Understanding Manufactured Home Loan Calculators

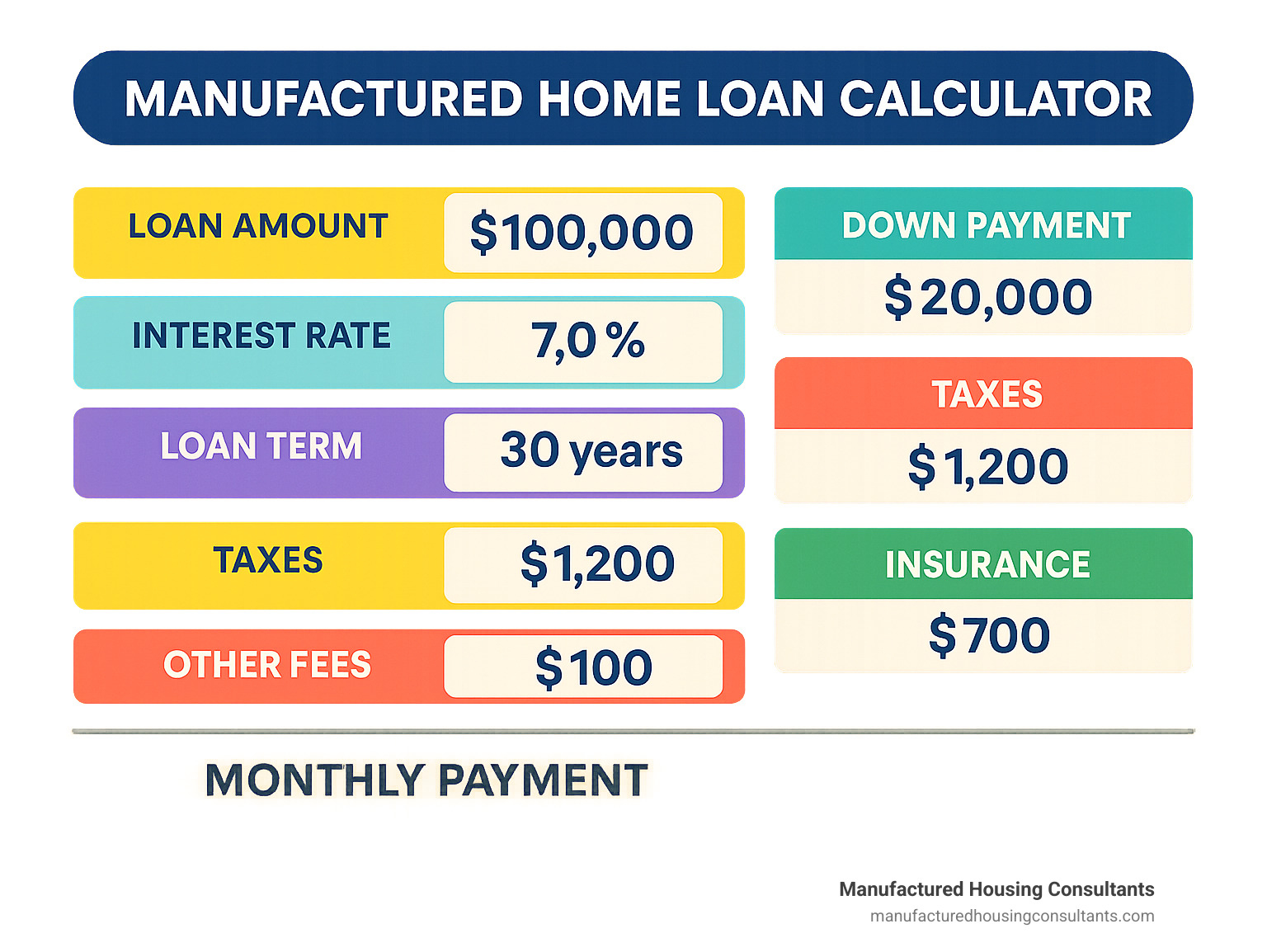

A manufactured home loan calculator is an essential tool that helps you estimate monthly payments for financing a factory-built home. If you’re looking to quickly calculate your potential manufactured home payments, follow these steps:

- Enter the loan amount (home price minus down payment)

- Input the interest rate (typically 0.5-1% higher than traditional homes)

- Select your loan term (commonly 15, 20, or 30 years)

- Add property taxes and insurance costs

- Include additional expenses like land lease fees or HOA dues

Manufactured homes offer an affordable path to homeownership, with prices typically ranging from $40,000 to $100,000 compared to traditional homes that often exceed $200,000. However, financing these homes can be different from conventional mortgages.

When you use a manufactured home loan calculator, you’re taking the first step toward understanding your budget and determining how much home you can afford. These calculators help you compare different scenarios by adjusting variables like down payment amounts, interest rates, and loan terms.

Unlike traditional home loans, manufactured home financing often needs to account for additional factors such as:

- Whether the home is on a permanent foundation

- If you’re buying just the home or home with land

- Land lease or space rent costs in a manufactured home community

- Setup and transportation fees

Most calculators will break down your monthly payment into principal, interest, taxes, and insurance, giving you a clear picture of your total housing costs. This transparency helps you make informed decisions about your housing budget.

Simple manufactured home loan calculator word guide:

- manufactured home financing rates

- manufactured home mortgage

- using land as down payment for mobile home

How to Use a Manufactured Home Loan Calculator in 5 Simple Steps

Wondering how to make sense of all those numbers when financing your dream manufactured home? Don’t worry – using a manufactured home loan calculator is easier than you might think! While manufactured homes have some unique financing quirks compared to traditional houses, the calculation process follows familiar principles. Let’s walk through how to use these calculators to plan your purchase with confidence.

Before we dive in, it’s worth noting that manufactured home loans typically come with slightly higher interest rates than traditional mortgages – usually about 0.5% to 1% more. This difference is even more pronounced if you’re financing the home as personal property (chattel loan) rather than real estate.

Here’s a quick comparison of typical rates for different loan types:

| Loan Type | Typical Interest Rate | Down Payment Requirement | Max Loan Term |

|---|---|---|---|

| FHA | 5.5% – 7.5% | 3.5% minimum | 30 years |

| VA | 5.0% – 7.0% | 0% for eligible veterans | 30 years |

| USDA | 5.0% – 7.0% | 0% for eligible buyers | 30 years |

| Conventional | 5.5% – 8.0% | 5% – 20% | 30 years |

| Chattel | 7.0% – 12.0% | 5% – 20% | 15-25 years |

Note: Rates change based on market conditions, your credit score, and other factors. Check Bankrate mortgage rates for current averages.

Now, let’s break down the 5 simple steps to calculate your manufactured home loan payment.

Step 1: Gather Key Data for Your Manufactured Home Loan Calculator

The first step to getting accurate results from your manufactured home loan calculator is having all the right information at your fingertips. Think of it like gathering ingredients before cooking – you want everything measured and ready!

Start with your gross monthly income – that’s what you earn before taxes and deductions. Lenders use this figure to calculate your debt-to-income ratio (DTI), which helps determine how much home you can afford.

Next, list all your monthly debt obligations. This includes car payments, student loans, credit card minimums, and other recurring debts. Don’t include your current rent or utilities in this calculation.

You’ll also need the purchase price of the manufactured home you’re eyeing. At Manufactured Housing Consultants, our homes throughout San Antonio and Texas range from cozy single-wides to spacious double-wides at various price points.

Your down payment amount matters too. Different loan types have different requirements:

- FHA loans need at least 3.5% down

- VA loans offer 0% down for eligible veterans (a great benefit for our service members!)

- USDA loans may require 0% for eligible rural buyers

- Conventional loans typically need 5% or more

- Chattel loans often require 5-20% down

Don’t forget about your credit score – it’s like your financial report card. Most manufactured home loan programs have minimum requirements:

- FHA: 580 minimum (though many lenders prefer 620+)

- VA: 620 minimum (some lenders may accept lower)

- USDA: 640 minimum

- Conventional: 620-640 minimum

- Chattel: 600-660 minimum

Finally, calculate your debt-to-income ratio. Lenders typically cap this at:

- FHA and Conventional: 50%

- VA: 65%

- USDA: 41%

Having all this information ready helps you determine what you can realistically afford. For more detailed information on qualification requirements, check our Guidelines Manufactured Home Financing.

Pro Tip: Pull your credit report before applying for financing. You’re entitled to one free report annually from each major credit bureau. This gives you a chance to fix any errors that might hurt your chances of approval or increase your interest rate.

Step 2: Choose the Right Loan Type & Input Into the Manufactured Home Loan Calculator

Now that you’ve gathered your financial information, it’s time to select the right loan type for your manufactured home purchase. Think of this as choosing the right vehicle for your journey – some options might get you there faster, while others might be more comfortable for the long haul.

FHA Loans for Manufactured Homes are government-backed options that offer more flexibility. With a down payment as low as 3.5% and more lenient credit requirements (minimum 580), these loans can be perfect for first-time buyers. Just remember that FHA loans require both upfront and annual mortgage insurance, and your home must be on a permanent foundation and classified as real property. Want the full scoop? Visit our FHA Mobile Home Financing page.

VA Loans for Manufactured Homes are a fantastic benefit for those who’ve served our country. If you’re an eligible veteran, active-duty service member, or qualifying surviving spouse, you might enjoy no down payment, no PMI, and competitive interest rates. Like FHA loans, your home needs to be on a permanent foundation. Learn more about these patriotic options at our VA Loan Mobile Home Financing page.

USDA Loans for Manufactured Homes are designed for rural areas and also offer 0% down payment options. They feature low mortgage insurance costs but do have income limits. Your home must be new, on a permanent foundation, and meet specific size requirements. Many parts of Texas outside major city centers qualify as “rural” for these loans!

Conventional Loans for Manufactured Homes aren’t backed by government agencies and typically require higher credit scores (620+) and down payments starting at 5%. You might need PMI if your down payment is less than 20%, but these loans offer flexibility in many other areas.

Chattel Loans (Personal Property Loans) come into play when your home isn’t permanently attached to land. They typically have higher interest rates (often 2-5% higher than mortgage loans) and shorter terms (usually 15-25 years), but they offer a faster closing process and less stringent requirements for the home itself.

Important Note: Modular homes, while factory-built, are typically financed like traditional site-built homes because they’re assembled on a permanent foundation and meet local building codes. If you’re considering a modular home, you’ll likely have access to standard mortgage options with more favorable terms.

After selecting your loan type, input these key figures into your calculator:

- Loan amount (home price minus down payment)

- Interest rate (based on loan type and your credit profile)

- Loan term (number of years)

Want a more comprehensive look at your options? Explore our Mobile Home Financing Calculator or chat with our friendly financing specialists at Manufactured Housing Consultants. We help buyers throughout San Antonio, New Braunfels, Laredo, Corpus Christi, Victoria, and across Texas find their perfect financing fit.

Step 3: Factor In Land, Taxes, Insurance & Setup Fees

One of the biggest mistakes people make when using a manufactured home loan calculator is forgetting about all those “extra” costs that aren’t really extra at all – they’re essential parts of your total housing expense! Let’s make sure your calculation includes everything.

Property Taxes in Texas typically run between 1.5% and 2.5% of your home’s assessed value annually. The good news? Manufactured homes are often assessed at lower values than comparable site-built homes, potentially saving you money. If you’re unsure about exact figures, a good rule of thumb is to estimate about 2% of your home’s value for your calculator input.

Homeowners Insurance for manufactured homes usually costs between $300-$1,000 per year, depending on your home’s size, value, location, and whether it sits on a permanent foundation. Texas weather can be unpredictable (to say the least!), so good coverage is essential for protecting your investment.

Land Costs play a huge role in your financing picture:

- Buying land with your home? Include that cost in your loan amount.

- Already own land? You might be able to use that equity as your down payment – a smart way to leverage what you already have!

- Leasing land or renting a space? Add that monthly cost to your calculated payment.

Curious about combining home and land financing? Our Manufactured Home and Land Financing page has all the details.

Setup Fees and Transportation Costs are those one-time expenses that get your home from the factory to your property and ready for you to move in. These typically run $3,000-$10,000 and include delivery, foundation construction, utility connections, and various permits and inspections. While these costs are often rolled into your loan amount, they’re important to factor into your total project budget.

Space Rent or HOA Dues apply if your manufactured home will be in a community. In Texas, monthly space rent typically ranges from $300-$800, while HOA dues (if applicable) usually run $50-$200 monthly. Don’t forget to add these to your calculated mortgage payment for a true picture of your monthly housing cost.

Let’s look at a quick example: Say you’re buying a $75,000 manufactured home with a $15,000 down payment. Your base loan amount is $60,000, but your total monthly payment would include:

- Principal and interest on the $60,000

- Property taxes: about $125/month ($1,500 annually)

- Insurance: about $50/month ($600 annually)

- Space rent (if applicable): $400/month

Most good manufactured home loan calculators have fields for these additional costs, but if yours doesn’t, simply add them to the calculated principal and interest payment to get your true monthly housing expense.

Step 4: Interpret Results, Compare Scenarios & Plan Early Payoff

Now comes the fun part – seeing what those numbers actually mean for your future! Once you’ve entered everything into a manufactured home loan calculator, it’s time to dig into the results and play around with different possibilities.

A good calculator will break down your payment into easily digestible chunks:

- Principal and Interest: This is the base payment that goes toward your loan balance and interest

- Taxes and Insurance: Often collected monthly and held in an escrow account

- Additional Costs: Space rent, HOA dues, or other recurring expenses

- Total Monthly Payment: The bottom line – what actually comes out of your bank account each month

You should also be able to see the total interest you’ll pay over the life of the loan, an amortization schedule showing how each payment chips away at your balance, and your loan payoff date. These details help you understand the big picture beyond just the monthly payment.

One of the most valuable things about using a manufactured home loan calculator is the ability to play “what if” with different scenarios. It’s like trying on different financial outfits to see what fits your life best! Try adjusting these variables:

Change your down payment amount and watch how it affects both your monthly payment and total interest paid. That extra $5,000 down might save you tens of thousands in interest over the life of your loan!

Compare different loan terms – a 15-year loan will have higher monthly payments than a 30-year loan, but you’ll build equity faster and save a small fortune in interest. For many families, finding the sweet spot between affordable monthly payments and reasonable long-term costs is key.

See how different interest rates impact your payment. Even a seemingly small difference of 0.5% can save you thousands over the life of your loan. This is why it pays to shop around and work on improving your credit score before applying.

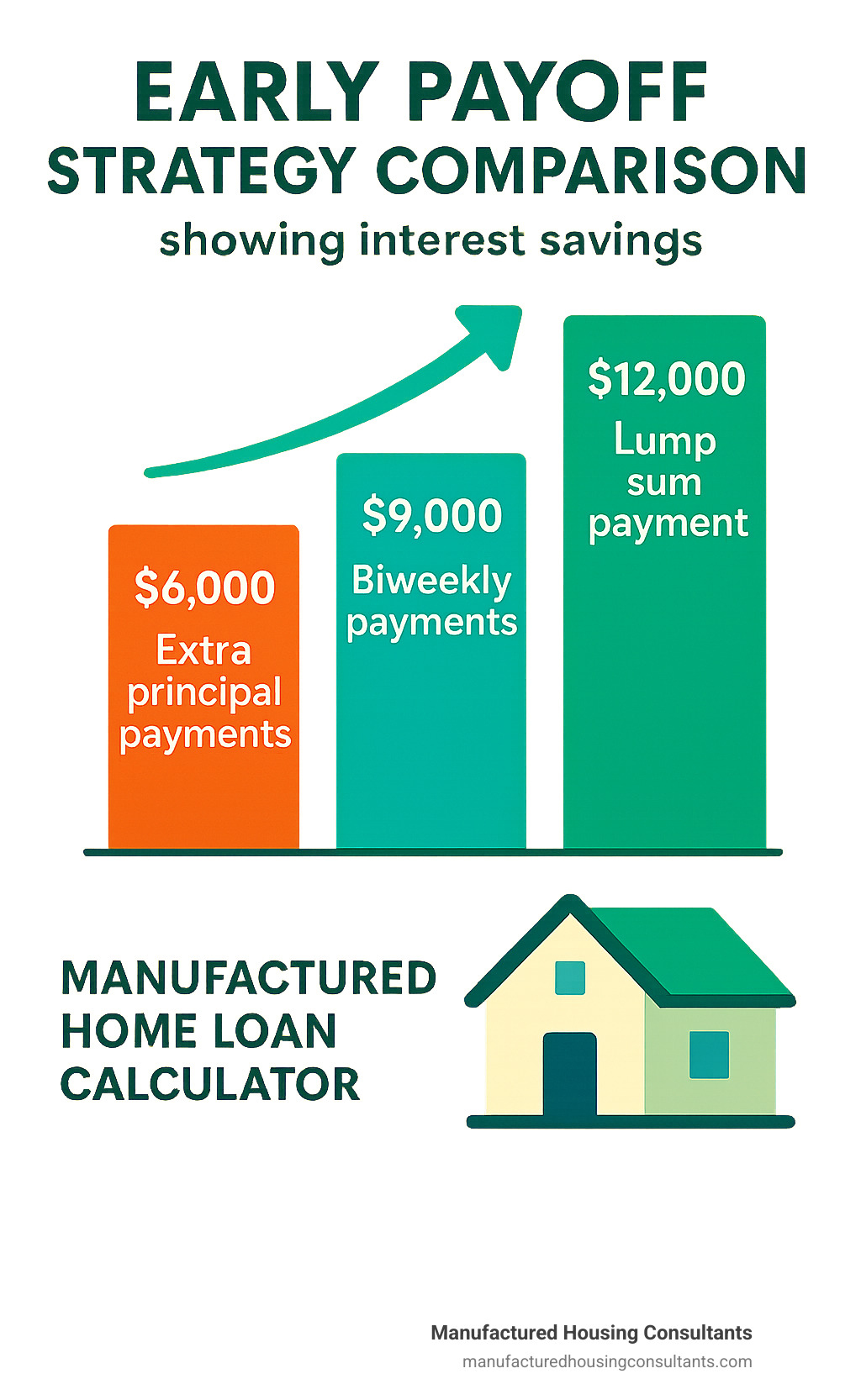

Want to pay off your home faster? Most people do! Try these strategies:

Making extra principal payments can work wonders. Even an extra $100 per month might shave years off your loan and save you thousands in interest. Most calculators will show you exactly how much time and money you’ll save.

Let’s look at a real example for a $75,000 manufactured home with a $15,000 down payment ($60,000 loan amount):

| Scenario | Interest Rate | Term | Monthly P&I | Total Interest Paid |

|---|---|---|---|---|

| Base Scenario | 7.0% | 30 years | $399 | $83,640 |

| Higher Down Payment | 7.0% | 30 years | $332 | $69,520 |

| Shorter Term | 7.0% | 15 years | $539 | $37,020 |

| Lower Rate | 6.5% | 30 years | $379 | $76,440 |

| Extra $100/month | 7.0% | 30 years | $499 | $61,980 |

Pretty eye-opening, isn’t it? That shorter term saves over $46,000 in interest! Or you could keep the longer term for flexibility but make extra payments when possible – giving you the best of both worlds.

For current market rates, check Bankrate mortgage rates or give us a call at Manufactured Housing Consultants for personalized rate quotes. We work with manufactured home buyers throughout San Antonio and all across Texas.

Step 5: Boost Accuracy, Improve Approval Odds & Lock Your Rate

While a manufactured home loan calculator gives you a great starting point, there are several steps you can take to move from estimation to action – making your calculations more accurate and improving your chances of getting approved with favorable terms.

Getting More Accurate Numbers

Online calculators are wonderful tools, but they can’t capture every detail of your unique situation. To get numbers you can truly count on, consider getting pre-qualified or pre-approved. This gives you real figures based on your specific financial profile rather than general estimates. Visit our Pre-Approval Process page to get started.

Once you’ve selected a lender, ask for an official Loan Estimate. This document breaks down all costs, including those closing costs and fees that online calculators typically don’t capture. Speaking of closing costs – these typically run 2% to 5% of your loan amount and include origination fees, appraisal fees, title insurance, credit report fees, recording fees, and prepaid taxes and insurance.

Boosting Your Approval Chances

Your credit score has a massive impact on both your approval odds and your interest rate. Even a small improvement can make a big difference! Try these strategies:

- Pay down credit card balances to less than 30% of your available credit

- Make all payments on time (set up automatic payments if needed)

- Hold off on applying for new credit before your home loan

- Check your credit report for errors and dispute any you find

A larger down payment works wonders too. It reduces your loan-to-value ratio, might eliminate the need for mortgage insurance, improves your debt-to-income ratio, and could qualify you for better interest rates. Even an extra few thousand dollars down can make a significant difference.

Don’t forget to reduce existing debt where possible. Pay down high-interest debt first, avoid taking on new obligations before applying, and consider postponing major purchases until after closing.

Locking In Your Rate

Once you’ve been approved, consider a rate lock to protect yourself from market fluctuations. Rate locks typically last 30-60 days and shield you from rate increases during the loan process. Some lenders charge a fee for this service, while others offer it as part of their package.

Timing your lock strategically can save you money. Work with your lender to time the lock based on market trends, making sure the lock period covers your expected closing date. Ask about “float down” options that allow you to benefit if rates decrease after locking.

As you prepare for closing, review your Closing Disclosure carefully, have funds ready for your down payment and closing costs, and maintain your credit and employment status until the keys are in your hand.

Here’s a Real-Life Success Story:

Maria and Carlos were eyeing a $90,000 manufactured home in San Antonio. Their initial manufactured home loan calculator estimate showed a monthly payment of $650 including taxes and insurance with an FHA loan at 7.25%.

They didn’t stop there, though. With some guidance from our team, they spent a few months improving their credit score by 30 points (from 640 to 670) and saved for a larger down payment (10% instead of 3.5%). These efforts helped them qualify for a 6.75% rate – reducing their monthly payment to $610 and saving them over $14,000 in interest over the life of their loan!

At Manufactured Housing Consultants, we help buyers throughout Texas steer the financing process with personalized guidance. We can connect you with lenders who specialize in manufactured home loans and truly understand these unique properties. Whether you’re in San Antonio, New Braunfels, Laredo, Corpus Christi, Victoria, or anywhere else in Texas, we’re here to help you calculate your way to homeownership!

Conclusion: Calculate With Confidence & Take the Next Step

Now that you’ve mastered using a manufactured home loan calculator, you’re standing at the threshold of affordable homeownership. These calculations aren’t just numbers on a screen—they’re the first concrete steps toward your new home.

At Manufactured Housing Consultants, we’ve guided countless Texas families through this journey. From the busy streets of San Antonio to the charm of New Braunfels, the border energy of Laredo to coastal Corpus Christi and Victoria, we’ve helped people just like you turn calculations into keys.

Your calculator journey has taught you some valuable lessons:

First, manufactured homes truly open doors to affordable homeownership. With prices typically between $40,000 and $100,000, they offer a practical path to building equity without the staggering price tags of traditional homes.

Second, you now understand the financing landscape—whether it’s an FHA loan with its low down payment, a VA loan for our veterans, a USDA option for rural settings, or conventional and chattel financing. Each has its place, and now you know which might work best for your situation.

You’ve also learned to think beyond the sticker price. Those property taxes, insurance premiums, land costs, and community fees aren’t afterthoughts—they’re essential pieces of your monthly budget puzzle.

Perhaps most importantly, you’ve finded how different scenarios—adjusting down payments, loan terms, interest rates—can dramatically impact both your monthly obligations and your long-term financial picture.

For our customers, manufactured homes represent more than just affordable shelter. They’re about building something lasting—financial stability, family memories, and often, surprising appreciation in value, especially when placed on owned land with a permanent foundation.

Ready to move beyond the calculator?

The next steps are simpler than you might think. Browse our selection of quality homes from leading manufacturers. Get pre-approved to lock in your real numbers (not just estimates). Visit us in person at our San Antonio, Von Ormy, or New Braunfels locations to see and feel your potential new home.

Our financing specialists are ready to discuss programs custom to your situation, including zero-down options for qualified buyers. We’ll help you steer from that first calculation to your closing day with confidence. Learn more about our secure financing programs designed with your success in mind.

While a manufactured home loan calculator gives you powerful insights, it’s just one tool in your homebuying toolkit. The personal guidance we provide at Manufactured Housing Consultants transforms those calculations into a concrete plan for your future home.

Give us a call today. Let’s talk about turning those calculator results into a set of keys to your very own manufactured home. After all, the best calculations are the ones that lead to action—and to a place you can proudly call home.