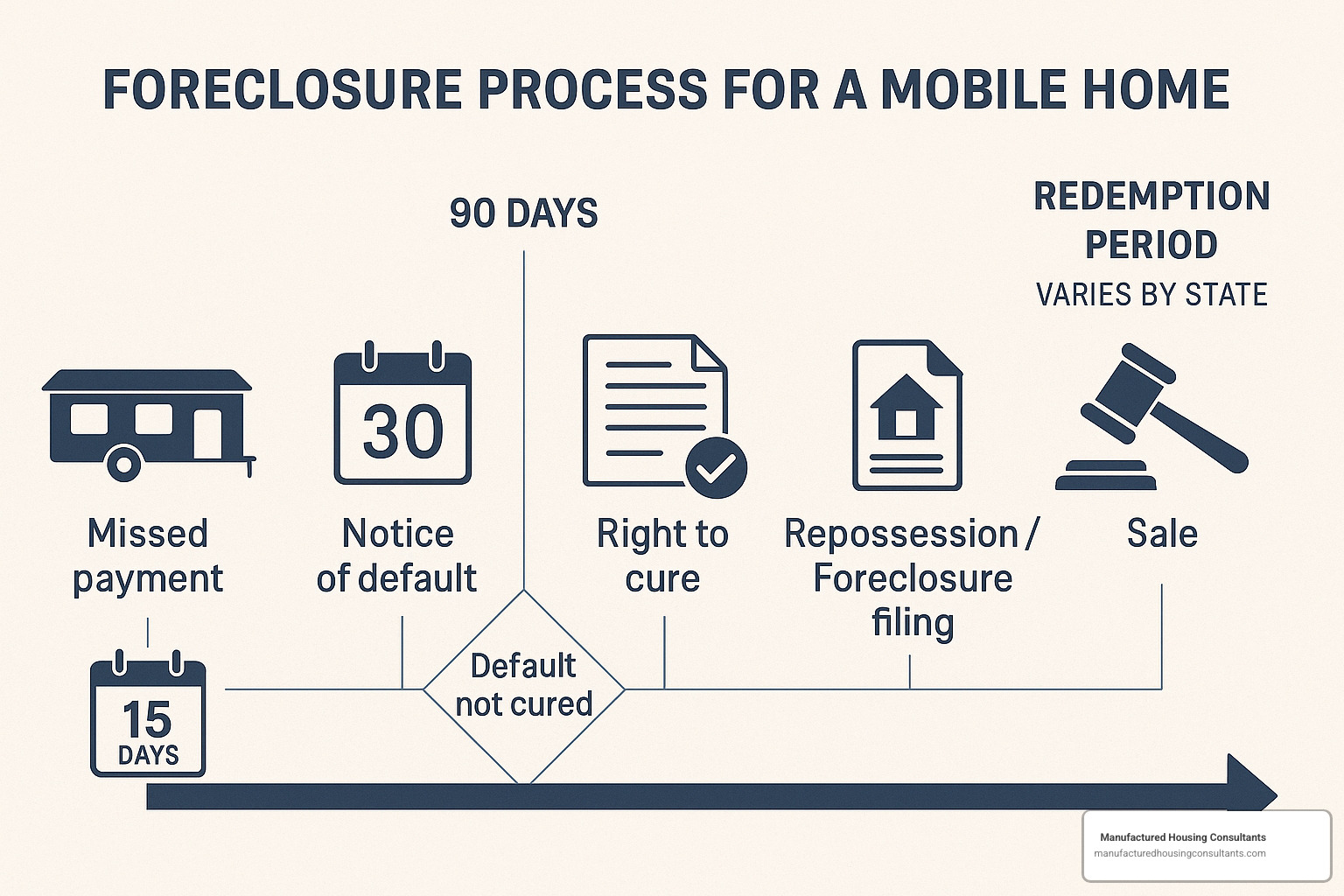

Step 2 – Track the Foreclosure on a Mobile Home Timeline

Once you know what type of property you have, you need to understand your timeline. Missing important deadlines can cost you your home and your rights.

When Your Home is Personal Property

If your home is still personal property, the lender has to give you notice of default, but requirements vary by state. Some states require 10 to 30 days’ notice before they can take your home back.

In states that allow “self-help repossession,” the lender could theoretically just show up and take your home as long as they don’t cause a “breach of the peace.” But most lenders go to court and get a replevin order instead.

When Your Home is Real Property

If your home is real property, you get much more protection. The lender typically has to give you 30 to 90 days’ notice before they can even start foreclosure proceedings. You usually have the right to cure the default by paying what you owe, often up until five days before the sale.

Judicial foreclosure states require the lender to go to court, which can take four months to over a year. Non-judicial foreclosure states allow trustee sales, which are faster but still take two to six months.

Special Situations You Need to Know About

If you’re behind on lot rent at a mobile home park, you’re facing eviction from the park on top of potential home foreclosure. Park evictions typically give you just 5 to 30 days’ notice.

Government-backed loans have special protections. FHA loans require lenders to try reaching you before you’re three payments behind. VA loans have additional notice requirements.

Many states give you “redemption rights” – the ability to buy back your home after foreclosure by paying the full sale price plus costs. These redemption periods typically last anywhere from 30 days to a full year after the sale.

For detailed information about your consumer foreclosure rights and timelines, check out resources from the National Consumer Law Center.

Step 3 – Assert Your Rights & Protections

Even when you’re facing foreclosure on a mobile home, you still have important legal rights. Knowing these rights can help you negotiate better deals or buy precious time to figure out alternatives.

Federal Laws That Protect You

If you’re active duty military, the Servicemembers Civil Relief Act gives you special protections. Courts have to pause foreclosure proceedings if your military service affects your ability to pay.

The Consumer Financial Protection Bureau has rules that require lenders to give you clear, timely information about your account. They have to offer you ways to avoid foreclosure before they can start the process.

Texas homestead laws are particularly strong. Your primary residence gets protection from most creditors, and if your manufactured home sits on land you own, it might qualify for homestead protection too.

Getting Free Help

HUD-approved housing counselors will help you for free. They’ll review your situation, help you negotiate with lenders, and explain all your options. You can find one at HUD’s housing counselor directory.

Watch Out for Scams

Be suspicious of anyone who contacts you out of the blue claiming they can “save your home,” especially if they want money upfront or pressure you to sign papers immediately.

Legitimate help never charges upfront fees for loan modifications, never guarantees specific outcomes, and never tells you to stop talking to your lender.

Step 4 – Use Loss-Mitigation Tools

Before you lose your home, explore every possible way to avoid foreclosure. Lenders often prefer these alternatives because foreclosure costs them time and money too.

Forbearance Can Buy You Time

A forbearance temporarily reduces or stops your payments, usually for three to six months. This doesn’t make the debt go away – you’ll still need a plan to catch up – but it can help if you’re dealing with temporary hardship.

Repayment Plans Spread Out the Pain

With a repayment plan, you spread your past-due payments over several months while keeping up with current payments. For example, if you’re $2,400 behind on $800 monthly payments, you might pay $1,200 monthly for six months to get caught up.

Loan Modifications Change the Game

A loan modification permanently changes your loan terms. The lender might reduce your interest rate, extend your loan from 30 to 40 years, or add your missed payments to your loan balance.

If You Can’t Keep the Home

Sometimes the best option is letting the home go, but doing it on your terms. With a short sale, you sell the home for less than you owe with the lender’s approval. You avoid foreclosure showing up on your credit report.

A deed in lieu of foreclosure means you voluntarily give the home back to the lender. It’s faster than foreclosure and causes less credit damage.

Bankruptcy Can Stop Everything

Chapter 7 bankruptcy stops foreclosure temporarily and might wipe out deficiency judgments, but it won’t save your home long-term. Chapter 13 bankruptcy can permanently stop foreclosure and let you catch up on missed payments over three to five years while keeping your home.

For specialized help with repo situations, you might want to explore repo mobile home purchase and renovation options.

Step 5 – Recover After Foreclosure on a Mobile Home

If you couldn’t save your home, don’t give up. Focus on recovery and protecting your future housing options.

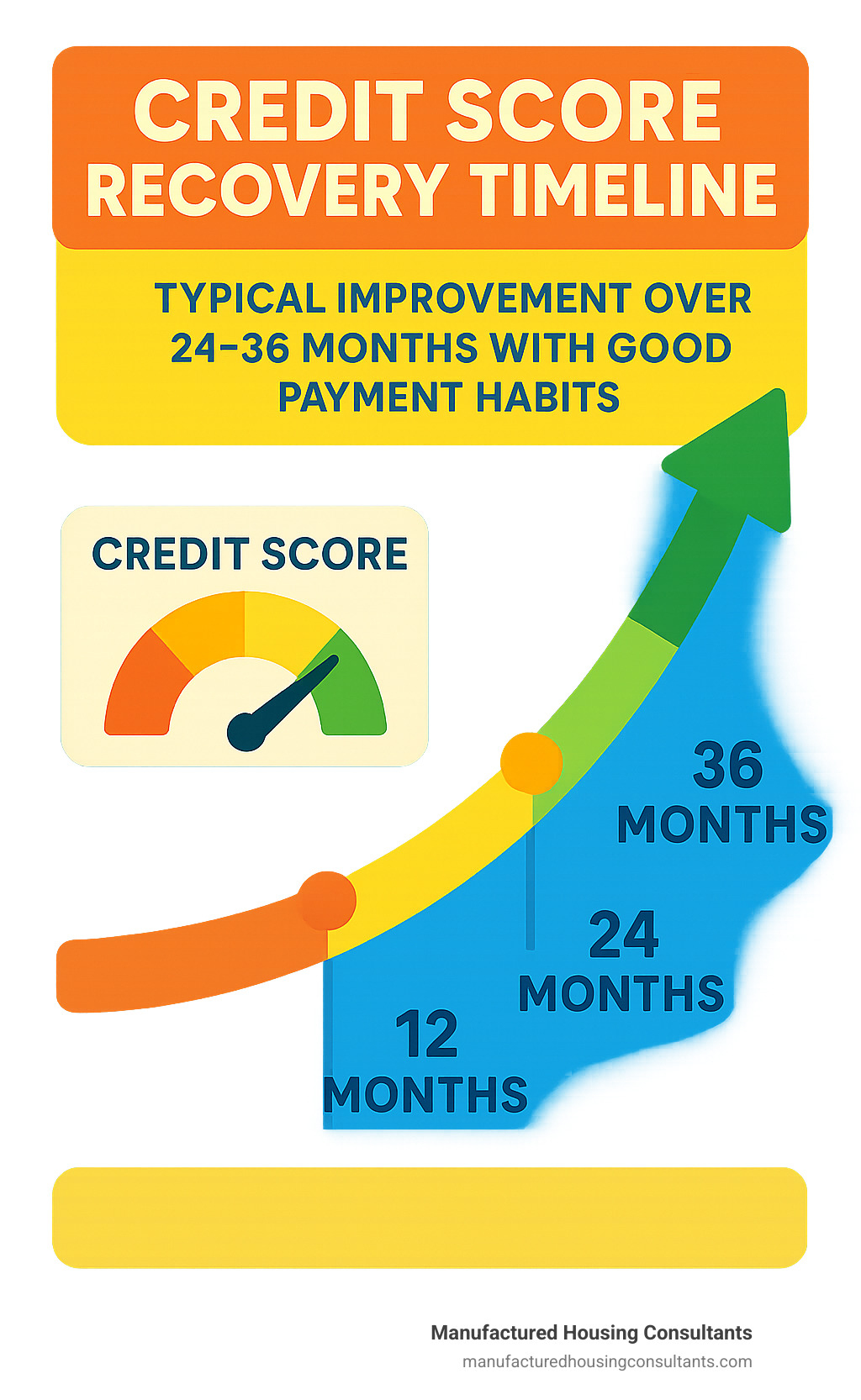

Dealing with Credit Damage

Foreclosure on a mobile home typically drops credit scores by 100 to 300 points and stays on your credit report for seven years. But the impact gets smaller over time if you make good payment decisions going forward.

Start rebuilding by paying all your remaining bills on time – payment history makes up 35% of your credit score. Get a secured credit card that requires a deposit but helps rebuild credit. Keep your credit card balances low and dispute any errors on your credit report.

You Might Still Be Able to Get Your Home Back

Even after foreclosure, many states give you “redemption rights” – the ability to buy back your home by paying the foreclosure sale price plus costs. These rights usually last 30 days to a year, but you need to act fast.

Don’t Forget Your Stuff

You typically have just 10 to 30 days after foreclosure to remove your belongings. Document everything you take with photos, and don’t abandon valuable items.

Planning Your Next Move

When you’re ready to rent again, be honest with potential landlords about the foreclosure. Consider offering a larger security deposit.

If you want to buy again, the timeline depends on the loan type. Conventional loans typically require waiting four to seven years after foreclosure. FHA loans might let you qualify after three years. VA loans usually require a two-year wait for veterans.

Finding Your Next Home

Foreclosed homes often become available at reduced prices. Bank-owned properties are sold “as-is” but at discounts. Repo mobile homes might need some work but offer great value for families getting back on their feet.

We help Texas families find quality bank foreclosure mobile homes throughout the state.

Next Moves & How We Can Help

Facing foreclosure on a mobile home feels overwhelming, but you’re not alone. Whether you’re trying to save your current home or need to find new housing after foreclosure, there are resources and people ready to help.

If You’re Still Fighting Foreclosure:

- Contact a HUD-approved housing counselor immediately

- Gather all financial documents for loss mitigation applications

- Document any lender violations or servicing errors

- Consider consulting with a foreclosure attorney

- Don’t ignore notices – respond to every communication

If You’ve Lost Your Home:

- Focus on credit rebuilding strategies

- Explore rental options while your credit recovers

- Research government assistance programs

- Consider manufactured housing as an affordable path back to homeownership

How We Help Texas Families

At Manufactured Housing Consultants, we understand that life happens, and sometimes families need a fresh start. We specialize in helping people with various credit situations find quality, affordable housing solutions throughout Texas.

Our Services Include:

- Credit-friendly financing – we work with lenders who understand manufactured housing

- Repo and bank-owned inventory – quality homes at reduced prices

- Statewide delivery – we serve Von Ormy, New Braunfels, Laredo, Corpus Christi, San Antonio, Victoria, and beyond

- Guaranteed lowest prices – we’ll match or beat any competitor’s price

- Financial coaching – helping you understand your options and rebuild credit

Special Programs for Foreclosure Recovery:

We maintain an inventory of bank-owned manufactured homes for sale that can provide affordable housing solutions for families rebuilding after foreclosure. These homes often require minimal down payments and may qualify for special financing programs.

You can explore our complete selection of bank repos to see current available inventory.

The Road Forward

Recovering from foreclosure on a mobile home takes time, but thousands of families successfully rebuild their housing situation every year. The key is understanding your options, protecting your rights, and working with knowledgeable professionals who understand both the challenges and opportunities in manufactured housing.

Remember:

- Foreclosure isn’t the end – it’s a detour on your path to stable housing

- Your credit will recover with time and good financial habits

- Manufactured housing offers an affordable path back to homeownership

- You have more options and rights than you might realize

Whether you’re fighting to save your current home or ready to explore new housing options, take action today. The sooner you address your situation, the more options you’ll have available.

For immediate assistance with your housing situation, contact our team. We’re here to help Texas families find affordable, quality housing solutions regardless of their credit history or current circumstances.