Understanding Mobile Home Financing Calculations

Dreaming of owning a manufactured home but not sure what it’ll cost each month? That’s where a mobile home financing calculator comes in handy – your financial crystal ball for this exciting journey!

Think of these calculators as your friendly financial guide that takes all the numbers that might be swirling in your head and organizes them into a clear monthly payment estimate. No more guesswork or late-night worrying about whether you can afford your dream home.

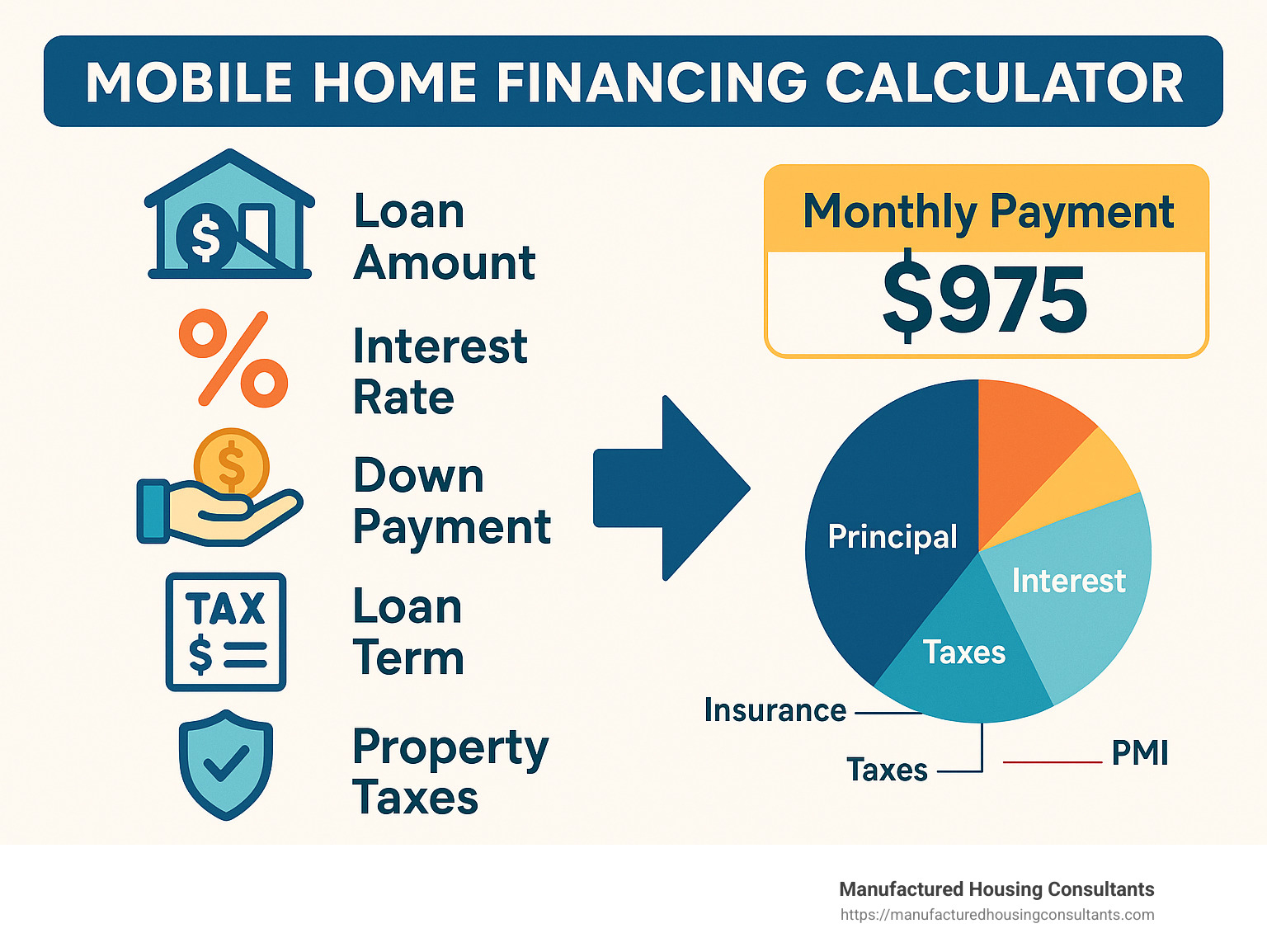

Here’s the quick rundown on calculating your mobile home financing:

- Enter home value (typically $50,000-$150,000)

- Input down payment (usually 3.5%-20%)

- Select interest rate (generally 0.5%-1% higher than traditional mortgages)

- Choose loan term (15, 20, or 30 years are most common)

- Add property taxes (0.5%-2% of home value annually)

- Include insurance costs (varies by location and coverage)

- Factor in PMI (required if down payment is less than 20%)

- Add land lease/HOA fees (if your home will be in a community)

One thing to keep in mind as you explore manufactured home financing: these loans often come with slightly higher interest rates than conventional mortgages – typically 0.5% to 1% higher. This difference might seem small, but it can add up over the life of your loan.

Loan terms for manufactured homes generally range from 15 to 30 years, similar to traditional mortgages. However, if you’re getting a chattel loan (which finances just the home without land), you might see shorter terms and higher rates. This is why playing with different scenarios in your calculator is so valuable!

“Understanding your potential mortgage payments and financing options is crucial for making an informed decision,” as industry experts often remind us. And they’re absolutely right – knowledge is power when it comes to such a significant investment.

The real magic of a mobile home financing calculator happens when you start tweaking the numbers. Try increasing your down payment and watch your monthly payment shrink. Extend your loan term and see how it affects both your monthly payment and the total interest paid over time. This kind of experimentation helps you find that sweet spot – where your monthly budget feels comfortable while still keeping your long-term costs reasonable.

When you’re ready to dive deeper into your manufactured home financing options, there are several paths worth exploring:

- Manufactured home and land financing offers the most traditional mortgage-like experience

- Manufactured home mortgage programs have specific requirements but often competitive rates

- Mobile home loan financing includes options for various credit situations and home types

A calculator gives you a solid estimate, but speaking with a financing specialist will help you understand all the nuances of your specific situation. The numbers don’t lie, but they also don’t tell the whole story of what might be possible for your unique circumstances!

Using a Mobile Home Financing Calculator: Step-by-Step

Let’s break down how to use a mobile home financing calculator effectively to get the most accurate estimate of your monthly payments. This step-by-step guide will help you steer the process with confidence.

What You Need Before Opening the Calculator

Before diving into numbers and calculations, take a moment to gather some essential information. Think of this as your financial homework – a little preparation now saves a lot of headaches later!

Your gross monthly income and debts need to be clear in your mind. Lenders typically want your total monthly debts (including your future home payment) to stay under 41-45% of your monthly income. If math isn’t your strong suit, don’t worry – it’s simpler than it sounds. If you earn $5,000 monthly, your total debts shouldn’t exceed about $2,250.

Know your credit score too – it’s like your financial report card. For manufactured homes, you’ll need at least 580 for FHA loans and 620 for conventional financing. The better your score, the sweeter your interest rate will be.

Have a firm grasp on your down payment amount. Can you put down 3.5% (the FHA minimum), 5% (conventional minimum), or the golden 20% that eliminates PMI? Every dollar you put down now saves you interest later.

Research home prices in your target area. Here in San Antonio and surrounding communities like Von Ormy, New Braunfels, and Laredo, we offer homes across various price points – knowing your budget helps narrow down your options.

Don’t forget about land costs or lease fees. Are you buying land with your home or placing it in a community? These costs significantly impact your monthly budget.

Finally, get an insurance quote from an agent familiar with manufactured homes in Texas. These rates often differ from traditional home insurance, and you’ll need this figure for an accurate calculation.

For more details about getting pre-approved, our Pre-Approval Process page walks you through each step with clarity.

Plugging Data Into the Mobile Home Financing Calculator

Now comes the fun part – seeing how all these numbers work together to create your monthly payment. Let’s walk through each input field:

Start with your total Home Value/Purchase Price. If you’re buying land too and financing it together, include that cost here. Be honest with yourself – this isn’t the time for wishful thinking!

Next, enter your Down Payment – either as a percentage or dollar amount. Putting down less than 20% typically means paying PMI, an extra monthly cost that protects the lender, not you.

The Interest Rate field often causes anxiety, but don’t let it. For manufactured homes, expect rates about 0.5-1% higher than traditional home loans. If you’re just exploring options, try 6.5-7.5% as a starting point. You can always refine this number after talking with a lender.

Select your preferred Loan Term – typically 15, 20, or 30 years. Quick tip: 30-year terms are only available for land-and-home packages, not chattel loans (which finance just the home).

Don’t skip the Property Taxes field. In Texas, manufactured home property taxes typically run about 1.5-2% of the home’s value annually. Enter this as either a percentage or annual dollar amount.

Your annual Insurance premium comes next. For manufactured homes in Texas, expect somewhere between $600-$1,200 annually, depending on your coverage and location.

If your down payment is less than 20%, the calculator should automatically include PMI/MIP. For FHA loans, there’s an upfront MIP of 1.75% plus annual premiums.

Finally, if applicable, enter monthly HOA/Space Rent for community living.

Here’s a quick comparison of typical settings for different loan types:

| Loan Type | Minimum Down Payment | Minimum Credit Score | Loan Term Options | Special Features |

|---|---|---|---|---|

| FHA | 3.5% | 580 | 15, 20, 30 years | MIP required |

| VA | 0% | 620 | 15, 20, 30 years | Funding fee instead of PMI |

| USDA | 0% | 640 | 30 years | Rural areas only |

| Conventional | 5% | 620 | 15, 20, 30 years | PMI until 80% LTV |

Comparing Loan Scenarios in a Mobile Home Financing Calculator

This is where a mobile home financing calculator truly shines – letting you play “what if” with different scenarios without affecting your credit score or making any commitments.

Try comparing a 15-year versus 30-year term. Yes, the 15-year payment will be higher, but the interest savings are eye-opening. On a $100,000 loan at 6.5%, you’d save approximately $75,000 in interest with the shorter term. That’s not pocket change!

Experiment with different down payment amounts. Watching your monthly payment drop as your down payment increases can be motivating. See what happens when you move from 3.5% to 10% or even 20%. The elimination of PMI at 20% down creates a noticeable monthly savings.

Many calculators allow you to add extra principal payments to your scenario. Even an extra $100 monthly can shave years off your loan and save thousands in interest. It’s like giving your future self a significant pay raise!

If you already own a manufactured home, toggle between purchase and refinance scenarios. Compare your current terms with potential refinance options – sometimes a small change in interest rate can yield substantial monthly savings.

When you find a scenario that fits your budget like a glove, save or print the amortization schedule for reference. This detailed payment breakdown shows exactly how each payment chips away at your principal balance over time.

While these calculators provide valuable estimates, current Manufactured Home Mortgage Rates will affect your actual payment. Always follow up with a financing specialist for personalized guidance based on your unique situation.

These calculators are tools to help you visualize possibilities – not set-in-stone commitments. The goal is to find a comfortable payment that lets you enjoy your new home without financial stress. After all, a home should bring joy, not anxiety about making the next payment!

Key Factors That Shape Your Manufactured Home Payment

Several critical factors influence your monthly payment when financing a manufactured home. Understanding these elements will help you use a mobile home financing calculator more effectively and prepare for the true cost of ownership.

Loan Programs for Manufactured & Mobile Homes

Your choice of loan program dramatically impacts both your monthly payment and long-term costs. Each option comes with unique advantages depending on your situation.

FHA loans remain a popular choice for many of our customers, requiring just 3.5% down and accepting credit scores as low as 580. These government-backed loans do require your home to sit on a permanent foundation, and you’ll pay both an upfront mortgage insurance premium (1.75%) and annual MIP. The good news? You can finance for up to 30 years if you’re buying both home and land.

For veterans and active service members, VA loans offer an incredible opportunity with zero down payment requirements and no monthly mortgage insurance. You’ll pay a one-time funding fee instead, which can typically be rolled into the loan. These loans require the home to be your primary residence and placed on a permanent foundation.

If you’re looking at rural areas around San Antonio, USDA loans might be your ticket to homeownership with zero down payment. These loans are specifically for rural properties, require the home to be new and permanently installed, and do have income limitations to ensure the program serves moderate-income families.

Conventional loans through private lenders typically require 5-10% down and credit scores starting around 620. You’ll pay PMI until you reach 20% equity, but these loans often offer competitive rates for well-qualified buyers.

For those buying just the home without land, chattel loans provide an alternative, though they come with higher interest rates (often 2-5% above traditional mortgages) and shorter terms, usually 15-20 years. The upside? Less strict requirements regarding foundation and land ownership.

We work with various lenders to find the perfect fit for your specific situation. For deeper insights, visit our What You Need to Know (Financing) page.

How Credit Score & Down Payment Impact Results

Your credit score and down payment amount aren’t just numbers—they’re powerful tools that can save you thousands over the life of your loan.

A strong credit score opens doors to better interest rates. Scores below 620 might limit you to FHA or specialized manufactured home loans, while each 20-point drop can increase your rate by 0.25-0.5%. The difference between a 580 and 720 score on a $100,000 home could mean paying $100 more each month and over $30,000 more in interest over a 30-year term.

Your down payment similarly shapes your financing landscape. Putting down less than 20% typically means paying PMI—adding roughly $30-$70 monthly per $100,000 borrowed. Every additional 5% you can put down reduces your monthly payment by approximately $25-$40 per $100,000 borrowed, plus you’ll pay less interest over time.

I’ve seen many customers surprised by how much they can improve their terms with just a few months of focused credit improvement or by finding ways to increase their down payment. If credit challenges are holding you back, don’t worry—we’ve helped many families with similar situations. Check out our Financing for Mobile Homes with Bad Credit resource for specific strategies.

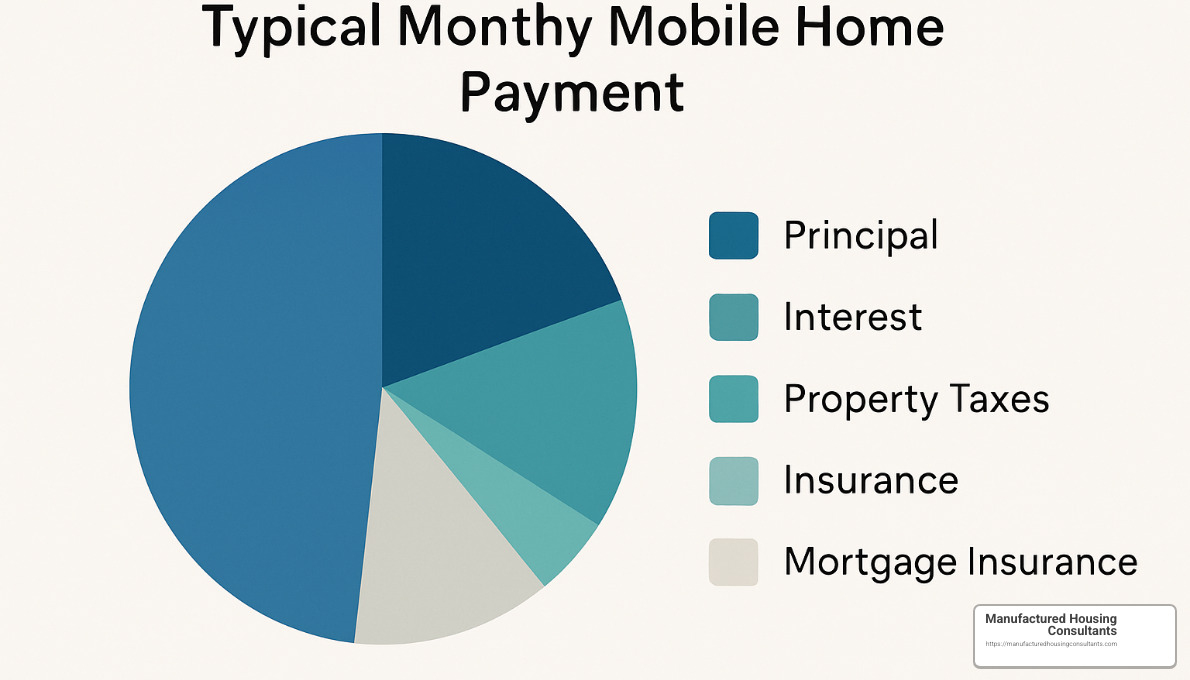

Taxes, Insurance, and Land-Related Costs

When budgeting for your manufactured home, your mortgage payment is just one piece of the puzzle. The full monthly cost includes several other important components.

Property taxes in Texas typically range from 1.5% to 2.5% of your home’s assessed value annually. For a $100,000 home, that means setting aside about $125-$200 monthly. And yes, rates vary quite a bit—San Antonio, Von Ormy, and New Braunfels each have their own tax rates, which we’re happy to clarify for your specific location.

Homeowner’s insurance for manufactured homes is structured differently than for traditional homes, generally costing between $600-$1,200 annually ($50-$100 monthly). Texas weather considerations, particularly our susceptibility to high winds and storms, can influence these rates.

If you’re placing your home in a community, land lease fees typically run $400-$700 monthly in the San Antonio area. These fees vary based on amenities, location, and community features. Some communities also charge additional HOA dues for maintaining common areas and amenities.

For homes in designated flood zones, flood insurance adds another $30-$100 monthly depending on your risk level. This isn’t optional if your lender requires it, so it’s important to factor into your calculations.

According to the National Association of Home Builders, these additional costs often add 30-50% to your base mortgage payment. That’s why it’s crucial to include them in your mobile home financing calculator inputs for an accurate monthly budget.

Closing Costs, Fees, and Calculator Limitations

While online calculators give you a helpful starting point, they don’t tell the whole story. Here’s what else to keep in mind as you plan your financing.

Closing costs typically run 2-5% of your loan amount and include origination fees (0.5-1%), appraisal fees ($300-$500), title services ($500-$1,000), recording fees ($20-$100), and home inspections ($300-$500). These costs can sometimes be rolled into your loan, but they’ll increase your monthly payment.

For new manufactured homes, don’t forget to budget for setup and installation. This includes foundation construction ($4,000-$10,000), utility connections ($1,000-$3,000), and delivery and setup fees ($3,000-$5,000). These costs vary based on your land, location, and the specific home you choose.

Even the best mobile home financing calculator has limitations. Most provide estimates only and may not account for all fees specific to manufactured homes. Interest rates change daily, credit score impacts vary, and local tax variations might not be captured accurately.

I’ve seen many customers get excited about calculator results only to find the actual figures slightly different. That’s why I always recommend getting a personalized quote once you’ve narrowed down your options. We can provide actual figures based on your specific situation, current rates, and the exact home you’re interested in purchasing—whether it’s in San Antonio, Corpus Christi, Victoria, or anywhere else in Texas.

A good estimate helps you plan, but a personalized quote gives you confidence to move forward. And that’s exactly what we’re here to provide.

Conclusion & Next Steps

Using a mobile home financing calculator gives you a clear picture of what you can afford when shopping for your manufactured home. But remember, it’s just the starting point on your path to homeownership – not the final destination.

At Manufactured Housing Consultants, we’ve helped countless Texas families steer from those initial calculator estimates to the exciting moment of getting their keys. Whether you’re looking in San Antonio, Laredo, Victoria, or Corpus Christi, we’re here to transform those numbers into your new reality.

So what happens after you’ve played with the calculator and found a monthly payment that works for your budget? Let’s talk about your next moves:

First, get pre-qualified with us. Unlike those online estimates, a proper pre-qualification letter shows sellers you’re serious and financially ready to make a purchase. It’s like upgrading from window shopping to having cash in hand – and it strengthens your position when you find that perfect home.

Next, don’t settle for the first financing option you see. We partner with multiple lenders who specialize in manufactured homes, which means we can help you review several quotes side by side. Sometimes the difference between lenders can save you thousands over the life of your loan!

If your calculator results weren’t quite what you hoped for, don’t worry. We can suggest practical ways to improve your application – whether that means quick strategies to boost your credit score or creative approaches to increase your down payment. Even small improvements can make a big difference in your terms.

When market conditions are favorable, it’s smart to lock in your rate. Interest rates change daily, and securing a good rate can protect you from market fluctuations that might increase your payment before closing.

The most exciting next step? Schedule a consultation at one of our locations in Von Ormy, New Braunfels, Laredo, Corpus Christi, San Antonio, or Victoria. Nothing beats seeing homes in person and sitting down with our team to discuss your specific situation face-to-face.

While online calculators provide helpful estimates, your actual payment may differ based on the specific home model, current interest rates, and your unique financial profile. That’s why having experts in your corner makes all the difference – we’ll guide you from those initial calculations all the way through to closing day.

Even if you’ve faced credit challenges in the past, don’t count yourself out. Our secure purchase programs have helped many families overcome financial obstacles and achieve homeownership when they thought it wasn’t possible.

Ready to move beyond numbers on a screen and start making your manufactured home dreams a reality? Contact us today at Manufactured Housing Consultants. We’ll help you find and finance the perfect mobile home that fits both your family’s needs and your budget. After all, calculators can show you what’s possible – but we’re here to make it happen.