Open up Homeownership: Using Land as a Down Payment

Using land as down payment for mobile home (also called land-in-lieu financing) allows you to leverage your property’s equity instead of cash to purchase a manufactured home. Here’s what you need to know:

- What it is: A financing option where your land’s value substitutes for a traditional cash down payment

- How much land value you can use: Up to 65% of your land’s appraised value

- Documentation needed: Deed, recent tax appraisal, pay stubs, W-2s

- Benefits: No large cash outlay, potential to finance improvements, no PMI required

- Common requirements: Clean title, professional appraisal, credit score ≥620 (typically)

If you own land but lack cash savings for a down payment on a mobile home, you’re not alone. Many prospective homebuyers find themselves land-rich but cash-poor. The good news? That piece of property you already own could be your ticket to homeownership without draining your bank account.

Land-in-lieu financing works by having the lender place a lien on both your land and the manufactured home as collateral, instead of requiring a traditional cash down payment. This option is especially appealing for rural landowners or those who’ve inherited property but don’t have significant cash reserves.

“Using land as a down payment is very appealing for buyers who already own property,” notes one housing consultant. “It eliminates the need for a large cash down payment while still securing the financing you need.”

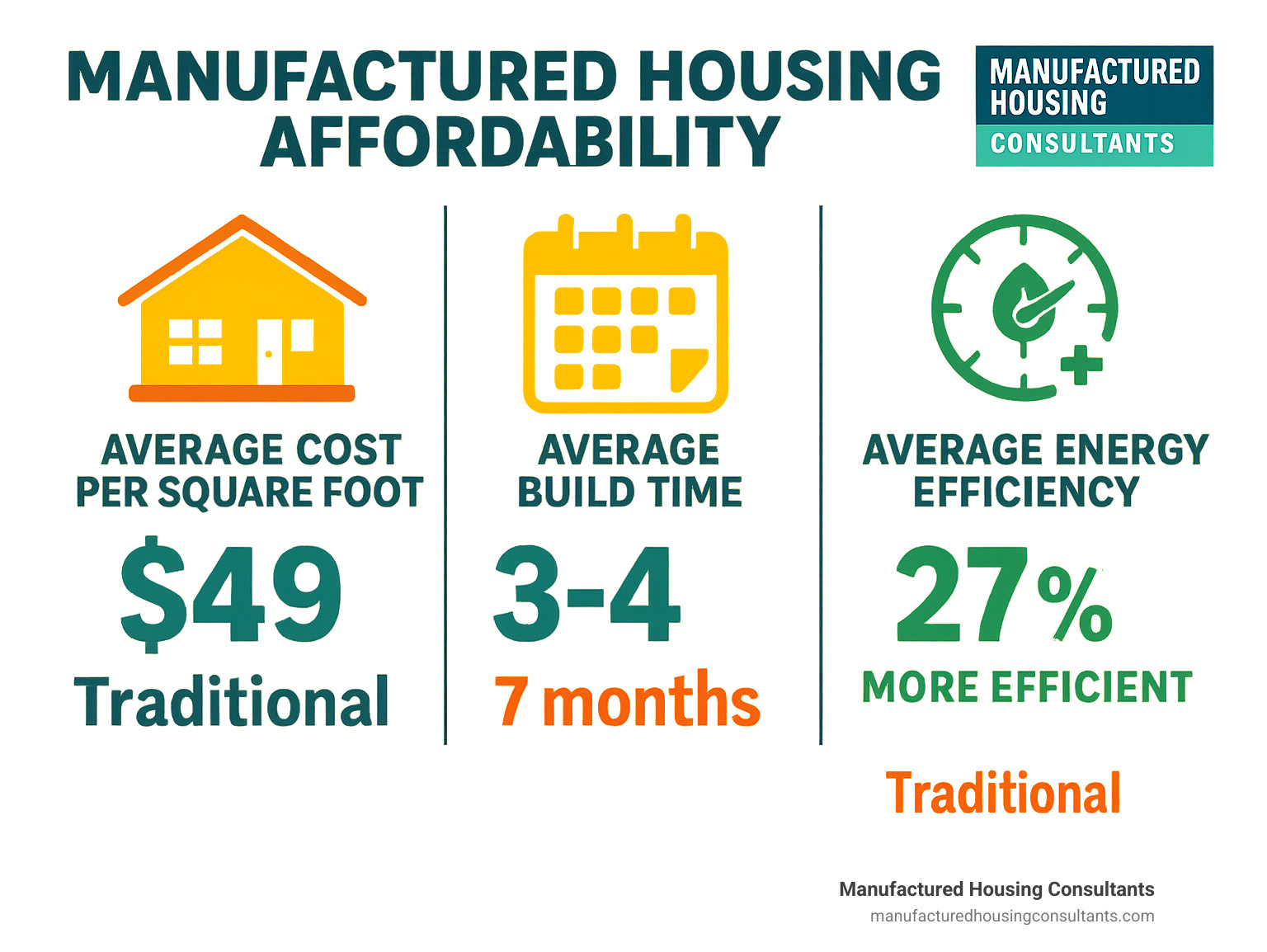

Most lenders require a down payment of between 5% and 10% of the total purchase price for a mobile home. With land-in-lieu financing, your property’s equity can satisfy this requirement, making homeownership more accessible and affordable.

Must-know using land as down payment for mobile home terms:

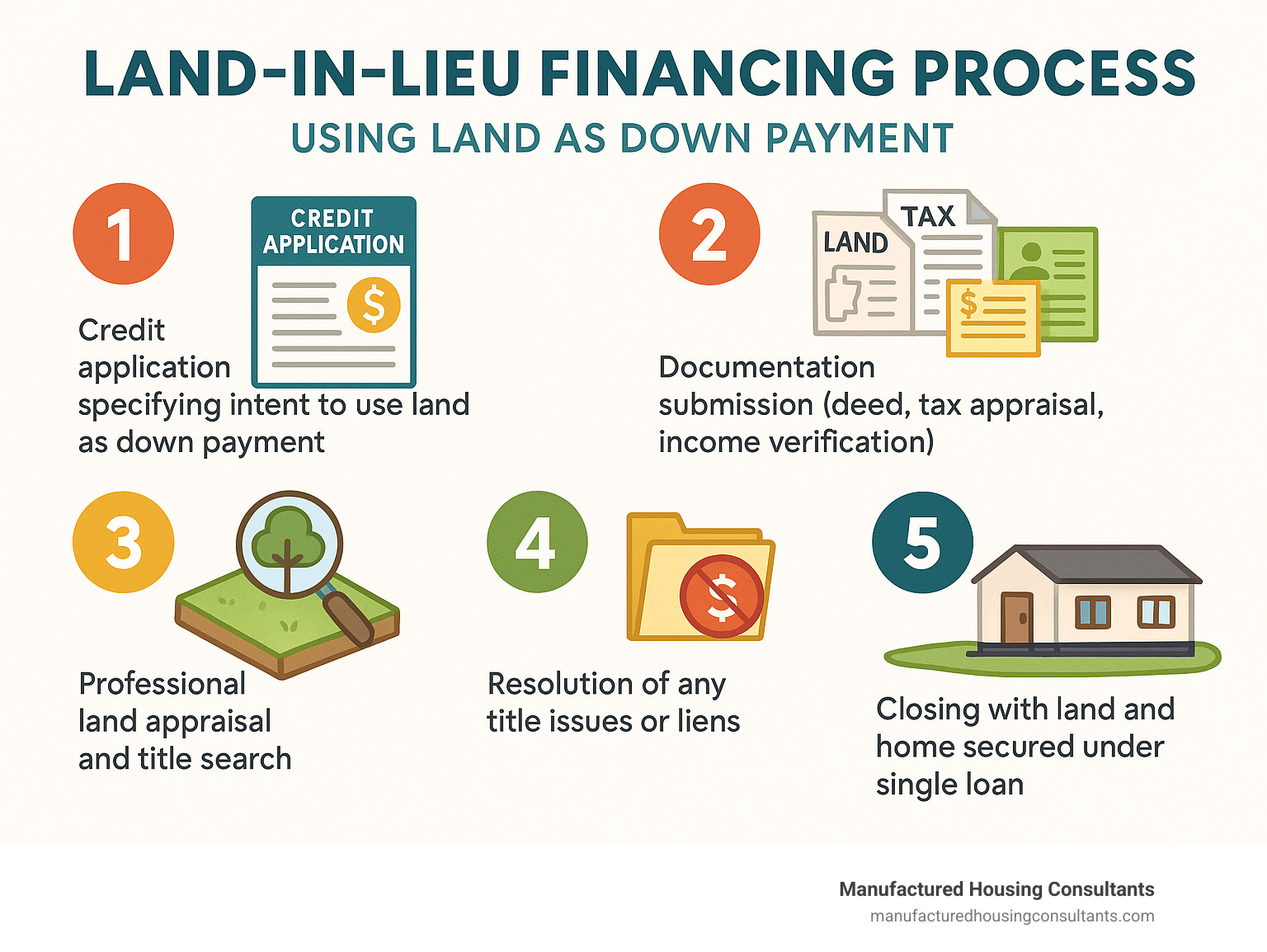

Using Land as Down Payment for a Mobile Home: Step-by-Step Guide

Turning your piece of Texas soil into the foundation for your dream home is easier than you might think. Here at Manufactured Housing Consultants, we’ve guided countless folks through the process of using land as down payment for mobile home purchases, helping them achieve homeownership without emptying their savings accounts.

The land-in-lieu journey follows a straightforward path. You’ll start by submitting a credit application that specifically mentions your intention to use land instead of cash. Next comes documentation proving you own the land, followed by a professional appraisal and title search. Once any title issues are cleared up, you’ll close on your loan in a single, streamlined transaction.

Let’s walk through each step so you know exactly what to expect.

Land Equity Valuation & Required Documentation

First things first – we need to figure out what your land is actually worth. Most lenders will accept up to 65% of your property’s appraised value toward your down payment. So if you’re buying a $100,000 manufactured home with a 10% down payment requirement, you’d need land valued at about $15,385 to cover it.

While your county tax assessment gives us a starting point, lenders almost always require a professional appraisal from a third party. This typically costs $300-$500 and looks at factors like your property’s location, size, topography, zoning rules, and comparable sales nearby. Any existing improvements like utilities or cleared land will boost your value.

To get the ball rolling, you’ll need to gather some paperwork:

- Your deed (proof you own the land)

- Recent tax appraisal

- Last 30 days of pay stubs

- W-2s from the past two years

- Bank statements (usually 2-3 months’ worth)

- Your photo ID

- Any lender-specific forms

Here’s a bit of good news – using land as down payment for mobile home purchases typically doesn’t require a survey or permanent foundation, which saves you considerable money upfront.

A critical step in this process is the title search. This investigation, conducted by a title company, confirms you legally own the land and identifies any existing liens, judgments, or unpaid taxes. Common issues include unpaid property taxes, mechanic’s liens, judgment liens, or boundary disputes. Sometimes there’s confusion with people who have similar names – in those cases, you might need to sign a “not-the-same-person” affidavit to clear things up.

When comparing traditional cash down payments to land-in-lieu, the paperwork differs significantly:

| Requirement | Cash Down Payment | Land-in-Lieu |

|---|---|---|

| Proof of funds | Bank statements | Deed, tax appraisal |

| Property assessment | Home appraisal only | Home and land appraisal |

| Title work | Home title only | Home and land title search |

| Closing documents | Standard mortgage | Land lien + home lien |

| Verification process | Income verification | Income + land ownership verification |

Loan Options and Qualification Requirements

When leveraging your land for a manufactured home purchase, several loan programs are available, each with distinct advantages:

FHA Loans require just 3.5% down (with credit scores of 580+), and your land can fulfill this requirement. The home must sit on a permanent foundation, with both land and home serving as collateral.

VA Loans offer eligible veterans and service members 0% down options, with land equity satisfying any lender requirements. The home needs permanent installation and must meet VA property standards.

USDA Rural Development Loans may offer 0% down for qualified buyers in eligible rural areas, though income restrictions apply. Your land equity can satisfy the lender’s requirements.

Conventional Loans typically require 5-20% down, which your land equity can cover. These loans offer more flexibility than government programs but often demand higher credit scores.

Chattel Loans finance just the home (not including land) and aren’t typically used with land-in-lieu arrangements. They carry higher interest rates and shorter terms.

Most lenders look for a credit score of at least 620, though some programs accept lower scores. Your debt-to-income ratio should be 43% or less in most cases. As mentioned earlier, up to 65% of your land’s appraised value can be used, and you’ll need clear title with no outstanding liens. Lenders also want to see stable income over the past two years.

Not sure where you stand? We recommend you check your credit score before applying. Even if your credit isn’t perfect, we at Manufactured Housing Consultants can help you steer various financing options.

Closing Process Timeline & Cost Breakdown

The timeline for using land as down payment for mobile home financing typically unfolds like this:

Your application and pre-approval usually take just 1-3 days. Gathering documentation might take 3-7 days, depending on how organized you are. The land appraisal needs 1-2 weeks, while the title search runs concurrently. Underwriting and approval take the longest – usually 2-4 weeks. Finally, closing happens in a single day.

One big advantage of land-in-lieu financing is the one-time close at a title company. This streamlined approach reduces paperwork and saves money on closing costs.

Speaking of costs, expect to pay between 2-5% of the loan amount for closing, which typically includes:

- Appraisal fee ($300-$500)

- Title search and insurance ($500-$1,000)

- Origination fee (0.5-1% of loan amount)

- Credit report fee ($30-$50)

- Recording fees ($50-$100)

- Notary fees ($50-$200)

Here’s another benefit worth smiling about: many lenders allow you to roll closing costs and site improvements into your loan, minimizing your out-of-pocket expenses. Site improvements that can often be financed include utility connections, land clearing, driveway installation, decks or porches, and foundation work.

Benefits, Risks & Next Steps

Now that you understand how using land as down payment for a mobile home works, let’s explore what this means for your financial future. This approach offers some compelling advantages, but like any major financial decision, it comes with considerations you should weigh carefully.

Why Choose Land-in-Lieu? Pros, Cons, Tax Implications

If you’re wondering whether using your property as equity makes sense for your situation, you’re asking the right question. For many Texas families, this approach has been a game-changer.

The most immediate benefit? No cash required. If you’ve got land but your savings account isn’t quite where you’d like it to be, this option makes homeownership possible without depleting your emergency fund. This can be especially meaningful for families who’ve inherited land or purchased it years ago as an investment.

You’ll also enjoy freedom from PMI payments. Unlike traditional mortgages with less than 20% down, land-in-lieu loans typically don’t require private mortgage insurance—potentially saving you hundreds of dollars every year throughout your loan.

Many of our customers appreciate the ability to finance site improvements along with their home purchase. Need to connect utilities, prepare the site, or add a driveway? These costs can often be rolled into your loan, making the entire process more affordable upfront.

The simplified closing process is another advantage we hear about frequently. With a single closing, you’ll have less paperwork and fewer fees compared to handling separate land and home transactions. Your property taxes get bundled too, meaning one payment instead of multiple bills to track.

“When we realized we could use our family land instead of emptying our savings, it was like a weight lifted off our shoulders,” shared one of our recent customers. “We kept our emergency fund intact while still getting the home we wanted.”

Of course, there are some important considerations to keep in mind. Since both your land and home serve as collateral, there is foreclosure risk if you default on the loan. You’re also committing your land equity to this purchase, which could limit other borrowing options down the road.

The appraisal process introduces another variable. If your land appraises for less than expected, you might need to cover the difference in cash or explore other options. And yes, the process may take a bit longer than a standard cash down payment due to the additional appraisal and title work required.

From a tax perspective, placing a manufactured home on your land in Texas may change your property tax assessment. The good news? If this is your primary residence, the mortgage interest you pay may be tax-deductible. And should you sell in the future, your original basis in the land will factor into capital gains calculations.

We always suggest chatting with a tax professional about your specific situation before moving forward. For more comprehensive information, our guide on Manufactured Home and Land Financing covers additional details you might find helpful.

Troubleshooting Common Issues & Under-Appraisal Scenarios

Even the smoothest journeys can hit a few bumps in the road. When using land as down payment for a mobile home, here are some common challenges we’ve helped customers steer over the years.

What happens if your land appraises for less than needed? This happens more often than you might think, but it doesn’t have to derail your plans. Many of our customers simply bridge the gap with available cash. Others have successfully negotiated with the home seller for a price adjustment that accommodates their available equity.

Some families explore secondary financing options to cover any shortfall, while others choose to make strategic improvements to their land before a second appraisal. Something as simple as clearing brush or adding utility connections can sometimes boost your property’s appraised value.

Title searches occasionally reveal surprises like existing liens or unpaid taxes. Don’t panic if this happens to you—these issues are usually manageable. Minor liens can often be paid off during closing, and sometimes creditors will accept partial payment to release a lien completely.

For those with common names, liens might appear that aren’t actually yours. In these cases, a simple “not-the-same-person” affidavit can clear things up quickly.

Inherited or gifted land comes with its own considerations. Before applying, make sure the deed has been properly transferred to your name. For gifted land, lenders may request documentation confirming it was a legitimate gift. And if you’ve inherited property, it’s important that all probate proceedings are complete before beginning the financing process.

Credit challenges? We work with folks across the credit spectrum. Some customers take time for credit repair before applying, while others bring in a co-signer to strengthen their application. At Manufactured Housing Consultants, we’ve developed relationships with lenders who specialize in various credit situations because we believe everyone deserves a path to homeownership.

Get Pre-Qualified Today

At Manufactured Housing Consultants, we’ve helped countless Texas families turn their land into the foundation for their dream home. With locations across the state—including Von Ormy, New Braunfels, Laredo, Corpus Christi, San Antonio, and Victoria—we’re your neighbors, ready to help wherever you are in Texas.

Our team doesn’t just sell homes; we build relationships. We’ll take the time to understand your unique situation, whether you’re dealing with land-in-lieu financing, navigating credit challenges, or simply trying to find the perfect manufactured home for your family.

We stand behind our guaranteed lowest prices on quality manufactured homes. With delivery anywhere in Texas and expert guidance through every step of the financing process, you’re never alone in this journey. Our wide selection from top manufacturers ensures you’ll find a home that feels just right for your family and budget.

Ready to turn your land into the key that open ups your new home? The process starts with a simple conversation. Visit our mobile homes financing programs page to explore your options, then reach out to us at any of our convenient Texas locations.

We’ll ask about your land and the type of home you’re dreaming of, help you complete a quick pre-qualification, and guide you through selecting the perfect home from our extensive inventory. From there, we’ll handle the details of the land-in-lieu process so you can focus on planning your future.

Using land as down payment for a mobile home doesn’t have to be complicated. Whether your land was inherited, purchased as an investment, or recently acquired with building in mind, we can help you steer the process with confidence. Our team understands the unique landscape of manufactured housing in Texas and will tailor a solution that fits your life.

Don’t let limited cash flow stand between you and homeownership. Your land could be the key that opens the door to your new beginning. Contact us today and take the first step toward making your manufactured home dreams a reality.