Repossession mobile homes are mobile homes sold by lenders (the bank, in most cases) who quickly want to regain their losses after the previous owner’s default on their loans. Hence, bank repos offer a chance to own a home at a lower price due to the swift sales clause attached to it. However, buying a repo home and finding out that it needs tons of repairs is not uncommon. Renovations can be expensive, and nobody wants these added expenses.

In this article, we will discuss the hidden costs associated with purchasing repo mobile homes and the possible renovation considerations buyers should keep in mind before investing in a repo home.

The Benefits of Buying Repo Mobile Homes

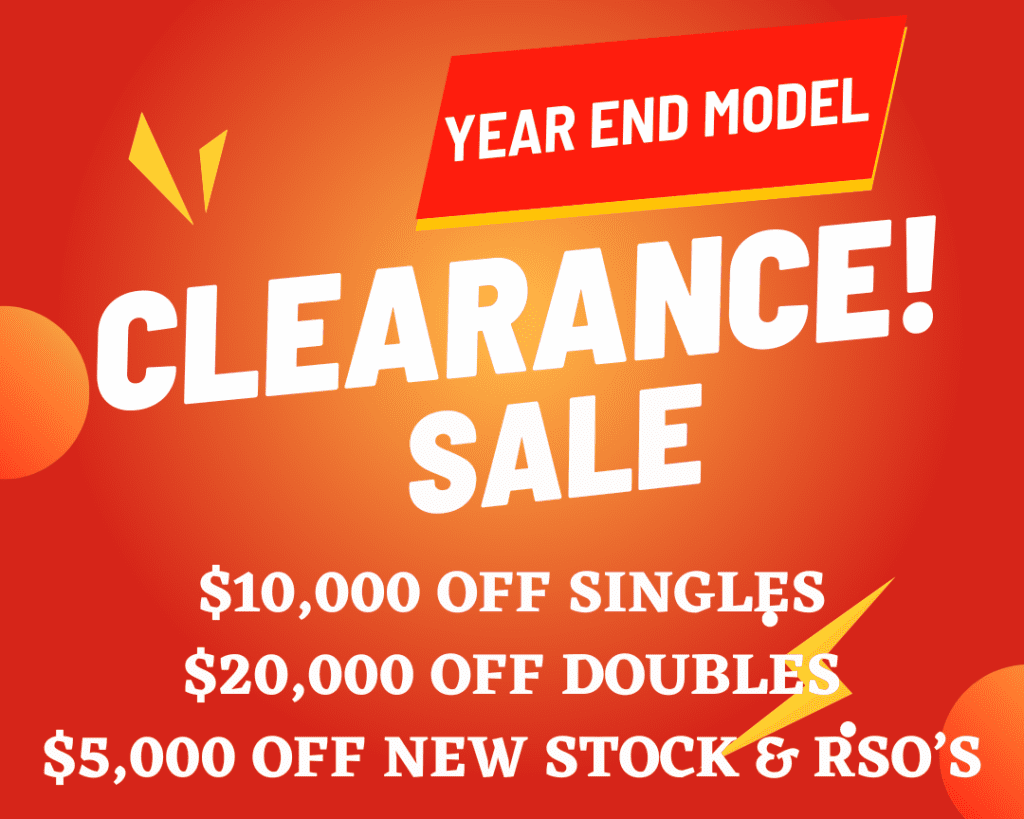

The most significant benefit of buying a repo home is that they are cheap. Repo homes often come at a lower price compared to new or pre-owned manufactured homes. With this affordability advantage, even if you are on a tight budget, you can easily afford the cost involved with its purchase.

Besides this, you can easily purchase your dream home from your favorite brand. Plus, most repo homes look and function like new. Hence, you won’t have to spend much on repairs. People who want new features that suit their lifestyle can even customize space since most repo homes may require some amount of repair work.

Potential Drawbacks of Repo Homes

Unfortunately, while repo homes offer affordability and customization benefits, they also have some downsides that limit their buying advantages. For instance, since repo homes are pre-owned, it means they may come with some damaged fixtures, worn-out components, structural damages, plumbing, and electrical problems, especially if the previous owners handled them carelessly. Hence, investing in these repo homes will require significant repairs and renovations to get them into working order, which can be time-consuming and financially draining.

On the other hand, you don’t know about the history of your repossessed homes. Has the mobile home undergone repairs? Does it have any significant issue that limits its working capacity? Knowing that you have to spend a few dollars on repairs is one thing, but having no idea of what to expect from your investment means you may risk unexpected problems when you never planned for these unforeseen events.

Oftentimes, repo homes may come with limited or no warranty coverage, unlike when you purchase a new mobile home. Hence, if buyers experience issues with these houses, the responsibility of repairs after the purchase may fall on them. The good news is that you can mitigate these risks and make informed decisions if you know and understand the cost involved in the purchase beyond the initial purchase price.

Hidden Costs Buyers Should Be Aware of When Buying Repo Mobile Homes

Although repo mobile homes cost less than their pre-owned or new models, there are several costs involved in making your mobile home a conducive residence for you and your family. You may be surprised because these are things you never even thought of. Here’s a rundown of some of the hidden costs of buying a mobile home:

1. Purchasing Land

The first thing many people neglect when buying mobile homes is getting a lot. You will need land to place your mobile homes when you buy them. Then again, most people don’t have land of their own or live in a region where buying land for mobile homes is expensive. In this case, you may need to factor in the price of renting a lot which requires paying monthly rental fees that range from a few to hundreds of dollars.

2. Delivery and Setup

Another basic cost people often overlook but is essential is the delivery and setup cost. Transporting a mobile home requires expert services, reliable logistics, specialized equipment, and labor, which can be expensive.

Plus, when the company delivers your mobile home to the site, they may clear your lot, level the soil, complete foundation work, connect utilities, mitigate flooding issues by working on the drainage, and even construct roads to help them set up your mobile home. While these jobs may seem insignificant, their cost can quickly add up even without you knowing.

3. Renovation

Every buyer has their specific preferences. So, you may be considering a renovation. However, no two mobile home renovation costs are the same. Your mobile home renovation cost may vary depending on the extent of the work you want to be carried out on it. For instance, if you only want to repair existing fixtures, you may not spend as much as when you install new upgrades and improvements to your repo mobile home.

4. Insurances and Taxes

While repo homes are used, they also need insurance coverage. Why?It is simply to protect them during the transportation of the home. Plus, you also need to pay property taxes because once you purchase a mobile home, you join the league of property owners. The good news is that property taxes can vary depending on the location and access value of the mobile home.

5. Ongoing Utilities

Once you purchase a repo mobile home, you should factor in recurring expenses, from water, electricity, gas, insurance, repairs, and property taxes, since you can’t avoid paying them.

How To Estimate Renovation Expenses for Repo Mobile Homes

Before starting a renovation project, you need to have a general idea of what your expenses may look like. Here are five tricks to help you create an estimate:

- Consider The Extent of the Remodel

Do you want to prioritize things that need immediate attention? Do you want to improve the plumbing or change the floor plan? Just keep in mind that larger renovation projects cost more. - Research Materials and Fixture Costs

What materials, fixtures, and appliances do you need for the renovation? Every product varies in price depending on its quality, durability, and energy efficiency. So, consider these factors when making your estimates. - Calculate Labor Costs

Labor costs can significantly impact the overall renovation expenses. If you plan to hire contractors, include their estimated labor costs in your budget. If you are performing the renovations yourself, determine the time required and consider any associated costs, such as renting equipment or tools. - Keep Contingency Funds

Additional expenses may arise during the renovation, and you need to be prepared to handle them. Planning for contingency funds during your estimates will help you prevent budget overruns when they arise. - Consult Professionals

Professional repo mobile home consultants are experienced in mobile home renovations. So they can provide insights into the potential scope of work and associated costs. Reach out to them to ease your workload and get the mobile home renovation cost estimates you need to start your renovation project.

Conclusion

Overall, buying a repo mobile home has its perks, but you also cannot overlook its drawbacks. Fortunately, you can overcome these challenges if you factor in the costs and renovation considerations involved in purchasing these homes. You can even take the stress out of the equation by buying repo mobile homes from reputed consultants such as Manufactured housing consultants since they often consider these cost considerations and offer a purchase bargain worthy of your investment.