Mobile home loan financing can open the door to affordable homeownership, offering flexible solutions for those on a budget. Whether you’re looking to purchase a new or used mobile home, understanding the basics of financing is crucial. Here’s a quick dive into what you need to know:

In the diverse landscape of Texas, from San Antonio to Corpus Christi, understanding your financing options can help you secure the home that suits your lifestyle and budget. As the demand for affordable housing grows, exploring the benefits of mobile home loans can be a viable step toward owning a comfortable, customizable home.

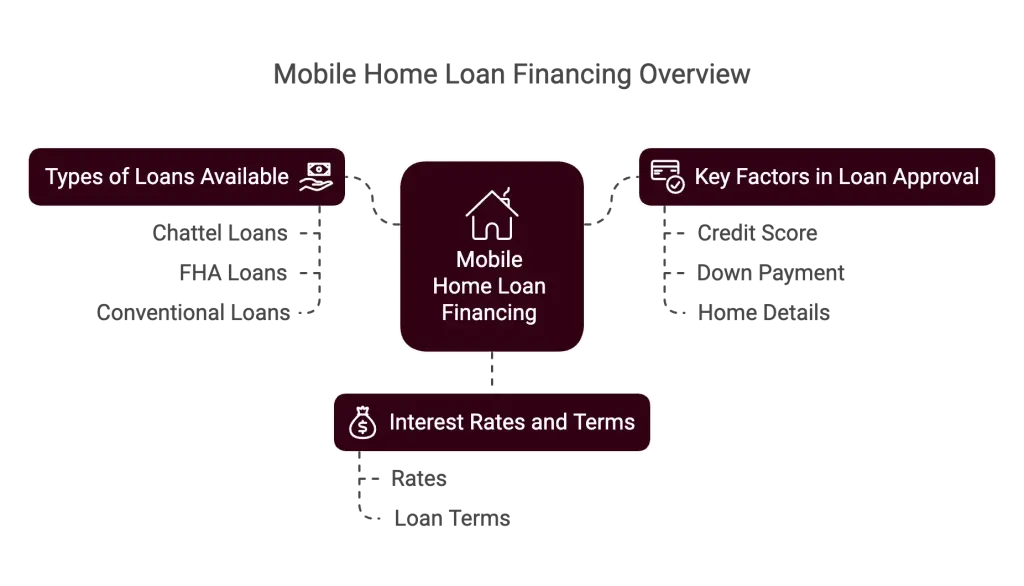

Understanding Mobile Home Loan Financing

Mobile home loan financing can be a gateway to affordable homeownership, especially for those seeking flexibility and cost-efficiency. Let’s break down the types of loans available, eligibility criteria, and credit score requirements.

Types of Mobile Home Loans

- Chattel Loans: These are personal property loans designed for mobile homes not tied to land. They often have shorter terms and higher interest rates, starting at around 8%. Chattel loans are a good fit if you’re placing your home on leased land.

- FHA Loans: Backed by the government, FHA loans are accessible for those with lower credit scores, starting from 500. They offer up to 30-year terms with interest rates averaging 6.45%. These loans can finance both the home and the land, making them a versatile option.

- Conventional Loans: These traditional loans require higher credit scores, typically above 620, and come with more stringent requirements. They offer competitive rates but may not be as flexible as FHA or chattel loans.

Loan Eligibility Criteria

To qualify for mobile home loan financing, you’ll need to meet certain eligibility requirements:

- Credit Score: A credit score of at least 700 is often necessary to secure favorable terms. However, some options are available for scores as low as 500, particularly FHA loans.

- Down Payment: Most loans require a down payment. For example, FHA loans need at least 3.5% of the home’s purchase price if your credit score is 580 or higher.

- Property Standards: The home must meet specific standards, such as being constructed after June 15, 1976, and being placed on a permanent foundation if financed as real estate.

Credit Score Requirements

Your credit score plays a pivotal role in mobile home loan financing:

- FHA Loans: Accept scores as low as 500, but better rates are available for scores above 580.

- Chattel Loans: Require a minimum score of 575, though higher scores can lead to lower interest rates.

- Conventional Loans: Typically require a score of at least 620, with the best rates reserved for scores of 750 and above.

Understanding these elements can help you steer the financing process effectively. By knowing your options and requirements, you can make informed decisions and move closer to securing your ideal mobile home.

Next, we’ll explore the different types of mobile home loans in depth, helping you choose the best option for your needs.

Types of Mobile Home Loans

When it comes to mobile home loan financing, there are three main types of loans you can consider: chattel loans, FHA loans, and conventional loans. Each has its own set of features, benefits, and requirements, so it’s important to understand how they differ.

Chattel Loans

Chattel loans are specifically designed for mobile homes that are not attached to land. This makes them ideal if you’re planning to place your home on leased land, such as in a mobile home park.

- Interest Rates and Terms: Chattel loans often come with higher interest rates, starting at around 8%, and shorter terms, typically up to 20 years.

- Ownership: With a chattel mortgage, the lender holds an ownership interest in the home until the loan is paid off. If you default, the lender can repossess the home.

- Flexibility: These loans are more flexible in terms of eligibility, making them accessible even if your credit score is not perfect.

FHA Loans

FHA loans are government-backed loans that offer a more accessible path for those with lower credit scores. They can be used to finance both the mobile home and the land it sits on.

- Credit Score Requirements: FHA loans are available for borrowers with credit scores starting as low as 500. However, a score of 580 or above is needed to qualify for the minimum down payment of 3.5%.

- Interest Rates and Terms: These loans offer competitive interest rates, averaging around 6.45%, and terms of up to 30 years.

- Versatility: FHA loans provide the flexibility to finance a home on a permanent foundation, making them suitable for those looking to purchase both the home and the land.

Conventional Loans

Conventional loans are traditional mortgage loans that typically require higher credit scores and more stringent approval criteria.

- Credit Score Requirements: These loans generally require a minimum credit score of 620, though better rates are available for scores of 750 and above.

- Interest Rates and Terms: Conventional loans offer competitive interest rates and terms that can extend up to 30 years, similar to site-built home mortgages.

- Property Requirements: The mobile home must meet specific standards and often needs to be classified as real property, meaning it’s permanently attached to land.

By understanding the different types of mobile home loan financing, you can choose the option that best fits your financial situation and homeownership goals. Each loan type offers unique benefits, so consider your needs carefully before making a decision.

Next, we’ll dig into the key requirements for mobile home loan approval, ensuring you’re well-prepared for the application process.

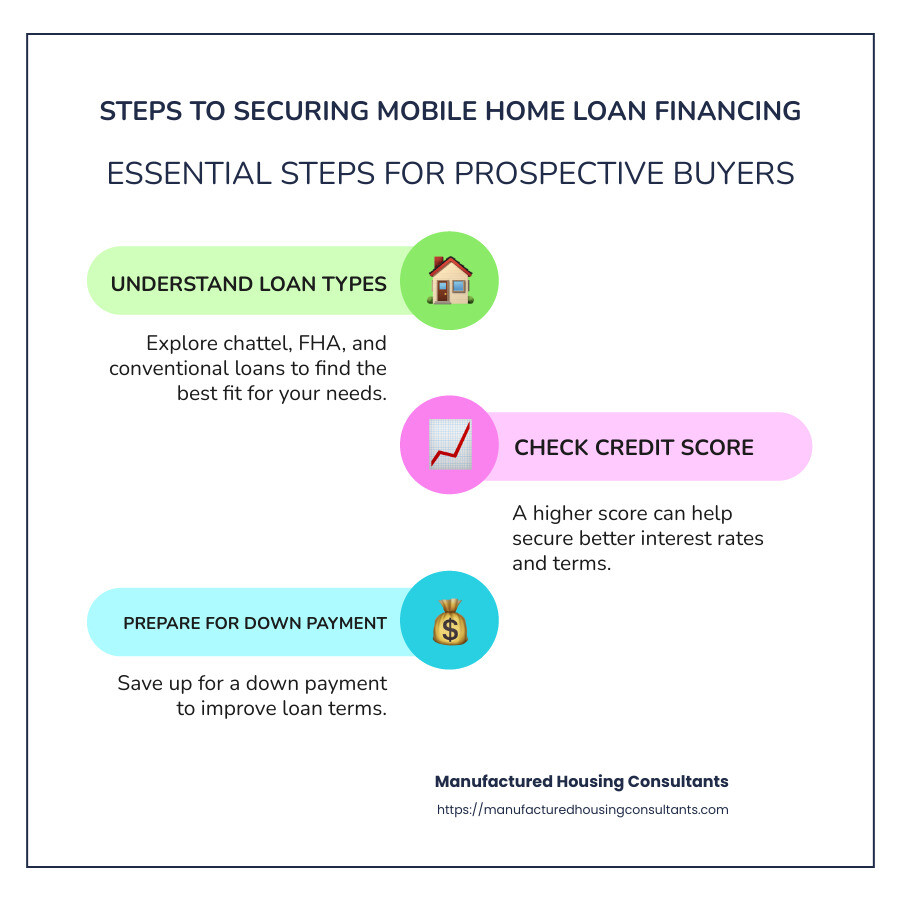

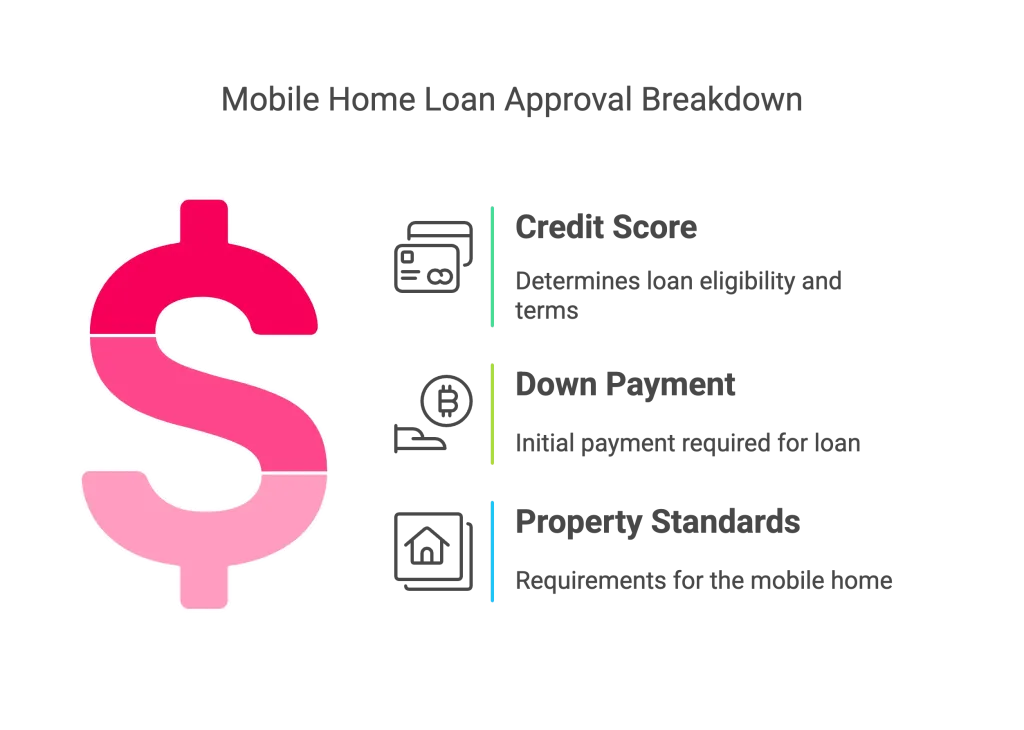

Key Requirements for Mobile Home Loan Approval

When you’re ready to dive into mobile home loan financing, understanding the key requirements is crucial. Here’s what you need to know about credit scores, down payments, and property standards:

Credit Score

Your credit score plays a significant role in determining your eligibility for a mobile home loan. Here’s a quick breakdown:

- FHA Loans: You can qualify with a credit score as low as 500, but you’ll need a 10% down payment. With a score of 580 or higher, the down payment drops to 3.5%.

- Conventional Loans: Typically, you’ll need a credit score of at least 620. Higher scores can help you secure better interest rates.

- Chattel Loans: These loans are more flexible, with some lenders accepting scores as low as 575.

Down Payment

The down payment is another critical factor. It varies depending on the loan type and your credit score:

- FHA Loans: As mentioned, a 3.5% down payment is possible with a credit score of 580 or above. Lower scores require a 10% down payment.

- Conventional Loans: Expect to put down at least 5% of the home’s purchase price, though larger down payments can lower your monthly payments.

- Chattel Loans: Down payments usually range from 5% to 20%, depending on the lender and your creditworthiness.

Property Standards

Your mobile home must meet specific property standards to qualify for financing:

- FHA Loans: The home must comply with HUD’s Model Manufactured Home Installation Standards and be on a permanent foundation. It also needs to meet local installation and construction requirements.

- Conventional Loans: The home often must be classified as real property, which means it’s permanently attached to land.

- Chattel Loans: Since these loans are for homes not tied to land, the property standards focus more on the home’s condition and age.

Understanding these requirements will help you prepare for the mobile home loan application process. With the right credit score, down payment, and property standards in place, you’ll be well on your way to securing the financing you need.

Next, we’ll explore interest rates and terms for mobile home loans, giving you a clearer picture of what to expect in terms of costs and repayment options.

Interest Rates and Terms for Mobile Home Loans

When it comes to mobile home loan financing, understanding interest rates and loan terms can make a big difference in your overall costs. Here’s what you need to know:

Interest Rates

Interest rates for mobile home loans can vary widely. Several factors influence the rate you might receive, including your credit score, the type of loan, and whether you’re purchasing land along with the home.

- FHA Loans: As of August 2024, the average interest rate is around 6.45%. To qualify for the best rates, aim for a credit score of at least 700.

- Chattel Loans: These loans typically start at 8% because they are secured by the home alone, not the land. This makes them riskier for lenders.

- Personal Loans: These can have higher rates, averaging 12.38%, because they are unsecured.

Shopping around can save you money. Interest rates can differ between lenders, so take your time to compare offers.

Loan Terms

The term of your loan affects both your monthly payments and the total interest you pay over time. Here’s a quick look at typical loan terms for different types of mobile home loans:

- FHA Loans: Terms can extend up to 30 years, similar to traditional mortgages.

- Chattel Loans: Usually have shorter terms, up to 20 years. This can lead to higher monthly payments but less interest paid over the life of the loan.

- Personal Loans: These loans often have the shortest terms, up to 84 months (or 7 years).

APR (Annual Percentage Rate)

The APR gives you a more complete picture of your loan’s cost by including both the interest rate and any additional fees. A lower APR means you’ll pay less over the life of the loan.

- FHA Loans: Offer competitive APRs due to government backing, but remember to factor in mortgage insurance costs.

- Chattel Loans: APRs can be higher due to the increased risk for lenders, as these loans are not tied to land.

- Personal Loans: Often carry the highest APRs due to their unsecured nature.

Understanding these factors will help you make informed decisions when choosing a loan for your mobile home. Next, we’ll address some frequently asked questions to clear up any lingering doubts about mobile home loan financing.

Frequently Asked Questions about Mobile Home Loan Financing

Let’s explore some common questions people have about mobile home loan financing. We’ll cover the challenges, credit score needs, and typical interest rates for these loans.

Is it harder to get a mortgage for a mobile home?

Yes, it can be more challenging to secure a mortgage for a mobile home compared to a traditional home. One main reason is depreciation. Mobile homes often lose value over time, unlike site-built homes that typically appreciate. This makes lenders cautious.

Lender concerns also include the mobility of these homes. If the home is not permanently attached to land, it’s riskier for lenders. This is why securing the land along with the mobile home can improve your chances of getting a mortgage.

What credit score do you need for a mobile home loan?

The credit score needed varies by loan type:

- FHA Loans: You can qualify with a score as low as 500, but you’ll need a 10% down payment. A score of 580 or higher lowers the down payment requirement to 3.5%.

- Conventional Loans: Generally require a higher score of at least 620.

- Chattel Loans: These can start with scores as low as 575, but higher scores will help you secure better rates.

Your credit score impacts not only your eligibility but also the interest rates and down payment amounts. A higher score can reduce your costs significantly.

What is the average rate for a mobile home loan?

Interest rates for mobile home loans vary based on the type of loan and your creditworthiness:

- FHA Loans: Currently average around 6.45%. They offer competitive rates due to federal backing, but remember, mortgage insurance is required.

- Chattel Loans: Start at 8% and can go higher, reflecting the increased risk for lenders.

- Personal Loans: These have the highest rates, averaging 12.38%, due to being unsecured.

Loan terms also play a role. FHA loans can extend up to 30 years, while chattel loans usually cap at 20 years. Personal loans are even shorter, up to 7 years, which can mean higher monthly payments.

Understanding these elements helps you steer mobile home loan financing. Now, let’s explore more about how Manufactured Housing Consultants can assist you in finding affordable housing and financing solutions.

Conclusion

At Manufactured Housing Consultants, we believe that everyone deserves a chance at homeownership, even when traditional site-built homes are out of reach. That’s why we specialize in offering affordable housing through mobile and manufactured homes. Our commitment is to provide you with the best financing solutions custom to your needs.

Affordable Housing: Mobile homes offer a budget-friendly alternative to traditional homes. With the median price of a manufactured home being significantly lower than that of site-built homes, you’re looking at a viable path to owning a home without stretching your budget. This affordability allows more families to achieve the dream of homeownership in vibrant communities.

Financing Solutions: We understand that securing financing for a mobile home can be daunting. That’s where we step in. We offer a variety of mobile home loan financing options that cater to different credit situations, including FHA, conventional, and chattel loans. Our goal is to make the process as smooth and accessible as possible, ensuring you have the support you need every step of the way.

With locations across Texas, including San Antonio, Von Ormy, and Corpus Christi, we’re ready to help you find the perfect home at the best price. Whether you’re a first-time buyer or looking to upgrade, our team is dedicated to making your home-buying journey seamless and stress-free.

Explore our financing programs to see how we can assist you in securing your new home. Your path to affordable homeownership starts here.