Finding Affordable Housing Solutions for Your Golden Years

Mobile homes for seniors offer an affordable, accessible housing option that combines independence with community living. For those considering this option, here’s a quick overview:

What You Need to Know About Mobile Homes for Seniors:

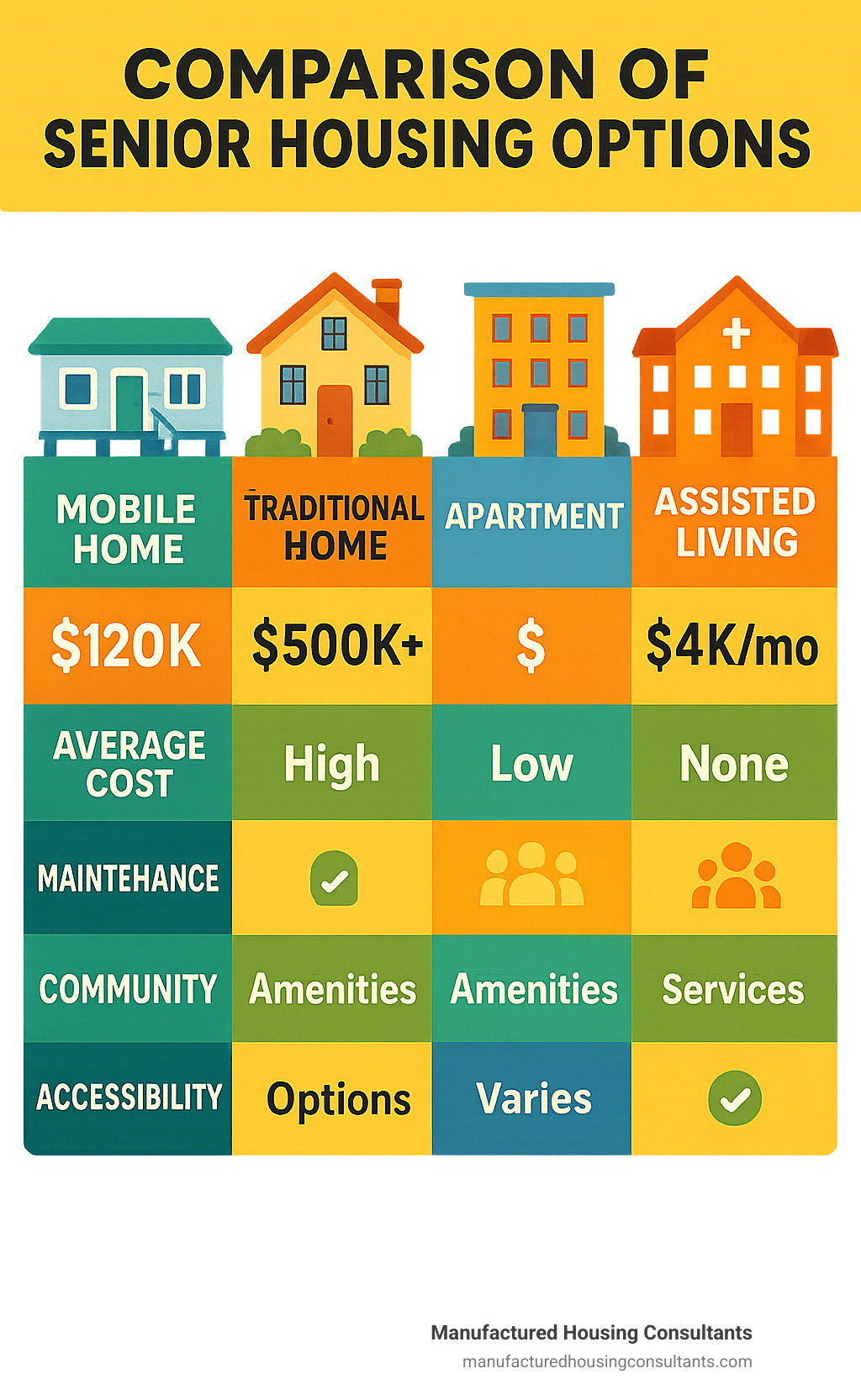

- Average Cost: New manufactured homes average under $120,000 (vs. $500,000+ for traditional homes)

- Monthly Expenses: Average mobile home park rent is $633/month (as of 2022)

- Community Benefits: Age-restricted (55+) communities with amenities like pools, clubhouses, and organized activities

- Accessibility: Can be customized with ramps, grab bars, wider doorways, and other senior-friendly features

- Ownership Options: Can own the home while renting the lot, or in some cases, purchase both

As we enter our golden years, housing needs often change dramatically. The family home that once bustled with children may now feel too large, too maintenance-heavy, and too expensive. Many seniors find themselves asking: “How can I maintain my independence while downsizing to something more manageable?”

Nearly 20 million Americans have found their answer in manufactured and mobile homes, with up to 6.7% of adults aged 65+ choosing this housing option. The appeal is clear: significant cost savings, single-level living, built-in communities, and the ability to customize for changing physical needs.

These homes offer a practical solution for retirees on fixed incomes, with the average new manufactured home selling for less than $120,000 – a fraction of the $500,000+ price tag for traditional site-built houses. This dramatic difference allows many seniors to sell their existing homes and purchase a manufactured unit outright, eliminating or significantly reducing mortgage payments.

Beyond affordability, senior mobile home communities address another critical need: social connection. These age-restricted neighborhoods typically feature clubhouses, swimming pools, fitness centers, and organized activities that combat isolation while respecting privacy.

“We purchased a beautiful home at an affordable price in an awesome 55+ community. The team made it easy to find our dream home near family,” shares one resident who made the transition.

Whether you’re looking to downsize, reduce expenses, or find a supportive community, mobile homes deserve serious consideration as you plan your retirement housing strategy.

Basic mobile homes for seniors glossary:

Why Mobile Homes for Seniors Are Shaping Modern Retirement

Retirement housing is changing rapidly, and mobile homes for seniors are leading this change. With nearly 20 million Americans already enjoying manufactured or mobile homes, this housing option has become a go-to choice for the 65+ crowd – and for good reason.

Affordability tops the list of advantages. As retirement savings face the double challenge of inflation and longer lifespans, housing remains one of the biggest expenses for seniors. Manufactured homes offer a breath of financial fresh air, with new units averaging under $120,000 – often allowing retirees to purchase their new home outright after selling their previous property.

Peace of mind comes standard with any home built after June 15, 1976, as these must comply with the HUD Code. This nationwide standard ensures modern manufactured homes are safe, well-built, and designed to stand the test of time – something every senior deserves in their retirement years.

The land-lease approach common in many communities further lightens the financial load. Seniors can own their home while simply renting the land beneath it, eliminating property taxes and reducing maintenance headaches. Monthly lot rents averaged $633 in 2022, though premium communities with resort-style amenities might charge up to $1,000.

It’s worth noting that research published in the Disability and Health Journal found some concerning health patterns among mobile home residents aged 65+. These seniors reported fair or poor health at higher rates (34.6%) compared to seniors in other housing types (28.8%), along with higher rates of conditions like lung disease and heart disease. However, these statistics likely reflect broader socioeconomic factors rather than the housing itself, especially considering that most senior mobile home dwellers (80.1%) own their residence – suggesting financial stability.

Despite these health correlations, the accessibility, affordability, and community aspects of manufactured housing continue making it an attractive and practical option for many seniors planning their golden years.

Understanding Mobile, Manufactured, and Modular Homes

The terms “mobile home,” “manufactured home,” and “modular home” often get tossed around interchangeably, but they’re actually distinct housing types with important differences that seniors should understand before making any decisions.

Mobile Homes are technically the older cousins in this housing family – specifically factory-built homes constructed before June 15, 1976. These homes were built to voluntary industry standards and might not meet current safety codes. True mobile homes are becoming increasingly rare finds on today’s market.

Manufactured Homes represent the modern evolution – factory-built homes constructed after June 15, 1976, when the HUD Code took effect. These homes are built on a permanent chassis with wheels that can be removed once the home is placed. They’re constructed in sections in a controlled factory environment and then transported to their final location. Look for the red HUD certification label on the exterior of each section – it’s your assurance of quality and compliance.

Modular Homes take a slightly different approach. While also factory-built, they’re constructed to the same state, local, or regional building codes as site-built homes. Unlike manufactured homes, modular homes don’t have a permanent chassis and typically rest on a permanent foundation. They’re generally considered real property and may appreciate in value similar to traditional homes.

Here’s a quick comparison of these housing types:

| Feature | Mobile Home | Manufactured Home | Modular Home |

|---|---|---|---|

| Construction Date | Before June 15, 1976 | After June 15, 1976 | Any time |

| Building Code | Pre-HUD voluntary standards | Federal HUD Code | Local building codes |

| Foundation | Temporary/semi-permanent | Permanent chassis with removable wheels | Permanent foundation |

| Transportation | Built to be moved | Built to be moved once or rarely | Sections moved to site once |

| Property Classification | Personal property (typically) | Personal property (can be converted) | Real property |

| Financing | Chattel loans (typically) | Chattel loans or conventional mortgages | Conventional mortgages |

| Value Over Time | Depreciation | Possible appreciation with land | Appreciation similar to site-built |

Understanding these distinctions matters tremendously when planning your retirement housing. For most of today’s seniors, newly built manufactured homes or modular homes offer the best balance of quality, safety, and value.

At Manufactured Housing Consultants, we focus primarily on modern manufactured homes that meet or exceed all current HUD standards, ensuring our senior clients enjoy safe, energy-efficient, and comfortable housing they can truly call home.

Key Benefits of Mobile Homes for Seniors

Mobile homes for seniors offer remarkable advantages that make them particularly well-suited for retirement living. Here’s what our senior clients consistently tell us they value most:

Significant Cost Savings make a world of difference for retirees on fixed incomes. With new manufactured homes averaging under $120,000 compared to traditional homes exceeding $500,000, seniors can dramatically reduce or completely eliminate housing debt. Used mobile homes can be even more budget-friendly, ranging from $10,000 to $50,000 depending on age, condition, and location.

The savings extend far beyond the purchase price. Property taxes typically run lower, and in land-lease communities, seniors may avoid property taxes entirely. Utility costs shrink thanks to smaller square footage and modern energy-efficient construction. This financial breathing room allows many seniors to enjoy retirement rather than worry about making ends meet.

Low-Maintenance Living becomes increasingly important as we age. Home maintenance tasks that once seemed simple can become challenging, expensive, and even dangerous. Manufactured homes solve this problem beautifully with smaller square footage that means less to clean and maintain. Modern units feature durable, low-maintenance materials like vinyl siding and metal roofing that stand up to the elements without constant attention. Many communities include lawn care and exterior maintenance in the monthly lot rent, and single-level living eliminates dangerous stairs while reducing cleaning challenges.

Built-In Social Connections address one of retirement’s hidden challenges: loneliness. Age-restricted (55+) manufactured home communities create environments where residents can easily form meaningful connections:

Clubhouses and community centers host regular events from book clubs to dance nights. Shared amenities like pools, fitness centers, and game rooms naturally encourage interaction. Your neighbors are typically in similar life stages with shared interests, making it easier to find common ground. Many communities organize clubs, classes, and outings that make socializing effortless.

Downsizing Becomes Easier when transitioning to a manufactured home. Moving from a larger family home to a more manageable space can feel overwhelming, but manufactured homes simplify this process with clear space limitations that help prioritize which possessions to keep. Modern floor plans maximize storage efficiency despite the smaller footprint. Many communities offer furnished models or design services to help you envision your new space, and open layouts create a spacious feel despite smaller square footage.

Research from the National Housing Conference confirms what many seniors already know intuitively: appropriate housing is a critical factor in successful aging, with direct impacts on physical health, emotional wellbeing, and financial security. For many seniors, manufactured housing provides that perfect balance of independence, community, and affordability.

Potential Drawbacks and How to Mitigate Them

While mobile homes for seniors offer tremendous benefits, it’s important to consider potential challenges and how to address them effectively. Being prepared means you can enjoy all the advantages while minimizing any downsides.

Weather Vulnerability is perhaps the most discussed concern. Modern manufactured homes are built to withstand specific wind zones, but they can still be more vulnerable to severe weather than traditional construction. Smart seniors mitigate this risk by choosing newer models built to improved wind resistance standards and considering locations less prone to hurricanes, tornadoes, or flooding. Investing in proper anchoring and foundation systems makes a significant difference, as does obtaining comprehensive insurance coverage specifically designed for manufactured homes.

Depreciation Concerns matter to anyone viewing their home as an investment. Unlike traditional real estate, manufactured homes may depreciate over time, particularly when placed on leased land. You can minimize depreciation by purchasing the land beneath your home when possible or choosing communities with a history of stable or increasing home values. Maintaining your home carefully and making strategic upgrades helps maintain value, as does considering modular homes, which typically appreciate more like traditional homes.

Financing Limitations can surprise first-time manufactured home buyers. These homes, especially those on leased land, often don’t qualify for conventional mortgages. Fortunately, alternatives exist, including chattel loans (personal property loans) specifically designed for manufactured homes and FHA Title I and Title II loans, which offer more favorable terms. Many seniors simply make cash purchases using proceeds from selling a previous home, while others explore seller financing, particularly for pre-owned units.

Health Considerations deserve attention, as research has identified higher rates of certain health issues among seniors in manufactured housing. These include higher rates of chronic conditions like lung disease (23.5% vs 14.8%) and heart disease (23.8% vs 18.3%) compared to seniors in other housing types. While correlation doesn’t imply causation, prudent seniors ensure proper ventilation and air quality in their manufactured home, choose newer models with healthier building materials, consider adding air purification systems, and schedule regular maintenance of HVAC systems.

Insurance Needs differ for manufactured homes. These homes require specialized policies that differ from traditional homeowners insurance. Smart seniors obtain quotes from multiple insurers who specialize in manufactured homes, consider comprehensive coverage that includes replacement cost, add specific riders for storm damage if in vulnerable areas, and look into tenant insurance if they own the home but not the land.

Modification Challenges can arise when accessibility needs change. Making accessibility modifications can sometimes be more complicated in manufactured homes due to their construction methods. Forward-thinking seniors choose models already designed with accessibility features, work with contractors experienced in manufactured home modifications, verify that desired modifications won’t void warranties, and consider newer models that are more easily adaptable.

With proper planning and awareness, most of these potential drawbacks can be effectively managed, allowing seniors to enjoy the many benefits of manufactured home living while minimizing risks.

Accessibility & Safety Features in Senior-Focused Units

When selecting mobile homes for seniors, accessibility and safety features should top your priority list. Today’s manufactured homes can include numerous features that support aging in place and accommodate changing physical needs over time.

Zero-Step Entry eliminates one of the most common barriers for seniors with mobility challenges. Many newer manufactured homes can be installed with a gentle slope or ramp instead of steps, making coming home a breeze rather than a challenge. This simple feature can make the difference between independent living and needing assistance.

Wide Doorways and Hallways provide freedom of movement that standard construction often lacks. Doorways at least 36 inches wide and hallways at least 42 inches wide easily accommodate wheelchairs and walkers. These wider passages also make moving furniture easier – something your back will thank you for when rearranging your living space.

Single-Level Floor Plans come standard with all manufactured homes, eliminating the dangers and difficulties of navigating stairs. This natural advantage of manufactured housing becomes increasingly valuable as we age, reducing fall risks and making the entire home accessible regardless of mobility changes.

Accessible Bathrooms transform daily routines from potential hazards to comfortable experiences. Look for units with thoughtful features like:

Roll-in showers eliminate dangerous tub edges that can cause falls. Strategically placed grab bars provide stability where you need it most. Higher toilet seats (17-19 inches) reduce strain when sitting and standing. Vanities with knee space allow for seated use when standing becomes difficult. Anti-scald faucets with lever handles prevent burns while being easier to operate with arthritic hands.

Kitchen Adaptations make cooking safer and more enjoyable as you age. Senior-friendly kitchens include variable height countertops to accommodate both standing and seated food preparation. Pull-out shelves and lazy Susans bring items to you rather than requiring uncomfortable reaching. Side-by-side refrigerators eliminate the need to bend for frozen items. Front controls on stoves prevent dangerous reaching over hot burners. Lever-style faucets work with a simple push rather than requiring a strong grip to twist.

Modern manufactured homes can also incorporate various Smart Technologies that improve safety and convenience. Smart thermostats maintain comfortable temperatures without constant adjustment. Motion-activated lighting illuminates your path automatically, preventing falls in dark hallways or bathrooms. Video doorbells let you see visitors before opening the door. Voice-activated systems control lights, temperature, and entertainment without requiring you to move. Medical alert systems integrated into the home’s design provide peace of mind for both seniors and their families.

The best senior-focused manufactured homes accept Universal Design Principles – creating spaces usable by people of all abilities without adaptation or specialized design. These thoughtful elements include lever door handles instead of knobs, which work with a simple push rather than requiring gripping and turning. Rocker light switches placed at accessible heights can be operated with an elbow if hands are full or painful. Non-slip flooring throughout prevents falls even when surfaces are wet. Good lighting with minimal glare reduces eye strain and improves visibility. Contrasting colors aid visual perception, making it easier to distinguish between surfaces. Easy-to-use windows and door locks provide security without requiring significant hand strength.

At Manufactured Housing Consultants, we understand that accessibility needs vary widely among seniors. Some need comprehensive accessibility features immediately, while others want homes that can be easily adapted as needs change. We work with manufacturers who specialize in accessible designs and can help customize a home to meet your specific requirements.

For seniors with more specialized needs, tiny homes and accessory dwelling units (sometimes called “granny pods”) offer another option. These smaller units can be placed on a family member’s property, providing independence with proximity to support. These compact homes can be fully equipped with accessibility features in a more manageable footprint, giving you the perfect balance of independence and connection.

Evaluating Senior Mobile Home Communities

Choosing the right community is just as important as selecting the right home. Senior mobile home communities vary widely in terms of amenities, rules, costs, and atmosphere. Here’s what to consider when evaluating potential communities:

Financial Considerations should be crystal clear before you commit. Monthly lot rents averaged $633 in 2022, but can range from $300 to over $1,000 depending on location and amenities. Ask what’s included in the rent and how often increases occur – some communities cap annual increases, providing budget predictability. Resident-Owned Parks operate as cooperatives where residents own shares in the park, typically offering more stable lot rents and greater resident control. Request a complete breakdown of all fees, including utilities, trash removal, taxes, and special assessments to avoid surprise costs. Some communities offer financing assistance or work with lenders who specialize in manufactured housing, which can be helpful for seniors with credit challenges.

The best senior communities offer Amenities and Services that promote active, engaged lifestyles. Look for a clubhouse with regular activities and events where you can meet neighbors and pursue interests. Swimming pools and fitness centers support physical health without requiring expensive gym memberships. Walking trails and green spaces encourage outdoor activity and connection with nature. Game rooms for billiards, cards, and other activities foster socializing. Community gardens allow you to grow fresh produce and flowers while connecting with neighbors. Convenient laundry facilities (if not in-unit) save trips to laundromats. RV and boat storage solves a common challenge for active seniors. Security features like gated entry and patrols provide peace of mind.

The Social Environment determines whether a community feels like home. Review the community’s activity calendar to ensure it offers events that match your interests, whether that’s book clubs, dance nights, or crafting circles. Visit at different times to meet current residents and gauge the community’s social atmosphere – are people friendly and welcoming? Understand how decisions are made within the community and what role residents play in governance. Some communities are very resident-driven, while others are more management-controlled.

Rules and Restrictions vary significantly between communities. Most senior communities require at least one resident to be 55+ and may have restrictions on younger visitors, including how long grandchildren can stay. If you have pets, verify size limits, breed restrictions, and any additional pet fees before falling in love with a community that might not welcome your furry family member. Many communities have rules about exterior maintenance, decorations, and modifications to maintain property values and community aesthetics. Understand guest policies, particularly if you plan to have family visit frequently or for extended periods.

Florida alone boasts more than 1,600 mobile home communities, many catering specifically to seniors. Other popular states include Arizona, Texas, California, and New Mexico, where warm climates allow for year-round outdoor activities.

When visiting potential communities, we recommend touring during different times of day and different days of the week to get a complete picture. Talk to current residents about their experiences – they’ll often share insights the management tour won’t mention. Review the community rules and regulations carefully before committing. Check the condition of common areas and amenities – are they well-maintained and actually used by residents? Investigate the management company’s reputation through online reviews and Better Business Bureau ratings. Consider proximity to healthcare, shopping, and services you’ll need regularly.

At Manufactured Housing Consultants, we maintain relationships with reputable communities throughout Texas and can help connect you with options that match your lifestyle preferences, budget, and needs. Our experience helps seniors find not just a house, but a true community where they can thrive.

Choosing & Customizing Your Ideal Mobile Home as a Senior

Finding that perfect manufactured home doesn’t have to feel overwhelming. As you start on this exciting journey toward more comfortable retirement living, let’s walk through the process together—just as we do with our senior clients every day.

1. Assess Your Current and Future Needs

Before you start browsing floor plans, take a moment to think about how you really live. Do you host family during holidays? Do you need a dedicated space for crafting or woodworking? Be honest about any mobility challenges you’re currently experiencing—and those you might face down the road.

“Many of our senior clients initially think they need the same number of bedrooms they’ve always had,” says our senior housing specialist. “But when they really consider their daily lives, they often realize a more efficient layout suits them better.”

Your budget considerations should include not just the purchase price, but also monthly expenses like utilities and lot rent. Writing down your must-haves versus nice-to-haves can bring remarkable clarity to your search.

2. Select the Right Type and Size

Manufactured homes come in various configurations to suit different lifestyles:

Single-wide homes (typically 14-18 feet wide) offer economical living with surprisingly efficient layouts. They’re perfect for individuals or couples who appreciate simplified living and lower maintenance.

Double-wide homes (28-32 feet wide) feel much more like traditional houses, with more generous living areas and separation between spaces. These homes give you room to breathe without excessive square footage to maintain.

Triple-wide or multi-section homes provide the most spacious floor plans but require larger lots. These can be ideal if you’re downsizing from a very large home and still need considerable space.

3. Choose a Reputable Builder

The quality difference between manufacturers can be substantial. At Manufactured Housing Consultants, we’ve carefully selected partnerships with respected builders like Clayton Homes, Fleetwood Homes, and Skyline Homes—companies with proven track records for quality construction and customer satisfaction.

Look for Energy Star certification, which indicates superior energy efficiency. This not only reduces your monthly bills but creates a more comfortable living environment with fewer temperature fluctuations.

4. Consider “Granny Pod” Options

Want to be close to family while maintaining your independence? Elder Cottage Housing Opportunity (ECHO) units—affectionately called “granny pods”—might be your perfect solution.

These compact, self-contained units can be placed on a family member’s property, typically ranging from 400-800 square feet with all the amenities of a full home. They’re specifically designed with senior accessibility in mind, and can be removed when no longer needed.

Research published in The Journals of Gerontology confirms what we’ve seen firsthand—these proximity arrangements benefit both seniors and their families by balancing security with autonomy. One of our clients recently shared, “Having my own space right in my daughter’s backyard gives me independence while knowing help is just steps away if I need it.”

5. Understand Warranty Coverage

Your new manufactured home typically comes with a 1-year comprehensive warranty covering manufacturing defects, plus longer structural warranties (usually 5-7 years). Appliances, HVAC systems, and other components often carry their own separate warranties.

Ask about transferable warranties—they can significantly improve your home’s resale value should you decide to move in the future. We always recommend keeping warranty documentation organized and accessible.

6. Prioritize Energy Efficiency

Energy-efficient features aren’t just good for your wallet—they create more comfortable living spaces. Modern mobile homes for seniors often include impressive efficiency features:

Improved insulation throughout walls, floors, and ceilings keeps your home comfortable year-round while reducing energy costs. Double-pane windows with Low-E glass block harmful UV rays while maintaining comfortable indoor temperatures.

Energy Star rated appliances and HVAC systems use significantly less electricity than older models. Smart thermostats let you program comfortable temperatures without constant adjustment—particularly helpful if you travel frequently.

Did you know the factory-built process actually creates less waste and allows for more precise construction than site-built homes? This precision often results in better energy performance and fewer drafts.

At Manufactured Housing Consultants, we understand that choosing a manufactured home isn’t just about finding shelter—it’s about creating the perfect setting for your retirement years. We offer personalized consultations to help you steer these decisions, with a wide selection of both single wide mobile homes and double wide mobile homes from leading manufacturers.

Whether you’re looking for a cozy single-wide or a spacious multi-section home, we’ll help you find the perfect balance of comfort, affordability, and features custom to your unique needs.

Budget & Financing Considerations for Mobile Homes for Seniors

Let’s talk dollars and cents—because finding affordable housing shouldn’t require a financial degree. For seniors on fixed incomes, understanding the complete financial picture of manufactured home ownership is essential for peace of mind.

Purchase Costs: More Affordable Than You Might Think

According to Census Bureau data, the average new manufactured home sold for under $120,000 as of September 2023—a refreshing price point in today’s housing market. Of course, prices vary based on size and features:

Single-wide homes typically range from $40,000 to $80,000, offering remarkable affordability without sacrificing comfort. Double-wide homes generally cost between $75,000 and $150,000, providing more spacious layouts similar to traditional homes. Luxury models with premium features can exceed $200,000 for those wanting upscale amenities.

Many of our senior clients are pleasantly surprised to find that pre-owned mobile homes for seniors offer even greater affordability, with prices typically ranging from $10,000 to $50,000 depending on age, condition, and location.

“I was shocked when I realized I could sell my traditional home and purchase a beautiful manufactured home outright—with money left over to boost my retirement savings,” shares Maria, a recent retiree who made the switch last year.

Beyond the Home Price: Understanding Total Costs

When budgeting for your new home, remember to factor in these additional expenses:

Transportation and installation typically runs $3,000-$10,000 depending on distance from factory to site. Foundation work adds another $4,000-$12,000 for proper installation on a foundation or pad. Utility connections for water, sewer, electric, and gas generally cost $1,000-$5,000.

If you’re purchasing land rather than leasing a lot, those costs vary dramatically by location. Site preparation (clearing, grading, and preparing the land) should also be factored into your budget.

Ongoing Expenses: Predictable and Manageable

One of the beauties of manufactured home living is the predictability of monthly expenses. Lot rent in communities averaged $633/month in 2022, though this varies by location and amenities. Utilities typically run lower than in traditional homes thanks to efficient design and smaller square footage.

Insurance for manufactured homes generally costs $300-$1,000 annually through specialized policies. For maintenance, we recommend budgeting about 1-2% of your home’s value annually—significantly less than the 3-4% rule for traditional homes.

If your home is classified as real property, you’ll pay property taxes, though these are typically much lower than for site-built homes of comparable size.

Financing Options Custom for Seniors

Several financing avenues are available for mobile homes for seniors:

Chattel loans are personal property loans specifically for manufactured homes, typically with 15-20 year terms. FHA loans offer more favorable terms through Title I loans (for homes on leased land) and Title II loans (for homes on owned land).

VA loans provide competitive rates for eligible veterans—a wonderful benefit for those who’ve served. For seniors 62+ who own their land and home, reverse mortgages can convert equity into valuable cash flow.

Many of our clients sell their previous homes and use the proceeds for an outright cash purchase, eliminating monthly mortgage payments entirely. Some dealers and private sellers also offer seller financing options.

For seniors with credit challenges, we specialize in finding financing for mobile homes with bad credit. Our relationships with multiple lenders allow us to explore various options based on your unique financial situation.

Grants and Assistance Programs: Extra Help When Needed

Several programs can help seniors with manufactured home purchases:

The Section 504 Home Repair Program offers USDA grants for seniors 62+ needing home repairs. Many State Housing Finance Agencies provide assistance specifically for senior housing needs. The Weatherization Assistance Program helps with energy efficiency upgrades, reducing ongoing utility costs.

Local Community Development Programs sometimes offer assistance with down payments or lot purchases—it’s always worth checking with your city or county offices.

At Manufactured Housing Consultants, we believe everyone deserves clear, straightforward information about financing options. We’ll help you understand the complete financial picture so you can make confident decisions that support your long-term stability and comfort.

Aging in Place Upgrades and Personalization

One of the greatest joys of helping seniors find their perfect manufactured home is seeing how thoughtful customizations transform a house into a true forever home. With the right modifications, your manufactured home can adapt with you through the years, supporting independence and comfort as your needs change.

Creating Accessible Entryways and Exteriors

The journey into your home should be safe and welcoming. Gently sloped ramps with sturdy handrails provide much safer access than steps, especially in inclement weather. These can be permanent structures or modular systems that can be removed if your needs change.

Mobile homes with porches or covered entryways aren’t just charming—they’re practical too. They provide protection from rain and sun while you’re entering or exiting your home. As one of our clients recently noted, “My covered porch gives me a place to set down groceries while I open up the door, which makes such a difference when my arthritis is flaring up.”

Motion-activated lighting illuminates pathways automatically as you approach, dramatically reducing fall risks after dark. Paired with widened walkways that accommodate mobility devices, these simple changes create a much safer home approach.

Consider low-maintenance landscaping too—native plants and simple designs reduce the need for bending, kneeling, and other physically demanding yard work while still creating beautiful surroundings.

Interior Modifications for Safety and Comfort

Inside your home, thoughtful modifications can make daily activities easier and safer:

Replacing carpet with non-slip vinyl, laminate, or engineered hardwood eliminates trip hazards and makes using mobility devices much easier. These surfaces are also easier to clean and maintain.

In the kitchen, small changes make big differences. Adjustable-height or varied-height countertops accommodate both standing and seated food preparation. Pull-out shelves in cabinets eliminate the need to reach into deep spaces. D-shaped cabinet handles are easier to grip than knobs, especially for those with arthritis.

Side-by-side refrigerators eliminate reaching high for frozen items, while induction cooktops reduce burn risks since the surface itself doesn’t heat up. One of our clients who loves to cook tells us, “These simple changes let me continue making family recipes independently, which means the world to me.”

Bathroom safety features provide tremendous peace of mind. Curbless showers with built-in seating eliminate the dangerous step over a tub edge. Comfort-height toilets (17-19 inches) reduce strain when sitting and standing. Reinforced walls allow for grab bar installation exactly where you need support.

Anti-scald faucets with lever handles prevent burns and are easier to operate with limited hand strength. Non-slip flooring provides secure footing even when surfaces are wet.

Smart Home Technology: Your Digital Assistant

Today’s mobile homes for seniors can incorporate impressive technologies that improve safety and convenience:

Smart thermostats learn your preferences and adjust automatically, maintaining comfortable temperatures without constant adjustment. Voice-activated controls for lights, entertainment systems, and even doors eliminate the need to steer in the dark or manipulate small switches.

Security systems with video doorbells let you see who’s at your door without getting up, while window sensors provide peace of mind, especially at night. Automated medication dispensers help manage complex medication schedules with timely reminders.

Fall detection systems can alert family or emergency services if a fall is detected—providing crucial quick response when minutes matter. Energy-efficient LED lighting reduces the frequency of bulb changes (no more climbing ladders!) while providing better illumination for aging eyes.

At Manufactured Housing Consultants, we work with manufacturers who truly understand the needs of senior buyers. Many of these features can be incorporated during the construction process—often more cost-effectively than aftermarket modifications.

For existing homes, we can recommend qualified contractors who specialize in accessibility modifications for manufactured housing. Many of these upgrades qualify for tax deductions or may be covered by certain insurance policies when medically necessary.

Your home should work for you, not against you. The right personalization not only improves safety and comfort but can also improve your home’s value should you decide to sell in the future.

Legal, Zoning & Insurance Checklist

Navigating the paperwork side of manufactured home ownership shouldn’t give you a headache. Let’s break down the essential legal, zoning, and insurance considerations into straightforward, manageable steps:

Understanding HUD Code Compliance

All manufactured homes built after June 15, 1976, must meet federal building standards known as the HUD Code. When shopping for a home, always verify that it has a HUD certification label (a small red metal plate) on the exterior of each section. This confirms the home meets national safety standards.

Ask for a copy of the Manufacturer’s Certificate of Origin—think of it as your home’s birth certificate. This document verifies when and where your home was built and is essential for proper titling.

“The HUD Code gives our senior clients peace of mind,” explains our housing consultant. “It ensures consistent quality standards regardless of where the home was manufactured.”

Navigating Zoning Considerations

Before falling in love with a specific location, confirm that manufactured homes are permitted there. Some areas have restrictions or special requirements for manufactured housing.

Check minimum size requirements, which vary by jurisdiction—some areas require at least 900 square feet, while others have no minimum. Understand setback requirements (how far your home must be from property lines) and any aesthetic requirements like skirting, roof pitch, or exterior materials.

If you’re placing a mobile home for seniors on private property, obtain all necessary permits before purchase. This small step prevents major headaches down the road.

Fair Housing Act Implications

Age-restricted communities must comply with the Housing for Older Persons Act (HOPA). These communities can legally restrict residency to people 55 and older as long as at least 80% of units have one resident who is 55+.

Know your rights regarding reasonable accommodations for disabilities. Communities must allow modifications that help you fully enjoy your home, though you may be responsible for the cost of these changes.

The Fair Housing Act protects against discrimination based on race, color, religion, sex, disability, familial status, or national origin. Any concerns about discriminatory practices should be reported to HUD or your local housing authority.

Securing the Right Insurance Coverage

Several types of insurance are important for manufactured homeowners:

Homeowners insurance for manufactured homes covers the structure itself, your personal property, liability protection, and additional living expenses if your home becomes uninhabitable. While similar to traditional homeowners insurance, these policies are specifically designed for manufactured homes.

If you own your home but lease the land, tenant insurance protects your personal belongings and provides liability coverage. Many communities require this coverage as part of your lease agreement.

New homes typically come with a manufacturer’s warranty covering defects in materials and workmanship. These usually include 1-year comprehensive coverage and longer structural coverage. For pre-owned homes, consider a service plan similar to a home warranty that covers major systems and appliances.

“Insurance for manufactured homes has improved dramatically in recent years,” notes our insurance specialist. “Today’s policies offer comprehensive protection at reasonable rates.”

Handling Title and Ownership Documentation

One important decision is whether your home will be titled as personal property (like a vehicle) or real property (like a traditional house). This affects financing, taxation, and resale value.

If converting from personal to real property, understand the process in your state—requirements vary significantly. Always ensure clear title before purchase, especially for pre-owned homes.

Keep all warranty information, manuals, and home specifications in a safe place. These documents will be invaluable for maintenance, repairs, and eventual resale.

Understanding Community Rules and Regulations

If you’re moving to a manufactured home community, review the complete set of community rules before signing a lease. Understand the process for rule changes and rent increases—some communities have caps on annual increases, while others don’t.

Know the policies regarding home sales within the community. Some communities have right of first refusal or age requirements for new buyers. Clarify guest policies and any age restrictions for visitors, especially if you plan to have grandchildren stay frequently.

At Manufactured Housing Consultants, our services include helping clients steer these complex legal and regulatory requirements. We ensure that all homes we sell meet or exceed HUD standards and can assist with permitting processes throughout Texas.

The paperwork might seem daunting at first, but with the right guidance, securing your perfect retirement home can be a smooth, worry-free process.

Conclusion & Next Steps

After exploring all the possibilities, it’s clear that mobile homes for seniors offer something truly special—a perfect blend of affordability, community connection, and personalization that makes retirement living both comfortable and financially sensible. When you consider that new manufactured homes typically cost under $120,000 while traditional homes often exceed $500,000, the financial advantage alone makes this option worth a serious look as you plan your golden years.

Today’s manufactured homes have come a long way from what you might remember. They now feature quality construction that rivals site-built homes, impressive energy efficiency, and attractive designs that feel like home from the moment you step inside. With thoughtful selection and customization, these homes provide comfortable, accessible living spaces that support your independence as you age.

If you’re considering making the move to a manufactured home, here’s what we recommend doing next:

First, take some time to think about what really matters to you—your budget, where you’d like to live, how much space you need, and any accessibility features that would make life easier. Then, go see for yourself! Visit some communities and tour model homes to experience the quality and lifestyle that today’s manufactured housing offers.

Understanding your financing options is crucial too. There are several loan programs designed specifically for manufactured housing that might work well for your situation. And while you’re planning, remember to think ahead about how your needs might change in the coming years. The best choice is a home and community that can grow with you, accommodating any physical changes that might come with aging.

Here at Manufactured Housing Consultants, we’ve helped countless seniors find their perfect manufactured home. We understand that retirement housing comes with its own set of considerations, and we’re here to guide you through every step of your journey. Our team offers a wide selection of quality homes from the industry’s top manufacturers, and we’re proud to guarantee the lowest prices you’ll find anywhere in Texas.

We deliver to communities throughout Texas—from San Antonio to New Braunfels, Laredo to Corpus Christi, Victoria and beyond. Don’t worry about your credit situation; we have financing options to suit various circumstances. And our expertise in senior-friendly features and communities ensures you’ll find a home that truly meets your needs.

Whether you’re looking to downsize, cut your housing costs, or find a supportive community where you can thrive, we’re here to help you figure out what type of mobile home is best for you.

Your retirement years should be about enjoying life, not stressing over home maintenance or stretching your budget too thin. With the right manufactured home in a community that feels like home, you can create a living situation that supports your independence, keeps your finances healthy, and improves your quality of life for years to come.

We’d love to help you start this exciting new chapter. Reach out to us today, and let’s begin the journey toward finding your perfect manufactured home—one that’s as unique as you are.