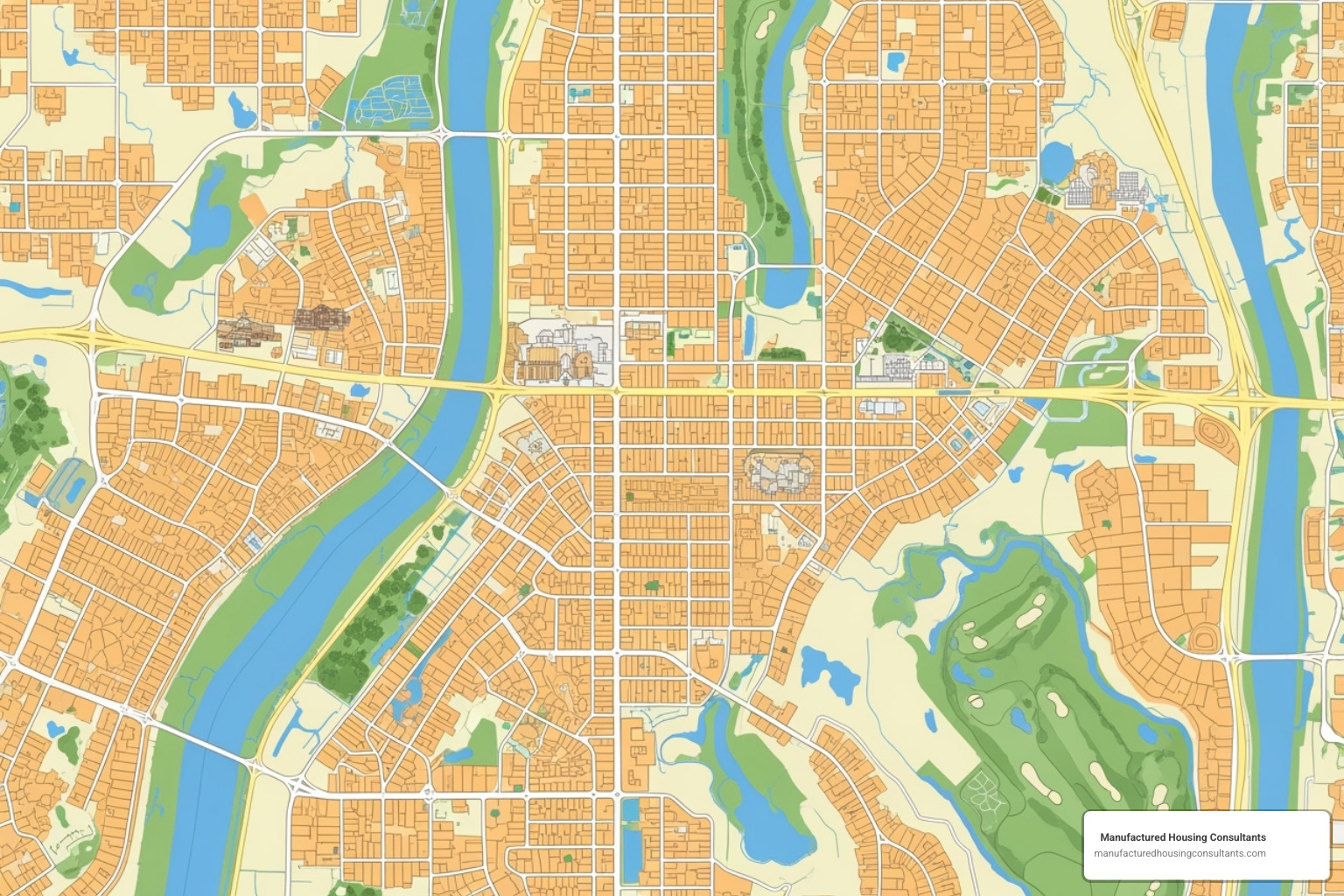

Your Path to Homeownership in San Antonio

Owner financing san antonio is a home buying method where the seller acts as the lender, allowing you to make payments directly to them instead of a bank. This path to homeownership is ideal if you have credit challenges, are self-employed, or want to avoid lengthy bank approvals.

Quick Facts About Owner Financing in San Antonio:

- Median Price: Around $275K for traditional homes, but significantly less for manufactured homes.

- Typical Down Payment: 10-20% of purchase price.

- Approval Speed: Often in days, not months.

- Credit Requirements: More flexible than traditional mortgages.

- Best For: Buyers with bad credit, self-employment income, or non-traditional finances.

If you’ve been turned down by banks, owner financing could be your answer. In San Antonio’s market, this method helps families secure homes with less competition than traditional sales.

Manufactured Housing Consultants specializes in connecting buyers with affordable manufactured and mobile homes that offer owner financing. We’ll guide you through the entire process, from finding a home to understanding the legal steps and avoiding common mistakes.

Your Guide to Owner Financing San Antonio

We know getting a home through a bank can feel impossible. If you have a good income but a challenging credit score, or you’re self-employed, you may have been turned down repeatedly. We’re here to tell you there’s another way: Owner financing San Antonio offers a path to homeownership that works for people in your situation.

How Owner Financing Works

Think of owner financing as cutting out the middleman. The seller becomes your lender, and you make monthly payments directly to them. The agreement is detailed in a promissory note—your written promise to repay the loan, outlining the interest rate, payment schedule, and loan term.

In Texas, the deal is secured with either a Deed of Trust (you get legal title at closing) or a Contract for Deed (the seller retains title until the loan is paid). Most buyers prefer a Deed of Trust for clearer ownership from day one.

Your buyer payments to the seller are typically monthly. A key benefit is that interest rates and loan terms are negotiable. While rates may be slightly higher than a bank’s, the flexibility in qualification is a major advantage. Be aware of balloon payments—a large lump sum due at the end of a shorter loan term—and ensure you have a plan to pay it.

Here’s how owner financing stacks up against traditional mortgages:

| Feature | Owner Financing (San Antonio, TX) | Traditional Bank Mortgages |

|---|---|---|

| Approval Speed | Often faster, sometimes in days, not months. | Can take weeks to months for underwriting and approval. |

| Credit Requirements | Highly flexible; bad credit, low credit, or non-traditional finances often accepted. | Strict credit score requirements (typically 620+ for conventional, 580+ for FHA). |

| Down Payment | Negotiable, often 10-20%, but can be lower or higher depending on the seller and property. | Typically 3-20% or more, depending on loan type (FHA, VA, Conventional). |

| Closing Costs | Generally lower, as many bank fees are eliminated. | Can be substantial, including origination fees, appraisal fees, title insurance, etc. |

| Loan Terms | Highly customizable; can be short-term with balloon payments or longer, fully amortized. | Standardized 15-year or 30-year fixed or adjustable rates. |

| Documentation | Simpler; focuses on ability to pay and agreeable terms. | Extensive; requires detailed income verification, tax returns, bank statements, etc. |

| For Manufactured/Mobile Homes | Often a viable option, especially for pre-owned homes or those without permanent foundations. We specialize in this! | Can be more challenging, with specific requirements for foundation, age, and land ownership (e.g., FHA, VA, USDA loans for manufactured homes). |

Benefits for San Antonio Home Buyers

Owner financing opens doors when banks close them. The benefits are clear:

-

Flexible Qualification: Sellers focus more on your ability to pay now, not past financial bumps. Your current income matters more than your credit score.

-

Bad Credit or No Credit OK: Many buyers with low credit scores or no credit history can qualify. For more details, see our guide on financing for mobile homes with bad credit.

-

Friendly to Self-Employment: Prove your income with bank statements instead of the mountain of paperwork banks demand. This is a game-changer for freelancers and small business owners.

-

Faster Move-In: Close in days or weeks, not months. The streamlined process gets you into your new home sooner.

-

Fewer Closing Costs: Avoid many traditional lender fees like loan origination and underwriting, leaving more money in your pocket.

-

Negotiable Terms: The down payment, interest rate, and loan term are all up for discussion, allowing for a deal that fits your budget.

-

Build Equity, Stop Renting: Every payment builds your ownership stake, turning your housing costs into a long-term investment.

At Manufactured Housing Consultants, we specialize in connecting you with affordable manufactured and mobile homes that can be secured through owner financing.

Finding Properties with Owner Financing in San Antonio

Finding homes with owner financing San Antonio options is easier than you think, especially in the manufactured home market. Here’s how to start:

-

Browse our website: We curate a selection of properties with flexible financing. You can find your dream home in San Antonio and ask us about owner financing options.

-

Work with our team: As specialized home dealers, our consultants have deep expertise in the San Antonio market and owner financing. A quick consultation can connect you with sellers offering these terms.

-

Visit our locations: Stop by our physical locations in San Antonio or Von Ormy to see properties with “Owner Financing Available” signs and get a current list from our team.

Working with professionals who understand the owner financing landscape is key. We make those connections and guide you through the process.

Types of Homes & Typical Terms

We focus on affordable, quality manufactured and mobile homes. Options include single-family manufactured homes, pre-owned mobile homes, and land-home packages where you own both the structure and the land. Pre-owned homes are especially attractive for owner financing due to lower price points. Explore our San Antonio affordable manufactured homes to see available options.

While terms are always negotiable, here’s what you can generally expect:

- Median Listing Price: The broader San Antonio market is around $275K, but our manufactured homes are often priced much lower, from $39,900 to $79,900.

- Down Payment: Typically 10-20%, but we’ve helped buyers secure homes with as little as $3,000 to $10,000 down.

- Interest Rates: Rates may be slightly higher than traditional mortgages (e.g., 7-10%) to compensate for flexible qualification.

- Loan Terms: Can range from short-term loans with balloon payments to fully amortized 15 or 30-year loans.

Key Legal Steps for Owner Financing San Antonio

While flexible, owner financing requires proper legal steps. All our closings are handled by state-licensed attorneys or authorized services to ensure everything is done correctly.

-

Hire a Real Estate Attorney: An attorney experienced in Texas owner financing will draft and review all documents to protect your interests.

-

Ensure Compliance: Your attorney will verify the seller complies with federal laws like the Dodd-Frank Act and SAFE Act, which regulate seller financing.

-

Conduct a Title Search: This is essential to verify the seller has clear ownership and that there are no hidden liens or claims against the property.

-

Create a Written Financing Agreement: This contract must detail every aspect of the loan: price, down payment, interest rate, payment schedule, and default terms.

-

Record the Deed: The deed must be recorded with the county to provide a public record of your ownership interest. You can learn about Texas regulations for manufactured housing from official state resources.

We emphasize legal diligence in every transaction to ensure you feel secure in your purchase.

Common Pitfalls to Avoid

It’s crucial to be aware of potential pitfalls. We believe in transparency to help you steer the process with confidence.

-

Vague Contract Terms: Ensure your agreement is crystal clear on the interest rate, payment schedule, and default clauses. Have an attorney review it.

-

High Interest Rates: While rates may be higher than a bank’s, they shouldn’t be excessive. Don’t be afraid to negotiate.

-

Large Balloon Payments: If your agreement includes a large lump-sum payment, make sure you have a realistic plan to pay it, such as refinancing.

-

Seller’s Existing Mortgage: Verify if the seller has a mortgage with a “due-on-sale” clause. If so, their lender could demand full payment, putting your home at risk.

-

“As-Is” Condition: Many properties are sold “as is,” meaning you are responsible for all repairs. All our properties are sold “as is where is,” so inspections are vital.

-

Skipping Home Inspections: Always get a professional inspection to uncover hidden issues. This helps you budget for repairs or negotiate the price. Learn more about what you need to know before you buy a mobile home.

-

Not Verifying Ownership: A title search is non-negotiable. It confirms the seller legally owns the property and has the right to sell it.

Our team at Manufactured Housing Consultants is here to guide you safely through these issues and toward successful homeownership.

Conclusion: Take the Next Step

This guide shows that owner financing San Antonio makes homeownership possible, even if you don’t have perfect credit or a traditional job. It’s a flexible, powerful tool for families in San Antonio and Von Ormy who are ready to stop renting and start building equity.

The San Antonio market is full of opportunities, especially with affordable and high-quality manufactured homes. You don’t have to sacrifice your dreams for a price you can afford.

At Manufactured Housing Consultants, we specialize in making homeownership accessible. We know the local market, understand owner financing, and are experts at connecting buyers with affordable manufactured and mobile homes. We’re not just selling houses—we’re helping families build futures.

Your next step is simple: reach out to us. Explore our homes for sale under $50,000 or talk with our consultants about land-home packages. We guarantee the lowest prices and can deliver anywhere in Texas.

Don’t wait. Contact Manufactured Housing Consultants today, and let’s turn your dream of owning a home in San Antonio into a reality.