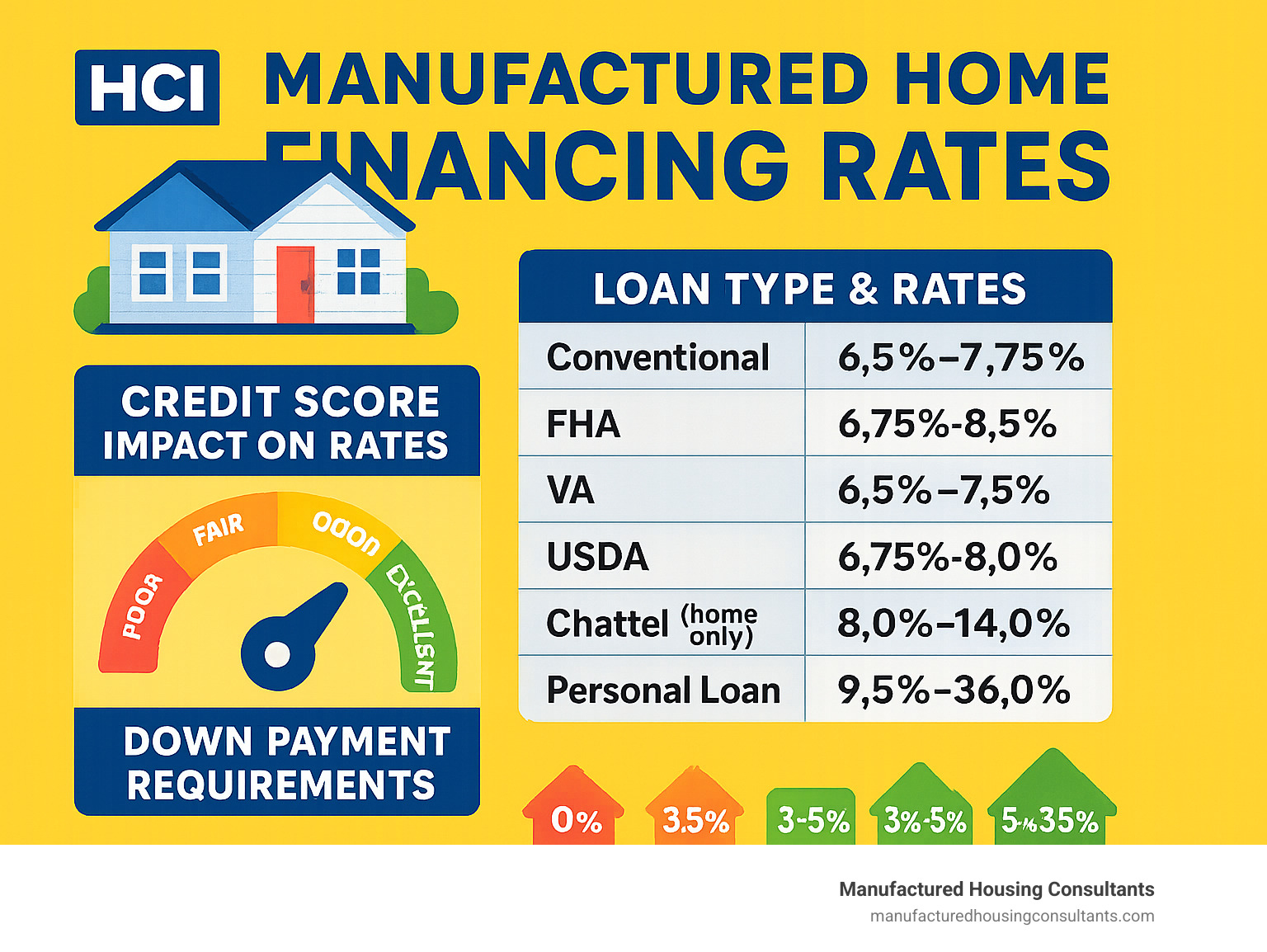

Today’s Manufactured Home Financing Rates at a Glance

Looking for a path to affordable homeownership in Texas? You’re in the right place! Manufactured home financing rates in 2025 typically range from 6.5% to 14%, depending on your unique situation. Whether you have perfect credit or are still building your financial foundation, there’s likely a financing option that fits your needs.

When we talk with families here in San Antonio, they’re often surprised by how accessible manufactured home ownership can be. Yes, rates are generally a bit higher than traditional home loans (lenders consider manufactured homes slightly higher risk), but they’re still within reach for many Texans.

Here’s what you can expect to see in today’s market:

| Loan Type | Interest Rate Range | Typical APR | Min. Credit Score | Down Payment |

|---|---|---|---|---|

| Conventional | 6.5% – 7.75% | 6.7% – 8.0% | 620 | 3% – 5% |

| FHA | 6.75% – 8.5% | 7.0% – 8.8% | 580 | 3.5% |

| VA | 6.5% – 7.5% | 6.8% – 7.9% | No minimum | 0% |

| USDA | 6.75% – 8.0% | 7.1% – 8.3% | 640 | 0% |

| Chattel (home only) | 8.0% – 14.0% | 8.3% – 14.5% | 575 | 5% – 35% |

| Personal Loan | 9.5% – 36.0% | 9.8% – 36.0% | 580 | N/A |

Your actual rate will depend on several key factors. Think of these as the levers you can pull to improve your rate:

Your credit score makes the biggest impact – the higher your score, the lower your rate. Even a 20-point improvement can sometimes drop your rate by 0.5%.

Down payment size matters too – putting down 10% instead of 5% often secures you a better rate and reduces your monthly payment.

Loan term affects both your rate and total cost – 15-year loans typically have rates about 0.5% lower than 30-year loans, though monthly payments are higher.

Land ownership is a significant factor – financing both land and home together (known as a land-home package) typically gets you rates 1-3% lower than home-only loans.

Home age and condition influence lender decisions – newer homes in good condition qualify for the best rates, while older homes might face rate increases.

If you’re working with a tight budget (and who isn’t these days?), focus first on improving your credit score and saving for a larger down payment. These two factors alone can dramatically reduce your manufactured home financing rates and monthly payments.

Want to explore your options further? Check out our resources on manufactured home mortgages, mobile home loan financing, or use our mobile home financing calculator to see what your monthly payments might look like.

At Manufactured Housing Consultants, we work with folks across all credit situations. Your dream of homeownership might be closer than you think!

Manufactured Home Financing 101: Loan Types, Eligibility & Costs

Let’s face it—navigating home financing can feel like learning a new language. But don’t worry! We’ve helped thousands of Texas families just like yours find the perfect financing solution for their dream manufactured home.

Manufactured vs. Mobile vs. Modular: Know the Difference

Before we dive into dollars and cents, let’s make sure we’re speaking the same language about what you’re buying:

Manufactured homes are built entirely in a factory after June 15, 1976, following strict HUD Code standards. They have a permanent chassis and can be placed on your own land or in a community.

Many folks still say “mobile home” when they mean manufactured home. Technically, mobile homes are factory-built homes made before June 15, 1976—before those important HUD standards kicked in.

Modular homes are different animals altogether. They’re built in sections at a factory, then assembled on a permanent foundation at your site. They follow local building codes (not HUD Code) and typically get financed like traditional stick-built homes.

Every genuine manufactured home has a HUD certification label (sometimes called a “HUD tag”) attached to the exterior of each section—it’s like the home’s birth certificate! For real home nerds, you can explore the complete HUD Code regulations online.

Loan Programs at a Glance

When it comes to manufactured home financing rates and options, you’ve got more choices than you might think:

Conventional loans are the gold standard if you have good credit (minimum 620) and can put down 3-5%. Fannie Mae and Freddie Mac back these loans, which typically offer the most competitive rates.

FHA loans are more forgiving on credit (minimum 580) with down payments as low as 3.5%. They come in two flavors: Title I (for the home and/or lot) and Title II (for home and land together).

VA loans are a fantastic deal for veterans and active-duty service members. Think 0% down payment and no private mortgage insurance—that’s Uncle Sam saying “thank you for your service.”

USDA loans are perfect if you’re looking at rural areas. They offer 0% down payment options if you meet income requirements and have a credit score around 640.

Chattel loans are specifically for manufactured homes and treat them as personal property (like a car). Rates typically run from 8% to 14%—higher than mortgage rates but lower than personal loans. These are common when you’re buying just the home and placing it on leased land.

Personal loans are the high-interest option of last resort, with rates up to 36% and shorter terms. They’re quick to get but expensive to keep.

Sarah from Boerne told us recently, “I was shocked when a big bank turned me down flat. Manufactured Housing Consultants explained that only about 1 in 4 manufactured home loan applications get approved nationwide—then they helped me become one of those success stories!”

Learn more about your options on our Mobile Home Loan Financing page.

Eligibility & Property Requirements

Getting your loan approved depends on several key factors:

Your credit score opens or closes doors. With excellent credit (740+), you’ll qualify for the best manufactured home financing rates across all loan types. Good scores (680-739) still get you most options with slightly higher rates. Even with fair credit (620-679), you have conventional, FHA, VA, and chattel options. With scores below 580, you’re looking at hefty down payments of 25-35% for most chattel financing.

Your down payment matters too. Conventional loans start at 3-5%, FHA at 3.5%, while VA and USDA loans offer that attractive 0% down for qualified buyers. Chattel loans typically require 5-35% down, depending on your credit profile.

The property itself also affects your options. Owning both the home and land opens up all financing avenues with better rates. Homes on leased land usually limit you to chattel or personal loans. Age matters too—homes built after June 15, 1976 (when the HUD Code kicked in) qualify for more financing options.

A permanent foundation is non-negotiable for conventional, FHA, VA, and USDA loans. This isn’t just a concrete slab—it’s an engineered foundation system that meets specific requirements.

Mike from New Braunfels shared, “My credit wasn’t perfect at 650, but I owned my land outright. Manufactured Housing Consultants helped me leverage that land ownership to secure a conventional loan with a rate just 0.75% higher than prime. The foundation requirements seemed complicated at first, but they walked me through every step.”

For more details on eligibility, check out our Guidelines for Manufactured Home Financing.

Upfront Costs & Ongoing Fees

Budgeting for your manufactured home means looking beyond just the monthly payment:

When you close on your loan, expect to pay an origination fee (typically 1% of the loan amount), a processing fee (around $350), and your down payment. You’ll also need to cover an appraisal ($300-$500), home inspection ($300-$500), title insurance (varies by loan amount), and potentially a survey ($300-$700).

If you’re getting an FHA, VA, or USDA loan, you’ll likely need a foundation certification ($300-$1,000) to verify the home meets government standards.

After closing, ongoing costs include your mortgage payment (principal and interest), property taxes (typically lower than site-built homes), and homeowners insurance (required by all lenders). If your down payment is less than 20% on a conventional loan, add private mortgage insurance. FHA loans have their own mortgage insurance that typically lasts the life of the loan.

If you’re placing your home in a community, factor in lot rent or land lease payments, which can range from $300 to $800+ monthly depending on location and amenities.

At closing, you’ll need to bring your government ID, proof of income (pay stubs, W-2s, tax returns), bank statements, proof of down payment funds, and your insurance policy.

“I was worried about all the paperwork,” said Rosa from San Antonio, “but Manufactured Housing Consultants created a simple checklist for me. They even helped me find ways to reduce some closing costs by timing my purchase at the end of the month.”

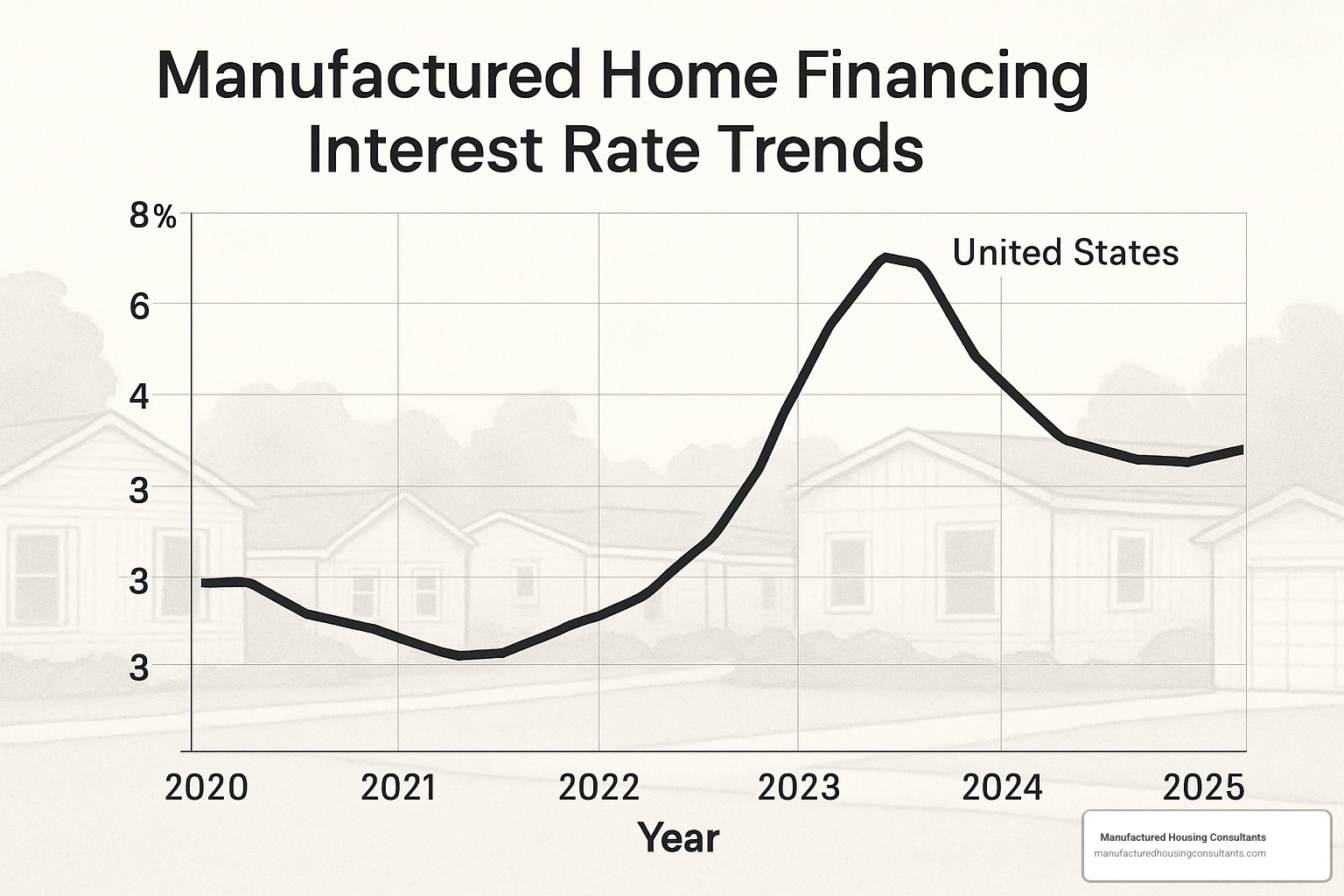

Current Manufactured Home Financing Rates & How to Secure the Best Deal

Navigating manufactured home financing rates can feel a bit like riding a roller coaster – exciting but sometimes unpredictable! Let’s walk through what you need to know to get the best possible deal in today’s market.

Snapshot of 2025 Manufactured Home Financing Rates

If you’re shopping for a manufactured home loan in early 2025, you’ll find quite a range of manufactured home financing rates depending on your situation. Brand new homes typically secure better rates than previously-owned ones – it’s just like car financing in that way!

For new manufactured homes, conventional loans are offering some of the most competitive rates we’ve seen. You can expect around 6.44% to 7.00% APR on a 15-year fixed mortgage, while 30-year terms are running about 6.87% to 7.50% APR. FHA loans are in a similar range, with 30-year terms between 6.75% and 7.75% APR.

If you’re looking at chattel loans (those personal property loans for homes without land), rates are understandably higher – typically starting around 8.75% for a 15-year term on a new home.

For previously-owned manufactured homes, you’ll generally pay a bit more in interest. Conventional 30-year mortgages for these homes are currently ranging from 7.25% to 8.00% APR, while chattel loans can reach up to 12.00% APR for a 15-year term.

I was chatting with a client just last week who found Holy Rosary Credit Union offering 30-year fixed manufactured home loans at 10.24% APR (with 25% down on a $200,000 purchase). Meanwhile, Sterling Associates has been advertising rates as low as 6.50% APR – but that’s with a hefty 50% down payment. With just 10% down, their rates jump to 7.25%.

The takeaway? Rates vary tremendously between lenders, which is why shopping around is absolutely essential!

What Drives Manufactured Home Financing Rates

Your credit score is the heavyweight champion when it comes to determining your rate. With an excellent score of 740+, you’ll qualify for those attractive rates you see advertised. But each step down the credit ladder adds to your rate – about 0.25-0.5% for very good credit (700-739), 0.5-1% for good credit (660-699), and 1-2% higher for fair credit (620-659).

Your down payment makes a huge difference too. While you can get into a manufactured home with just 3-5% down on many conventional and government loans, putting down 20% or more eliminates mortgage insurance and often secures significantly better rates. For chattel loans especially, a large down payment of 30-50% can knock 1-2% off your rate!

The loan term you choose affects your rate as well. Shorter terms (10-15 years) typically come with lower rates but higher monthly payments. A 30-year loan will have a higher rate but might be more affordable month-to-month.

Manufactured home financing rates are also influenced by the home itself. Newer homes in excellent condition qualify for the best rates, while homes over 30 years old may face limited financing options or significantly higher rates. And perhaps most importantly, whether you own the land underneath your home makes an enormous difference – homes on leased land are typically limited to chattel loans with rates several percentage points higher than conventional mortgages.

I remember Sarah from Corpus Christi who came to us initially with a 640 credit score and was quoted 9.5% for a chattel loan. After working on her credit for six months and boosting it to 720, plus saving for a larger down payment, she qualified for a conventional loan at 7.25%. That simple change saved her over $100 every month!

If you’re looking at rural properties, don’t forget to check the USDA eligibility tool – their programs often offer excellent rates for qualifying locations.

Shopping, Comparing & Refinancing Tips

Getting the best possible manufactured home financing rates takes some legwork, but the savings are worth it! Always get at least 3-5 quotes from different types of lenders – traditional banks, credit unions, specialized manufactured home lenders, and online options. Try to get all quotes within a two-week window so multiple inquiries only count once on your credit report.

When you find a rate you like, don’t hesitate to lock it in. Most lenders offer free rate locks for 30-60 days, which protects you if rates rise before closing. This simple step saved one of our clients nearly $1,500 over his first five years when rates jumped just before his closing date!

Already have a manufactured home loan? Refinancing might make sense, especially if you’ve improved your credit or have built substantial equity. Cash-out refinancing is typically limited to 65% LTV for manufactured homes, but a rate-and-term refinance could lower your payment without taking cash out. One of the biggest wins is refinancing from a chattel loan to a conventional loan if you now own both the home and land.

Smart mortgage insurance strategies can save you money too. With conventional loans, you can cancel private mortgage insurance (PMI) once you reach 20% equity. FHA mortgage insurance, however, typically sticks around for the life of the loan if your down payment was less than 10%. VA loans skip mortgage insurance altogether, though they do have a funding fee.

Improving your credit before applying is one of the smartest moves you can make. Pay down credit card balances below 30% of your limits, avoid new credit applications for several months before applying for your home loan, and make sure all your payments are on time for at least a year. These simple steps can boost your score significantly and potentially save thousands over the life of your loan.

Consider buying down your rate by paying discount points if you plan to stay in the home for a long time. Each point costs 1% of your loan amount and typically reduces your rate by about 0.25%. For a $150,000 loan, paying $1,500 upfront to save $20-30 monthly can break even in just a few years.

Don’t forget to explore specialized programs like Fannie Mae’s MH Advantage for manufactured homes with site-built features, or FHA’s Title I program for homes on leased land. Veterans should definitely look into VA loans, which often offer the most favorable terms.

Our Mobile Home Financing Calculator can help you compare different scenarios and see how changes in rate, term, and down payment affect your monthly payment. And if credit challenges are holding you back, check out our guide on Financing for Mobile Homes with Bad Credit.

Michael from San Antonio had a similar experience to many of our clients. With a 610 credit score, he was quoted an 11% chattel loan. After working with us to improve his credit for just three months, he qualified for an FHA loan at 7.75% – saving over $200 monthly! These kinds of changes happen all the time when you know what levers to pull.

Conclusion & Next Steps

Finding the right financing for your manufactured home might seem like climbing a mountain, but I promise you – the view from the top is worth it. After helping thousands of Texas families become homeowners, we’ve seen how the right loan can transform dreams into reality.

Let me walk you through what happens next. Start by taking a good look at your financial picture – your credit score, savings, and monthly budget. This honest assessment will guide every decision moving forward. Knowing where you stand financially isn’t about judgment; it’s about creating a realistic path to success.

Next, think about where your home will sit. Will you place it on land you already own? Are you looking at a welcoming manufactured home community? Or perhaps you’re dreaming of buying both land and home together? Each option opens different financing doors, with manufactured home financing rates varying accordingly.

Before you start shopping, gather your financial paperwork – those pay stubs, tax returns, and bank statements might not be exciting reading, but they’re your ticket to approval. Having these documents organized shows lenders you’re serious and prepared.

Then comes the fun part – shopping around for rates. Don’t settle for the first offer! I remember helping Maria from San Antonio who saved nearly $15,000 over her loan term simply by getting quotes from three different lenders instead of just one.

Pre-approval is your next power move. It’s like having a financial passport that strengthens your position when shopping for homes. Sellers and dealers take pre-approved buyers seriously because they know you can actually close the deal.

When you find that perfect manufactured home – the one where you can already picture holiday gatherings and quiet Sunday mornings – you’ll finalize your financing with confidence, knowing you’ve done your homework and secured the best possible terms.

At Manufactured Housing Consultants, we’ve turned this process into an art form. Whether your credit history is spotless or has a few bumps along the way, we specialize in finding financing solutions that work for your unique situation.

We’re proud to serve communities across Texas, with locations in San Antonio, New Braunfels, Laredo, Corpus Christi, Victoria, and Von Ormy. Our promise is simple: the lowest prices guaranteed, with delivery anywhere in the Lone Star State.

I’ve seen the joy on families’ faces when they realize manufactured homeownership is within reach. These homes offer quality, style, and most importantly, affordability. With thoughtful financing, you’ll build equity while keeping monthly payments manageable – something that feels increasingly rare in today’s housing market.

Ready to take that next step? Visit our guide on mobile homes financing programs for more detailed information, or simply reach out to our team. We’re real people, not algorithms, and we’re genuinely excited to help you find your way home.

After all, we’re not just financing homes – we’re helping build futures. And yours could begin with a simple conversation today.